Ethereum is below stress as broader market sentiments battle to alter bullishness. Costs proceed to drift round the principle demand zones, with few indications of quick power from the bull, whereas derivatives and chain actions present indicators of consideration.

Technical Evaluation

By Edris Dalakshi

Every day Charts

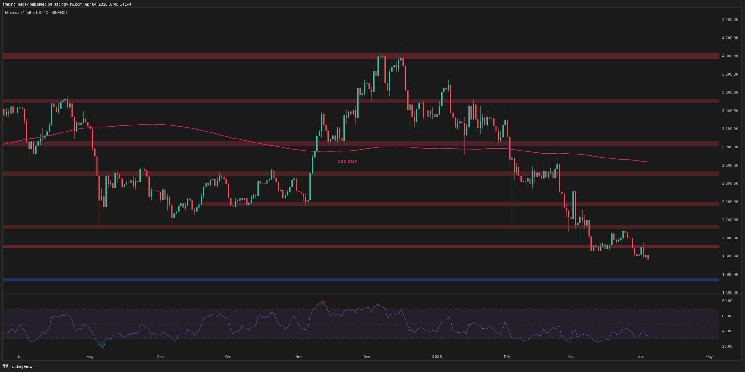

Within the every day timeframe, ETH has did not get better earlier assist almost $2,000 in resistance. The every day construction stays bearish, with refusal from the $2,200-$2,000 provide zone strengthening gross sales stress.

The 200-day shifting common, now above $2,800, highlights a broader bearish bias, but it surely means that RSI is oversold, suggesting that draw back momentum continues to be current however probably weakened. The subsequent robust assist is close to the $1,550 space and could possibly be touched rapidly.

4-hour chart

Zooming into the 4-hour chart, ETH types a horizontal integration sample, compressing a low excessive for horizontal assist of almost $1,750. The asset lately retested the $1,900 zone, however was rapidly rejected and did not create a bullish breakout.

The RSI additionally reveals that it is going to be pulled again from earlier bounces and lose momentum. A confirmed breakdown beneath $1,750 assist could be the primary indication of short-term power to surpass the sample.

Emotional evaluation

By Edris Dalakshi

Substitute Reserve

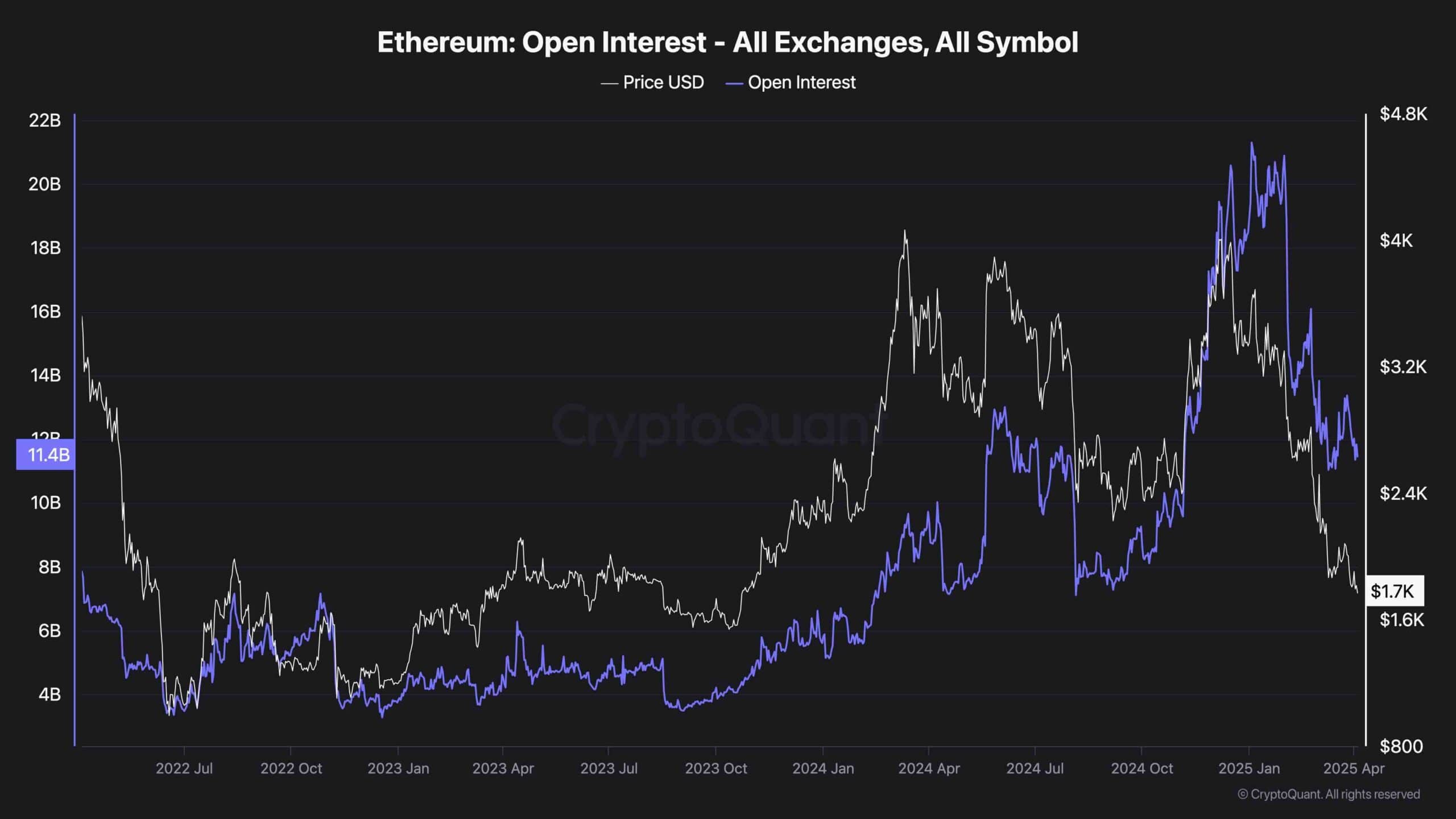

When it comes to sentiment and open curiosity, Ethereum’s open curiosity continues to rise in comparison with historic worth lately, regardless of the continued slide in costs.

This implies an inflow of offensive brief positioning or gradual leverage coming into the market. If this open curiosity is quickly rewinded, it might trigger a brief stress on any reverse volatility. Nevertheless, so long as costs stay excessive whereas they’re lowered, the stress and threat of continuous liquidation, particularly near the principle assist zones, will add to the stress and threat of continuous liquidation.