Circle desires an IPO, and S1 Submitting particulars the unbelievable variations between a regulated US-based Stablecoin writer and its offshore competitor Tether.

Regardless of their comparatively comparable dimension, the 2 largest stubcoin issuers on the earth are miles aside in finance.

As of December 31, 2024, there have been USDT of USD137.4 billion and USDC of 43.9 billion in circulation. Regardless of USDC’s market capitalization being about one-third of USDT, profitability may be very completely different.

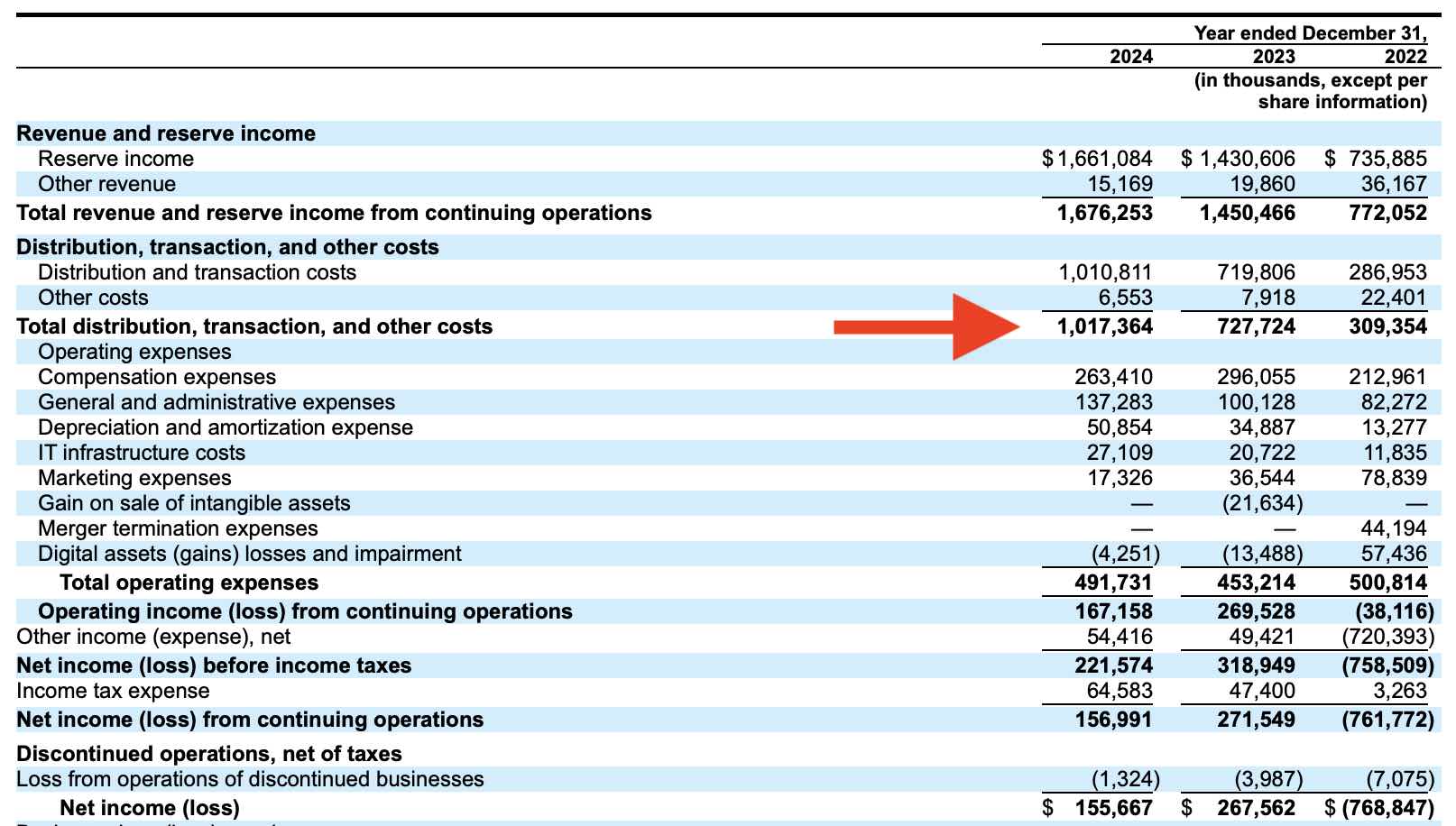

Particularly, Tether reported gross income $13 billion that 12 monthsIn the meantime, the circle reported solely $156 million in internet revenue.

Particularly, Tether reported gross revenue of $13 billion that 12 months, whereas Circle reported simply $156 million in internet revenue.

By way of share, USDT’s market capitalization was solely 213% better than USDC. Nevertheless, the revenue was about 8,000% increased.. That definitely brings to the query of how Tether achieved its extraordinary income.

Low-cost books offshore, costly books on land

Like Tether, the Circle helps USDC with US Treasury bonds, which have lots of curiosity. Nevertheless, in contrast to Tether, it prices a considerable payment for companions like Coinbase.

And in contrast to circles, it claims that Tether ranks it as essentially the most worthwhile firm on the earth. Almost 200 Workers apparently generated gross income of greater than $65 million per individual final 12 months.

In distinction, the circle, Paying greater than half of your income, Or it is going to be ranked for “distribution charges” to Coinbase’s Coinbase clients final 12 months, which value round $900 million, and as a most well-liked stubcoin on the alternate. Tethers are uncommon with comparable incentive funds.

“We occurred within the 12 months ended December 31, 2024 Distribution prices of $907.9 million In relation to the contract with Coinbase. Future distribution prices are anticipated to extend as distributors and accepted contributors are added. Our distribution prices additionally improve to the extent that our reserve earnings will increase over time. ”

-circle s-1 submitting

Circle paid about $900 million final 12 months in Coinbase’s “distribution payment.”

Worse, Tether has by no means filed an software for the Securities and Trade Fee, nor has he ever filed a public doc that will subjugate it to the definition of a committee of monetary accounting requirements or record-keeping.

As a substitute, keep away from auditing and use non-standard terminology to make it tough to carry out apple and april comparisons.

Learn extra: Howard Lutnick hopes Tether will get audited

In actual fact, Tether doesn’t specify 2024 internet revenue. This can be a regulated time period. As a substitute, they merely reported “gross revenue” of $13 billion with out acknowledging the commonly accepted accounting ideas.

Definition of Arrival Revenue and Minority

Worse, Tether didn’t specify the income it particularly acquired with property supporting USDT towards different property comparable to Xaut, CNHT, and MXNT. So, we all know that the overwhelming majority of $13 billion comes from property supporting USDT, however nobody besides Tether is aware of the precise quantity.

Tether Holding Group’s actions additionally embrace a a lot bigger set of property than Circle, investing in quite a lot of corporations to seek out extra yields.

It doesn’t matter what, Tether claims to take a seat on the earth from its closest opponents by way of profitability. Regardless of the low distinction in triple girders dimension, the distinction in profitability between the tether and circle is the excessive isolation girders.

Perhaps Tethers are higher in enterprise than circles. Maybe it advantages from historic lies and alliances with Donald Trump’s administration. Maybe one thing else explains the contradictions of the wild.