Ethereum (ETH) has declined nearly 6% over the previous 24 hours, growing its sharp decline over the week. With costs under $1,500, market watchers are more and more questioning whether or not ETH might drop to $1,000 in April.

Liquidation, declining community exercise and rising issues about bearish applied sciences have fueled dialogue. As buyers’ sentiment shaking, the subsequent few days might show essential to Ethereum’s short-term trajectory.

If ETH falls under $1,200, almost $342 million can be liquidated

Ethereum is at the moment simply above the $1,500 mark, falling greater than 15% over the previous week as bearish pressures intensify throughout the crypto market.

The current recession has sparked concern amongst merchants, particularly as ETH struggles to carry key help ranges. Customary Chartered not too long ago stated that XRP might overtake Ethereum by 2028.

This decline displays wider risk-off sentiment and uncertainty surrounding altcoins, with Ethereum now dangerously near ranges that might trigger a significant wave of liquidation.

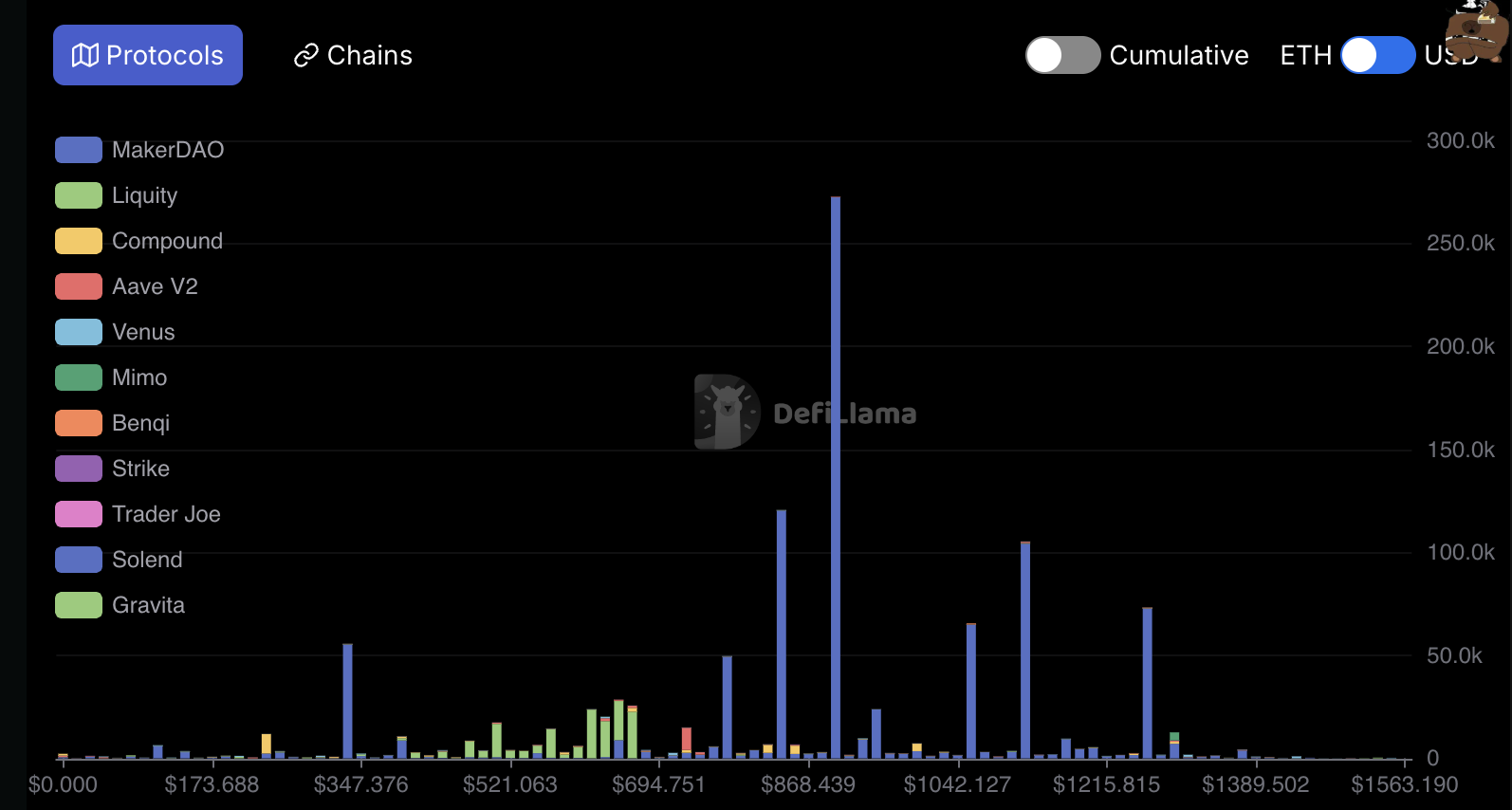

Ethereum liquidation. Supply: Defilama.

Based on on-chain information, if ETH falls under $1,200, it might lead to a liquidation of roughly $342 million throughout all leveraged positions.

Liquidation happens when merchants who borrowed capital to succeed in Ethereum for a very long time are pressured to carry resulting from a fall in worth. This successfully amplifies the drawbacks and will increase gross sales strain.

Specializing in this example, investor Peter Schiff received the X and warned him that he would not anticipate it to take earlier than Ethereum fell under $1,000.

Ethereum TVL has declined 43% since December

Ethereum’s Complete Worth Lock (TVL) has been declining sharply since peaking at $86.6 billion in December.

Thus far, Ethereum’s TVL has fallen to $49.34 billion, down 43% in just some months.

This decline highlights the decline in person exercise and capital outflows from Ethereum-based protocols, elevating new issues in regards to the community’s short-term momentum.

Ethereum tvl. Supply: Defilama.

TVL measures the whole capital deposited in distributed monetary (DEFI) protocols on the blockchain and serves as a key indicator of ecosystem well being and investor belief.

The rise in TVL typically signifies a rise in belief and use of defi functions, whereas the decline in TVL suggests a lower in demand and a lower in engagement.

Ethereum’s TVL is at the moment hovering at a low of a number of months. This could possibly be a bearish sign for ETH costs. This displays a decline in utility and a decline in capital circulating via the community, each of which might put additional downward strain on property if the pattern continues.

Ethereum is at the moment down 70% from its all-time excessive

Ethereum costs have been buying and selling under $2,000 since March twenty sixth, and its technical indicators should not seen Promising.

The present setup of exponential transferring averages (EMAS) exhibits the formation of bearishness by which long-term Emma is positioned below long-term momentum.

This means that the vendor continues to be below management and the market could also be embellished for additional modifications.

ETH worth evaluation. Supply: TradingView.

If the bearish momentum continues, Ethereum might retest almost $1,400 in help. A breakdown under that degree might result in a deeper sale, with Ethereum priced at $1,000 in April. That is at an essential psychological and historic degree.

Nonetheless, as soon as the Bulls regain management and reverse the pattern, ETH might initially problem resistance for $1,749.

If the above breakouts open the door for a $1,954 check, and the momentum stays sturdy, Ethereum will overtake the $2,000 barrier to goal for $2,104.