The Federal Reserve referred to as for dangerous investments in shares and actual property on Friday, dropping the warning a day after loosening the grip on the crypto guidelines.

The Fed’s monetary stability report stated asset costs stay “distinguished” regardless of some markets hit earlier this month.

“Even after the current decline in inventory costs, costs stay larger than analysts’ earnings forecasts, and are adjusting slowly than market costs,” the report additionally revealed that Treasury yields keep over all maturities, near the very best degree anybody has seen since 2008.

The Federal Reserve additionally identified that it might use the market as a serious concern, saying the dangers of funding nonetheless seem like critical. The report masking the market state of affairs by means of April eleventh stated the funding market remained robust by means of a tough patch in early April, however that did not imply that the whole lot went effectively.

The central financial institution famous that the losses within the honest worth of fixed-rate belongings remained “substantial” for some banks, and that these losses are extremely delicate to modifications in rates of interest.

The Federal Reserve leverages asset costs, liabilities and troubles

The Monetary Stability Report solved how unhealthy issues might be seen in 4 bigger areas. Beginning with an asset valuation, he stated the Federal Reserve stays costly in comparison with revenues after the sale in April.

The Treasury yields remained stubbornly excessive, and spreading between company bonds and funds remained average. It had gathered by the tip of March and worsened in April, however the buying and selling was nonetheless working.

On the true property facet, house costs remained excessive, and family value ratios hovered close to file peaks. The business actual property index, tailor-made to inflation, confirmed some indications of leveling, however the Fed warned that the necessity for refinance might shortly trigger issues.

The debt did not look that good. Enterprise and family debt as a share of GDP fell to its lowest level in 20 years. Nevertheless, enterprise leverage stays excessive and personal margin buying and selling continues to rise.

Supply: Federal Reserve System

Family debt was tamed in comparison with current historical past. Most mortgages have fastened rates of interest, low revenue margins, and general debt service ratios are somewhat higher than earlier than the pandemic. Nonetheless, the Fed has flagged a rise in bank card and automotive mortgage delinquency, particularly for individuals with non-prime credit score scores and low incomes.

In terms of leverage, the Federal Reserve stated banks nonetheless look wholesome and capital ranges are above the regulatory minimal. Nevertheless, losses on fixed-rate belongings continued to assault some banks strongly. Some banks, insurance coverage firms and securitization shops additionally continued to pile up on business actual property.

The Fed stated financial institution lending to banks to monetary firms continues to climb thanks to raised monitoring strategies. Hedge fund leverage is nearing the very best degree of the previous decade, with principally extra funded. Some leveraged buyers have begun dumping positions to cowl margin calls throughout volatility in April.

The Federal Reserve is flagging on financing threat and ongoing market vulnerabilities

The Federal Reserve stated the danger of funding has slipped to average ranges over the previous yr however has not disappeared. Liabilities like operational cash stay close to historic median and nonetheless pose long-term threats. Banks have lowered their reliance on uninsured deposits because the 2022 and 2023 highs.

Prime Cash Market Funds appeared good, however different money autos with the identical threat proceed to develop. Bonds and mortgage funds noticed a bigger than typical outflow throughout market stress in early April, holding belongings that might change illiquidity below strain.

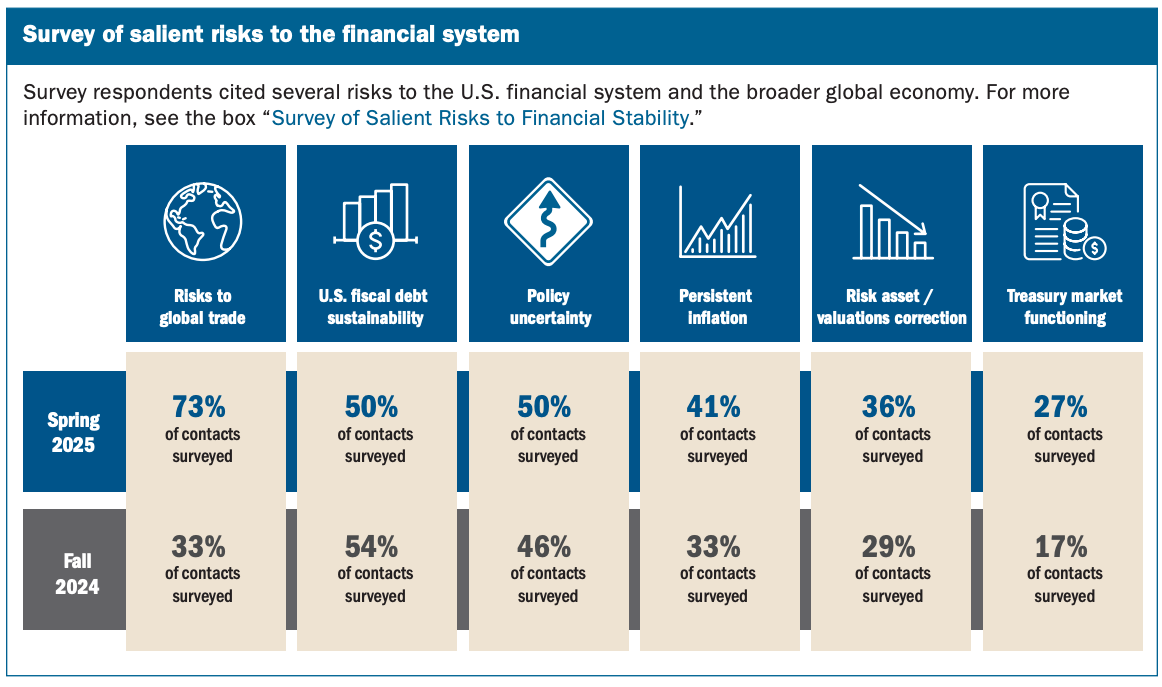

The Monetary Stability Report additionally states that world commerce dangers, debt issues and inflation are exacerbated. “Many respondents cited sustained inflation and correction within the asset market as a big threat,” including that almost all suggestions was collected previous to April 2nd.

Only a day earlier than it blasted shares and actual property, the Federal Reserve repeated years of crypto restrictions. I eliminated the earlier guidelines that advised the financial institution to get pre-approval earlier than doing something with crypto. In an announcement Thursday, the Federal Reserve stated, “These actions will be sure that board expectations are alongside evolving dangers, additional supporting innovation within the banking system.”