Later immediately, the US President celebrates what he calls liberation day by persevering with his tariff coverage to cut back reliance on international merchandise. Relying on the severity of the tariff, the home crypto business will endure substantial losses.

In an interview with Beincrypto, Matt Pearl, director of the Strategic Expertise Program on the Heart for Strategic Worldwide Research (CSIS), defined that taxation in China would inherently disrupt provide chain dynamics and improve operational prices for US mining.

How do customs duties on the discharge date have an effect on mining prices?

Right this moment, Trump is predicted to announce cleansing charges for US imports as a part of the financial agenda that he derived as Liberation Day. Nonetheless, particulars about how aggressive they’re and which international locations are most focused are inactive.

The lack of know-how surrounding the occasion left the general public at midnight, speculating what would occur subsequent. Within the case of US mining, individuals will watch Trump’s announcement about China.

A few month in the past, the Trump administration slapped the brand new 10% tariff on items from China, along with the present 10% tariffs enacted just a few weeks in the past. Throughout his marketing campaign path, Trump proposed a border tax of as much as 60% on Chinese language items.

If Trump applies additional collections to China in mild of Liberation Day, American Bitcoin miners should make many choices relating to the character and scale of their future operations.

ASIC {Hardware}: Necessary Import

Cryptographic mining depends closely on application-specific built-in circuit (ASIC) gear. These pc chips are constructed to carry out the advanced mathematical calculations wanted to validate transactions and minify new cash. They’re significantly important in Bitcoin and different proof of labor cryptocurrencies.

ASICs have change into the dominant {hardware} in Bitcoin mining as a result of their superior efficiency over different kinds of {hardware}, corresponding to CPUs and GPUs. They supply a a lot greater hashrate per unit of vitality consumed and are designed for particular mining algorithms.

“This can be a very R&D intensive course of for creating an ASIC that’s vitality environment friendly and does the whole lot you want within the context of Bitcoin mining,” defined Pearl.

The US depends closely on imports of ASIC mining {hardware}, with a good portion coming from China. China, a longtime US commerce rival, has established manufacturing capabilities to provide superior semiconductor chips.

