Causes to belief

Strict modifying coverage specializing in accuracy, relevance and equity

Created by business consultants and meticulously reviewed

The best commonplace for reporting and publishing

Strict modifying coverage specializing in accuracy, relevance and equity

The soccer worth for the Lion and Participant is smooth. I hate every of my arcu lorem, ultricy youngsters, or ullamcorper soccer.

Solana reveals indicators of power when exceeding essential resistance ranges, suggesting that the Bulls are starting to regain some management after just a few weeks of weak spot. The broader crypto market stays unstable, pushed by continued macroeconomic uncertainty and rising commerce tensions between the US and China. Regardless of these dangers, traders’ sentiment seems to be barely improved, elevating hopes that Solana and different altcoins can enter the restoration rally.

Associated readings

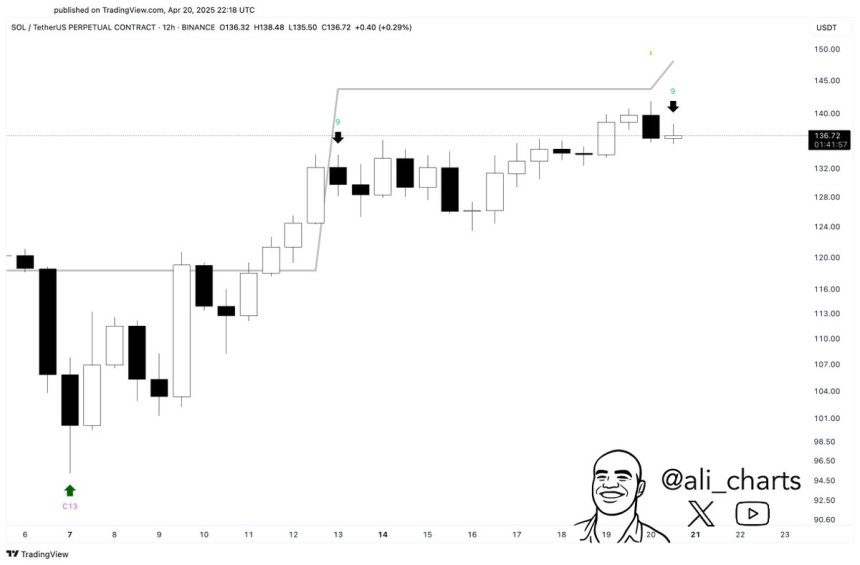

Nevertheless, warning stays assured. Prime analyst Ali Martinez shared a technical sign that it was assuaging latest optimism. In accordance with his evaluation, Solana could also be planning a short-term pullback. The gross sales sign is flashing on the 12-hour chart utilizing the TD sequential indicator. This has traditionally been marked as an area prime and worth elimination stage.

Solana’s latest breakouts are encouraging, however the presence of this bearish sign means that Larry could also be dropping steam within the brief time period. Traders watch and watch Sol can retain assist When you exceed the regeneration degree or retreat as a consequence of gross sales stress. For now, the market is trapped between early indicators of a restoration and the fixed threat of reducing one other leg.

Solana faces essential resistance when short-term pullback indicators seem

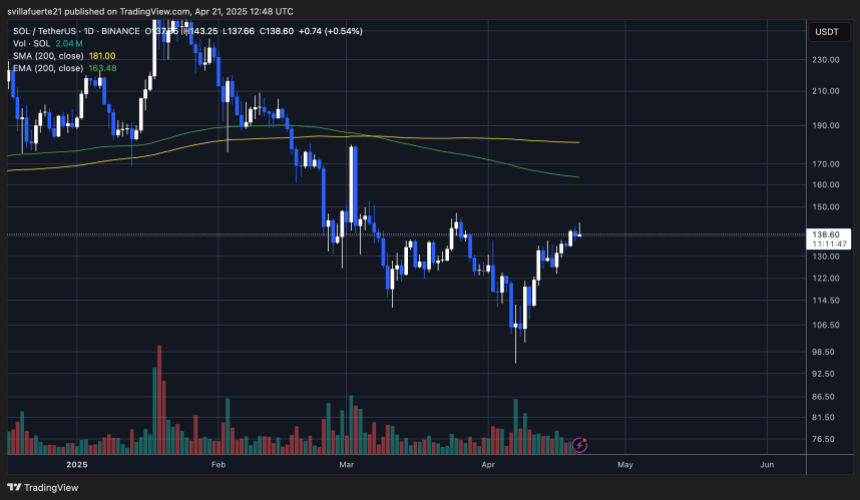

Solana has skyrocketed over 48% since April seventh, gaining momentum over a protracted interval of intense gross sales stress. As costs strategy the $150 degree, the Bulls are presently going through essential checks. This is a vital zone of resistance that has hindered additional progress prior to now.

Regardless of the latest restoration, Solana was some of the affected belongings throughout the downtrend in 2025, dropping greater than 65% of its worth since its peak in January. This underscores the significance of present actions and the significance of sustaining a better degree to verify a real reversal.

Nonetheless, you must watch out. Martinez shared knowledge on x Spotlight TD sequential gross sales indicators on a 12-hour chart. It is a technical indicator that usually precedes fatigue or inversion of short-term tendencies. TD sequential works by figuring out a collection of worth actions that may point out circumstances which might be oversold or bought. If the sign is deployed, Solana might face a short lived pullback earlier than a sustained rise continues.

Macroeconomic components live on as the continued commerce rigidity between the US and China nonetheless shaping feelings throughout international markets. Nevertheless, they need a possible settlement between the 2 nations, and the rising international liquidity has given the Bulls optimism, particularly throughout the Altcoin sector.

Associated readings

Sol Worth Hovers at Pivotal Zone: What’s subsequent?

Solana (SOL) is presently buying and selling at essential ranges and is testing its $150 resistance zone after a latest sharp restoration from low. The Bulls ought to acquire and maintain this degree as much as see breakouts and confirm the onset of sustained uptrends. A essential transfer above $150 might probably purchase extra momentum, resulting in a retest of a better goal that’s doubtless not seen after early March.

Nevertheless, if SoL doesn’t exceed this barrier within the brief time period, the mixing interval between the $130 and $120 ranges might nonetheless be indicative of power. Holding this zone means that the Bulls will construct a basis for steady upward worth motion and soak up gross sales stress with out vital retrospection. Such integration phases are sometimes thought of wholesome in bullish market constructions, with momentum rebuilding earlier than the subsequent leg.

Associated readings

On the draw back, failing to carry a $120 assist degree might expose Sol to deeper losses, with the $100 zone as the subsequent essential space of demand. A break under this degree will negate the present bullish outlook and maybe rekindle a wider downtrend. For now, all eyes are in Sol’s response across the $150 mark.

Dall-E particular photographs, TradingView chart