The net betting market went loopy after President Donald Trump dropped a tariff bomb. In response, the probability of a US recession in 2025 has skyrocketed, and crypto merchants are priced it.

Polymarket, the wild west of the Crypto forecasting market, is presently blinking vivid purple warnings for the economic system. At the moment, the opportunity of a recession in 2025 is at a 57% restrict. After falling to 44% over the previous week, the chances have simply risen. Nevertheless, the Crypto Linked Prediction Platform is nailing Trump’s 2024 victory.

Trump’s tariffs push the chances of the recession to 57%

Since returning to the workplace, Trump has promoted the Made-in-USA comeback and has known as on international locations who declare he has “ripped” America for years. In only a few weeks, the US has shifted from a secure financial drive to a supply of turmoil. Tariffs are virtually every thing, 25% are metal and aluminum, and 245% are slapped by Chinese language imports.

Recession bets are presently buying and selling at 57¢, whereas “no recession” is at 43¢, in keeping with information shared by Polymarket. The speed peaked at 36 cents with a “no recession” at 64¢. The tracker recorded an odds on April ninth, reaching a 66% excessive. Shortly after the spike, feelings have declined, however uncertainty has unfold and the chances have risen as soon as extra.

Supply: Polymarket

Even the Giants really feel the warmth, however Goldman is seeing a recession threat of 45% and JPMorgan is seeing 60%. In the meantime, Trump has not retreated as he just lately known as tariffs “medicine” and stated the commerce deficit would stay “climated.”

The likelihood of a US-China commerce contract earlier than June reached 38%. The possibilities of buying and selling are traded at 38¢, whereas “no transaction” is 63¢. Nevertheless, Polymarket merchants imagine there’s a 91% likelihood that the Fed won’t change costs, with solely 8% anticipating a 25 bps minimize.

Economists scale back our development to 1.4%

The worry of the recession is presently knocking onerous on the US door, with new Reuters polls exhibiting economists are practically 50% prone to have a US recession over the following 12 months. It has skyrocketed from simply 25% a month in the past. On this situation, Trump’s 90-day suspension on new tariffs will not be a lot.

Inflation expectations skyrocketed, and economists decreased their development forecasts. The US economic system is presently anticipated to extend by simply 1.4% in 2025, down from the two.2% forecast final month. That is essentially the most sharp downgrade since mid-2022. Economists say that actual injury is caused by uncertainty and nobody desires to speculate or rent if the foundations of the sport can change in a single day. That is changing into a crucial function of Trump’s financial coverage.

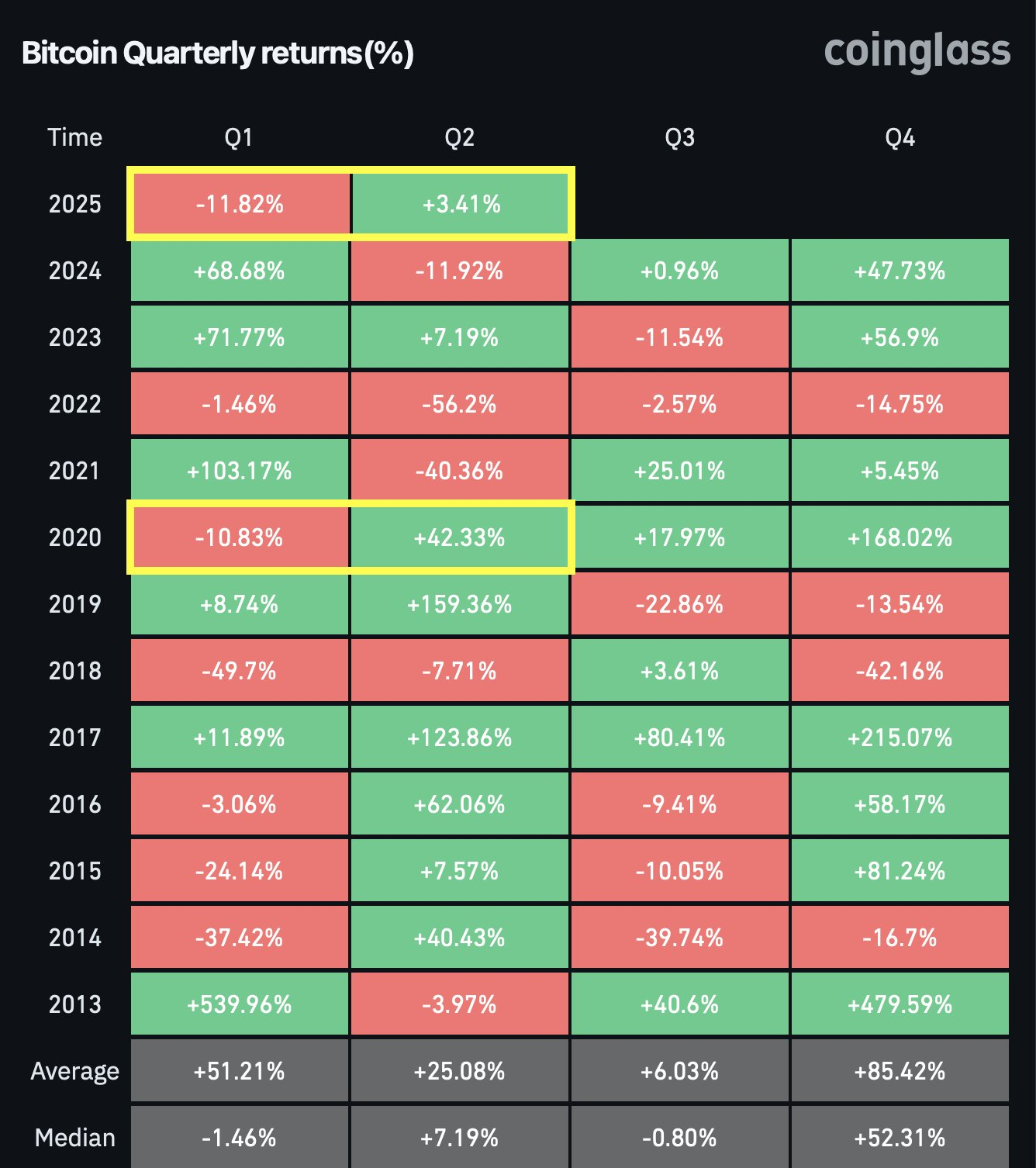

The worldwide digital asset market, which had crossed the moon when Trump stepped into the White Home, can be struggling. The cumulative crypto cap rose barely on Saturday to $2.69 trillion. Thus far, Bitcoin, the biggest crypto, has dropped by greater than 11% over the previous 60 days. BTC trades at a median worth of $85,273 at press time. The 24-hour buying and selling quantity fell 32% to $12.4 billion.