Binance Analysis has launched a report on Trump’s tariffs and the way it will have an effect on the crypto market. It famous that whereas essentially the most dangerous investments undergo essentially the most, RWA and the exchanges undergo the least.

Moreover, new correlations with the inventory market elevated the dangers related to Bitcoin. Solely 3% of buyers voted in thoughts had been contemplating their most popular asset lessons within the occasion of a commerce battle.

Binance Analysis analyzes tariffs

Binance Analysis, a subsidiary of the world’s largest crypto change, has been investigating business developments in 2025. Just lately, now we have reported an necessary hole between the most recent crypto air mounting fashions and distribution fashions.

As we speak, Binance Analysis has produced its newest report. This has to do with US tariffs.

President Trump’s proposed tariffs have been significantly related to vinance as they’ve had a serious impression on the crypto market. The report says these would be the strictest tariffs in the US because the Thirties, selling male canine horror and the world commerce battle.

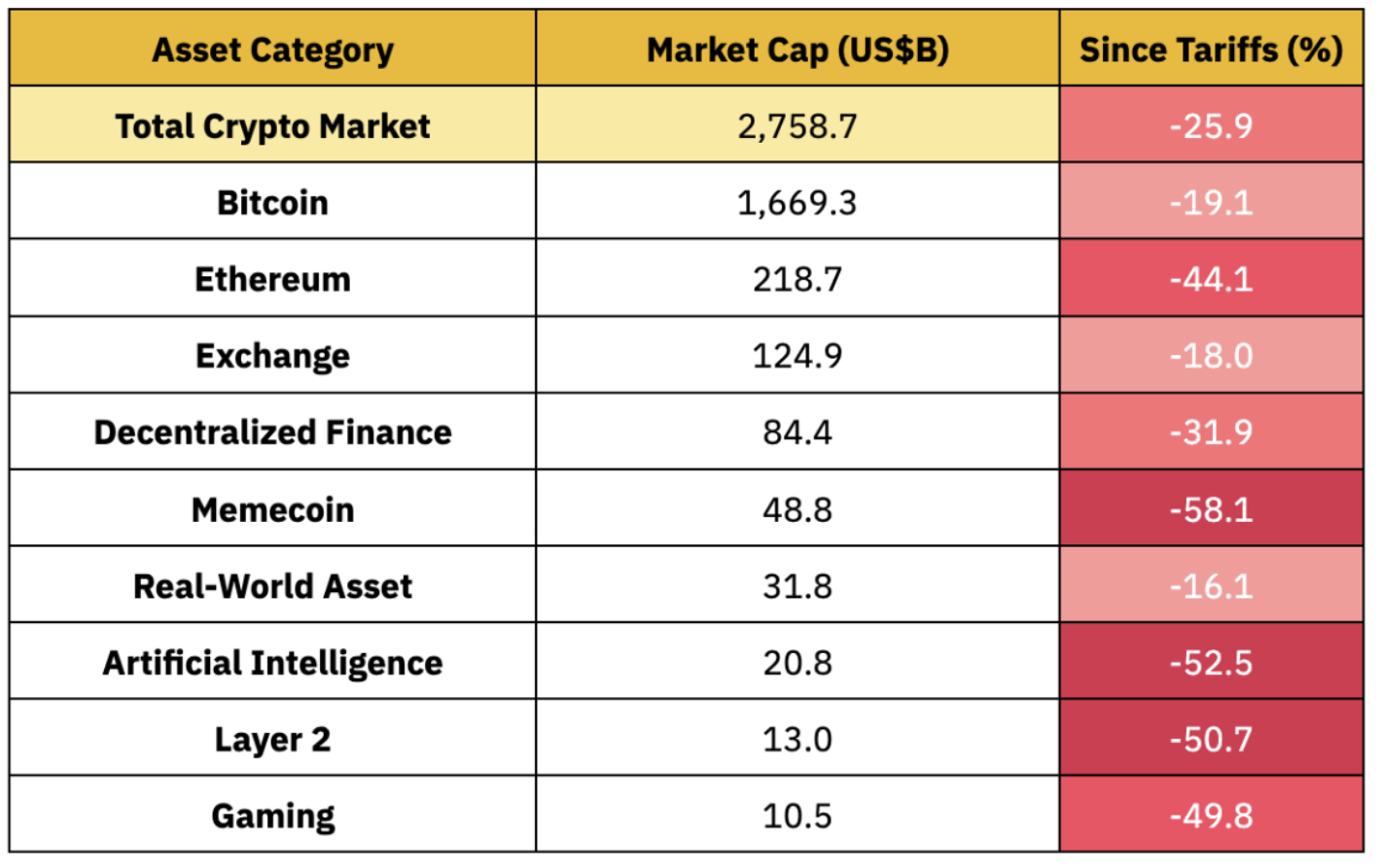

Binance Analysis analyzed numerous crypto-related belongings to find out danger.

Customs duties have an effect on cryptography. Supply: Binance Analysis

The declare is supported by in the present day’s market actions. For instance, Ethereum fell in March 2023, however Mantra’s OM token rose after it introduced its main RWA fund.

Apparently, RWA is the crypto market sector going through the bottom danger from tariffs. The report states that essentially the most weak sectors are these acknowledged as essentially the most in danger, comparable to memecoin and AI.

Each the AI tokens and meme coin sector have fallen by greater than 50% because the tariffs had been introduced, however RWA tokens have solely been misplaced 16%. Trade-based tokens had been solely soaked 18%.

Binance Analysis additional claims that solely 3% of FMS buyers view Bitcoin as a precedence asset class within the case of commerce wars. Probably the most widespread tales about Bitcoin is that it could possibly hedge in opposition to inflation, however this new correlation can have an effect on its traits.

“Macroeconomic elements, significantly commerce coverage and charge expectations, are more and more driving crypto market habits and quickly overturning demand dynamics. Whether or not this correlation construction will final is vital to understanding Bitcoin’s long-term positioning and diversifying worth,” argues Binance Analysis.

Finally, the report recognized many elements that might have a severe impression on the crypto market. A few of the different elements embrace escalation of commerce wars, rising inflation, Federal Reserve coverage, and crypto-specific improvement.

“The danger-off response to mutual tariff bulletins has resulted within the S&P 500 shedding greater than $5 trillion on two-day buying and selling days. Prior to now 44 buying and selling classes, the US inventory market has misplaced greater than $11 trillion. Gomining Institutional informed Beincrypto.

Total, the important thing level is that many variables are at present being performed, however regardless of this confusion it’s nonetheless very doable to decide on a secure possibility. Blockchain tasks pushed by utilities and long-term improvement appear to be the most secure possibility within the present risky ecosystem.