America’s dependence on Chinese language {hardware} gear

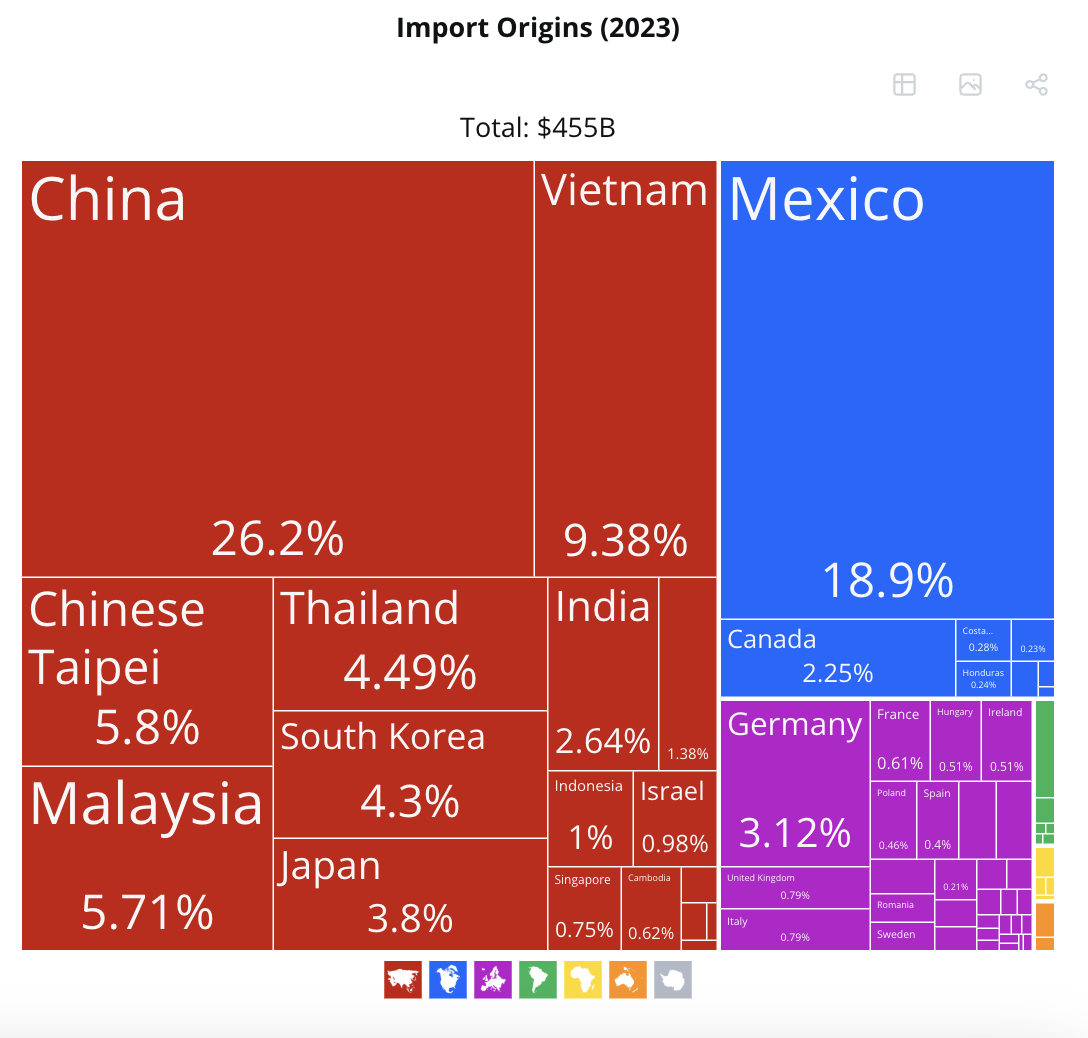

In 2023, the US grew to become the world’s largest importer {of electrical} equipment and electronics, in line with information from the Observatory of Financial Complexity (OEC). That 12 months, it imported $455 billion value of {hardware}, together with built-in circuits (ASICs), semiconductor gadgets, and electrical transformers.

The US imports the biggest electrical equipment from China. Supply: OEC.

Electrical equipment and electronics have been recorded because the second largest import class, with China supplying its whole of $119 billion, and cozy integration of its place as the highest US vendor.

In January 2025 alone, exports of electrical equipment and electronics within the US accounted for as much as $19 billion, imports reached $41.3 billion, with most imports coming from China.

Given the US’s closely depending on China for this specialised {hardware}, tariffs imposed on digital imports from China instantly have an effect on the prices of US ASIC mining {hardware}.

Although not too severe, Trump’s first time period tariff insurance policies supply a glimpse into the potential impression on cryptocurrency miners.

Classes from Trump’s First Terminology

In June 2018, US commerce representatives reclassified Bitmain, a Chinese language Bitcoin mining {hardware} producer, from “information processors” to “electromechanical gadgets.” Bitmain, particularly the “Antminer” sequence, is a significant producer of ASIC mining {hardware}.

By reclassifying the {hardware}, a 2.6% tariff has been added to the present 25% tariffs on Chinese language merchandise. This successfully elevated the entire tariffs on the US transport of Chinese language crypto mining gear to 27.6%.

Mining {hardware} prices are one of many greatest enter price operators within the face of the American mining enterprise. Following the tariff hike, crypto miners have confirmed that manufacturing prices will inevitably improve considerably.

The potential of additional will increase may very well be additional elevated after the present cumulative 20% tariffs on Chinese language items and the announcement of Trump’s launch date suggests related or extra extreme results.

“Within the quick time period, (US mining) is extraordinarily susceptible, particularly since many of the Bitcoin mining gear comes from China. ASICs will not be simple to provide, which raises the costs of US Bitcoin mining gear.

Other than a rise in prices, tariffs trigger disruption within the provide chain dynamics of {hardware} mining.

Provide Chain Disruption: The Coming Menace

In keeping with Pearl, US crypto miners can anticipate delays and shortages in {hardware} mining {hardware} if Trump applies additional tariffs on China. His judgment is based totally on the truth that this has already occurred.

“We’re already seeing delays. We have already seen customs and border patrols take time to have a look at gear and clear it by way of customs. And also you additionally had a US postal service that has halted package deal shipments from China very quickly,” defined Pearl.

