This can be a section of the Imperial publication. Subscribe to learn the total version.

There’s loads of optimistic information this morning. From a enterprise capital standpoint, the primary quarter wasn’t that dangerous!

Pitchbook’s preliminary information means that VC spending was round $4.5 billion this quarter, with half of that coming from Binance’s Abu Dhabi’s contract with MGX. It simply surpassed $2 billion per quarter final 12 months to make that quantity a context.

I do know that if I sustain this tempo, I do know it is fast to say this, however I’ve discovered that spending will attain $18 billion. That quantity is but to strategy the $33 billion wage enhance in 2021, nevertheless it exhibits the sector is bounced again and never bubbled.

In December, Pitchbook’s Robert Le stated he wasn’t stunned to see a “a number of” $5 billion quarter.

He stated a number of the momentum comes from huge offers over $100 million that he hasn’t seen a lot of this cycle to this point.

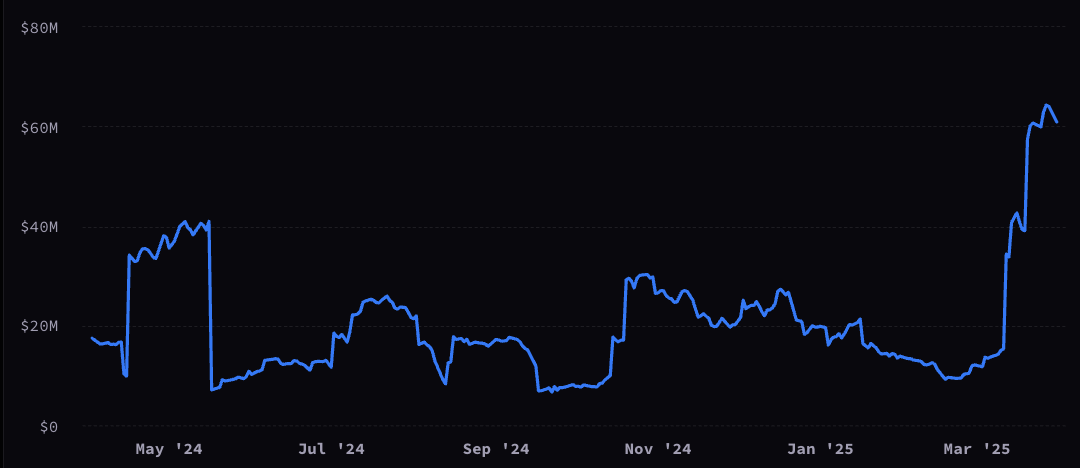

Supply: Ti terminal

At the moment, the typical buying and selling measurement in March is round $60 million, however trying on the chart above, it is clearly a soar from the buying and selling measurement we noticed final 12 months.

“I feel we’d anticipate loads of these huge offers to be funded as megafunds are again out there.

There’s preliminary proof to help that too. Le stated he heard that Katie Havn hasn’t struggled to boost $1 billion for 2 new funds. Curiosity exhibits that restricted companions try to spend money on a number of the so-called megafunds.

“Total sentiment” is completely suited to crypto VCs, even rising companions specializing in seed or pre-seed funds.

Talking of those small rounds, we may even see extra rounds at this level, however Le believes that larger offers will get better as companies scale. It is the query of the place we’re within the cycle. For every tie information, seed stage rounds are presently essentially the most lively spherical sort.

It isn’t in any respect shocking that Le is hoping for a undertaking centered on the establishments which can be presently most inquisitive about.

“One good thing for startups on this area is that these establishments usually tend to accomplice or purchase, quite than construct them internally.” Le hopes it will drive “giant enterprise funding” sooner or later.

On the flip aspect, Le does not assume we’ll see the flock in app tier spending – no matter serves retail, he revealed.

“The overall view is that retailers aren’t returning to the market,” Le admitted that this concept could possibly be “short-term considering.” Crypto’s “Holy Grail” is the mixing of retail customers who use the Crypto app at their precise worth. They do not intend to come back only for tokens, and a few folks do not even work together with them.