It is a phase of the Ahead Steering E-newsletter. Subscribe to learn the total version.

On the Tokenizethis Convention this week in New York, I used to be delighted to average a dialog with Dinari and STOKR executives concerning the potential tokenized shares.

It additionally caught a wider viewers on the retail adoption of tokenized actual world property (RWAs). Headwinds, tailwinds, what do you may have?

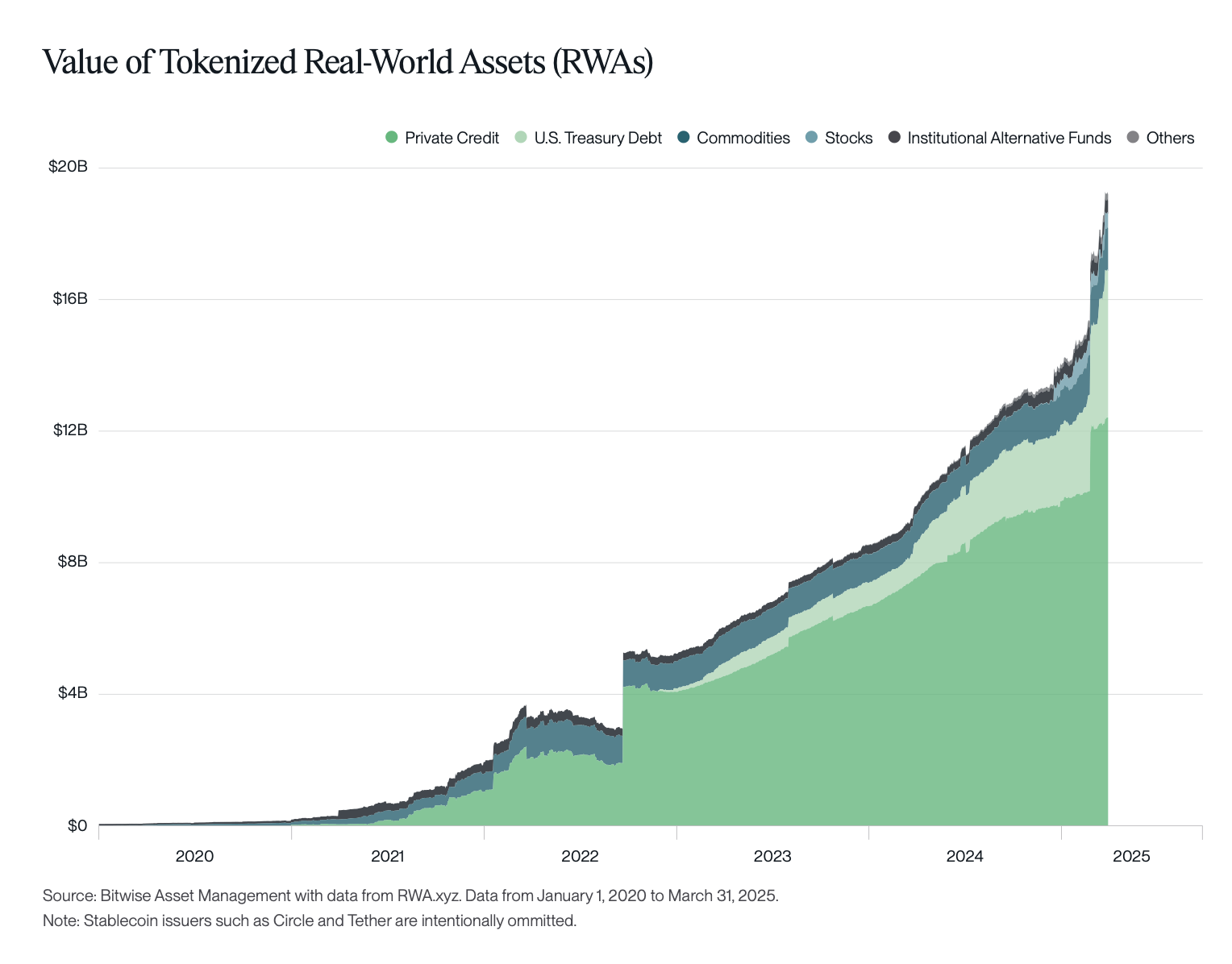

To start with: Stablecoins (primarily tokenized {dollars}, so to talk) is a market that prices practically $230 billion. Aside from that, Onchain RWA is at present at $18.5 billion, knowledge from RWA.xyz reveals.

A current report from Bitwise has been known as Q1 “The very best quarter in Crypto’s historical past.” Whereas asset costs have been falling, Stablecoin’s market capitalization reached a brand new excessive, with tokenized RWA rising 37% within the quarter. To not point out regulatory advances.

Supply: Bitwise

You’ll be able to see that huge chunk in non-public credit score, and a considerable portion of the US Treasury debt class. It consists of Buidl, BlackRock’s tokenized cash market fund.

The anticipated US regulation “permitting on and off-ramps to multiply” is extraordinarily vital, Neoclassical Capital Administration accomplice Mike Busera stated on Wednesday’s Tokeshitetis stage. Subsequently, Stablecoins and Tokenized Treasury merchandise will turn into the “base” of extra inventive on-chain merchandise over the subsequent few years.

“What’s boring is completely needed, as a result of it exists within the off-chain world,” he defined. “If you cannot do this within the on-chain world, I am not going to sit down there and anticipate some fascinating on-chain yield merchandise. I am going off-chain to conventional markets.”

As for the place we go from right here, Dinali CEO Anna Wobulska claimed that he has publicly held US shares after stubcoin and cash market funds, providing one other quick access level for traders who wish to transfer the on-chain.

Nonetheless, Galaxy Digital Tokenization Head Thomas Cowan has already identified a strong person expertise for investing in shares at venues like Robinhood. Subsequently, he argued that the subsequent wave of development was “the place transparency (and) a transparent lack of settlement danger,” particularly non-public credit score.

Sitting by Cowan, 21 share US gross sales head Anton Kozlov, pointing to SpaceX and Openai, added that he’s additionally seeing demand for tokenized non-public fairness. Carlos Gonzalez Campo, analysis analyst at Blockworks, expects that shares in such non-public corporations can be tokenized throughout the subsequent 4 years.

In a current report, Crypto Custody Agency’s Taurus had mounted the “market alternative” for fund tokenization at $1 trillion by 2030. Cash market funds have unlocked collateral administration use instances, however the report additionally bullishly concerning the symbolization throughout the illiquidity phase.