Two months in the past, the US Postal Service (USPS) introduced that it had quickly suspended package deal supply from China shortly after Trump imposed a ten% tariff on Chinese language imports. The USPS revealed that the suspension stemmed from eradicating the exemption, bringing tax-free, untested cargo to underneath $800.

“USPS and customs and border safety will work carefully to implement the brand new China’s environment friendly assortment mechanism to make sure minimal disruption in package deal supply,” the publish workplace mentioned in an announcement.

Nonetheless, the suspension was reversed inside 24 hours. Nonetheless, with new tariffs on the horizon, the same scenario unfolds, threatening to backlog the mining plans of American Bitcoin Miners.

“When (Trump) imposes tariffs, it turns into much more vital, rising prices, pushing down the quantities despatched, rising uncertainty about whether or not customs, border patrols or others will sluggish issues down after they attain us.

If tariffs proceed, US crypto mining corporations will want a big long-term restructuring.

Will we miners transfer as a result of customs duties?

There isn’t a proof that the American crypto mining firm moved as a result of Trump’s tariff coverage throughout its first presidency, however this feature is that this second cheap end result.

“I believe the distinction this time is that there’s extra uncertainty. The president seems to be extra targeted on tariffs, and up to now there appears to be a scarcity of permanence within the administration’s resolution. There’s a tariff levies, however we’ll alter or improve them. We,” Pearl informed beincrypto.

French Digital Minister Clara Chappaz proposed this week to monetize EDF’s surplus vitality by way of Bitcoin mining. EDF is the biggest state-owned vitality firm within the nation. In keeping with Chapappaz, this strategy will assist cut back the corporate’s debt. Many within the wider crypto neighborhood have celebrated the thought.

If Europe surrenders to those methods, do you’re feeling that American corporations have a tendency to maneuver their operations abroad? Pearl says sure, however Europe just isn’t my favourite area.

“I believe that labor prices are costlier in Europe, so there may very well be much more deficits to permit infrastructure and truly construct infrastructure. I believe that the transition to Europe and the labor obstacles usually tend to produce other rules and labor obstacles than the transition to different components of Asia,” he mentioned.

Nonetheless, easy transfers don’t rule out the necessity for entry to a constant ASIC provide.

Inconceivable outcomes

Thus far, no nation has been in a position to produce ASICs to match the dimensions and velocity of China. It is also China’s biggest curiosity to maneuver its enterprise to the US.

“Some Chinese language corporations that produce this gear may very well uncover US manufacturing capabilities and never be topic to customs duties. However it includes relocating the power and getting permission. It should take time and will not occur tomorrow.”

Nonetheless, given the hostility between the 2 international locations, this appears unlikely.

Finally, home manufacturing gives the most effective path to self-sufficiency in the USA. Nonetheless, it may be an advanced and lengthy course of.

Bringing operation to land and discipline

Below Biden, Congress permitted the Chips Science Act in July 2022. The regulation was designed to reinforce home semiconductor manufacturing in the USA.

Though ASIC gear just isn’t expressly single, the provisions strongly encourage and encourage the switch and institution of any kind of semiconductor manufacturing throughout the US border, together with these related to ASICs.

“If the (Trump) administration does not attempt to revert a few of what’s carried out underneath the Chips Act when it comes to shifting manufacturing capabilities to the USA, US corporations might develop aggressive ASICs over the subsequent few years.

Two days in the past, Hut 8, the main North American Bitcoin mining firm, is partnering with Eric Trump to launch American Bitcoin and switch it into the world’s largest pure playminer.

The initiative coincides with President Trump’s purpose of bringing manufacturing again to the US, however Hut 8 depends on ASIC {hardware}, like different American miners. This creates a possible battle along with his tariff coverage.

Within the interim, US miners might want to deal with present dependence on China’s ASICs.

American corporations will proceed to bear the impression of Trump’s tariffs on vital Chinese language crypto mining {hardware}. This continues till the US is ready to effectively perform a wider vary of producing and manufacturing on land.

If Trump’s launch date announcement contains additional tariffs on China, home mining corporations, giant and small, will see manufacturing prices rise considerably. Disturbing tightly interrelated provide chain dynamics additionally disrupt operations. It has not but been determined how they may reply.