The NFT market seems to be in a worse place because the crypto market prepares for turbulence amid the tariff struggle.

Buying and selling volumes are declining and the market is closed.

The once-dead world of uneven tokens may swell to greater than $264 billion by the as soon as boldly predicted 2032, however it appears to be limping now. Weekly buying and selling volumes have fallen like Domino’s for just a few weeks, scaring capital and bringing the market again to ranges that haven’t been seen since its explosive 2020 debut.

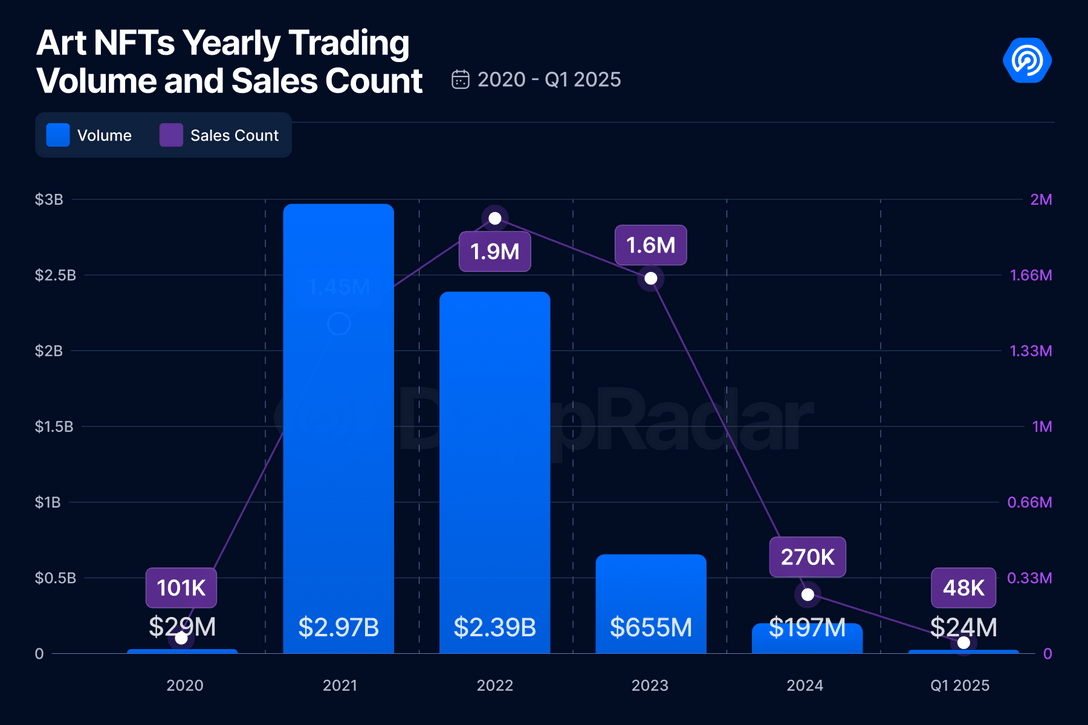

ART NFTS annual buying and selling quantity and gross sales quantity | Supply: Dappradar

Blockchain analytics agency Dappradar exhibits that buying and selling volumes have run excessive in 2021, reaching practically $3 billion.

Quick ahead to the primary quarter of 2025. That determine focuses on simply $23.8 million from 93%, as “energetic merchants have disappeared.”

“This fast development coincides with the worldwide change pushed by the Covid-19 pandemic, which accelerated the adoption of digital platforms and inspired artists to discover revolutionary methods to interact with audiences. However three years later, ART NFT hype has dropped considerably.”

Sarah Gaszcheras

Information backs her up. In 2024, buying and selling volumes fell practically 20% from the earlier yr, however whole gross sales fell 18%. As Gherghelas put it in his 2025 examine, it was “one of many worst years since 2020”.

Nonetheless speculative belongings

In an interview with Crypto.Information, OntsetPR authorized officer Alice Frei implies that the laws are nonetheless confused as “the federal government continues to be undecided about classify NFTs.”

Within the US, they’re typically handled like securities. Which means that platforms should stroll legally tightropes. Within the UK, it’s seen as a collectible beneath mental property regulation.

“These are examples of main international locations with clear cryptocurrency laws. In lots of different international locations, the state of affairs is much more unsure. This lack of readability in laws creates an surroundings the place fraud is ripe and undermine investor belief.

Alice Fryer

Frey additionally highlighted a deeper drawback. Past the world of cryptocurrency and gaming, NFT emphasizes that they’re “making an attempt to show that they supply actual worth.”

“In principle, it may revolutionize some industries. Consider live performance tickets that forestall scalping, digital IDs for on-line verification, or property deeds saved on the blockchain. However in actuality, most NFTs are nonetheless primarily speculative belongings.”

Alice Fryer

Talking of video games the place NFTs are most probably for use in mainstream use, Frei factors out that their adoption can be struggling, and Ubisoft’s mission Quartz remembers that makes an attempt to combine NFTs into AAA video games “confront resistance from gamers and power them to close down.”

Frey says avid gamers are “he hesitated about digital belongings that really feel extra like foreign money than an actual addition to the expertise.”

You may prefer it too: What’s NFT? An entire information to not possible tokens

Rotating door

If the info continues to be darkish, March introduced even worse information. A collection of market closures added gas to the hearth. Amongst them, South Korean high-tech large LG has closed its LG Artwork Lab, which was launched simply three years in the past, on the top of NFT fanatics. The corporate would not share detailed causes and easily says, “It is the fitting time to vary our focus and discover new alternatives.”

Only a week later, former Opsy rival X2Y2, which as soon as boasted a lifetime quantity of $5.6 billion, can be struggling to remain aggressive within the area, citing “a 90% contraction of NFT buying and selling quantity since peaks in 2021.”

Then got here the Bybit. The crypto trade, nonetheless caught up within the $1.46 billion theft related to a North Korean-related hacker, quietly shut down the platform.

Emily Bao, head of Web3 at Bybit, stated the choice will permit the corporate to “improve the general consumer expertise whereas specializing in the following technology of blockchain-powered options.”

Amidst the wave of closures, Frey says the NFT market “seems like a rotating door.”

“For instance, get a boring Ape Yacht Membership. When you attain the height of your NFT standing, your costs have dropped dramatically. At its peak, bored apes are on sale for $400,000, however now they’re barely incomes $50,000.

Alice Fryer

The ultimate hope

Coinbase appears to be pulling again too. Though it has not formally shut down the NFT platform, all indicators counsel that it’ll change focus. In the course of the early 2023 income name, President and COO Emily Choi confirmed that the corporate is seeing “medium-term and long-term alternatives” with NFTS. However its actual focus seems to lie behind its Layer 2 blockchain community, the bottom.

Coinbase declined to touch upon its place as NFT exercise continues to say no regardless of a number of requests from crypto.information.

Ontpr’s authorized officer believes that the present trajectory of the market makes it unlikely {that a} small platform will survive the storm. “Small platforms proceed to shut, with only some dominant gamers like Opensea and Blur remaining,” she stated.

She defined that the shift is pushed by two foremost forces. First, there are extra stringent laws on the horizon, which can possible finish “NFTS’ Wild West Day.” Second, the gaming division could provide a lifeline to the NFTS, however it’s nonetheless slim. As Frei states, the sport could possibly be “Final Hope” for NFTS, however builders ought to keep away from “a good mechanic that would drive gamers aside.”

“The hype is over. If NFTs survive, they should show they provide greater than costly images on the blockchain,” concluded Frey.

learn extra: NFT gross sales slip 5.3% to $100.9 million, Bitcoin NFT gross sales fell 30%