Ethereum reached a notable milestone earlier this month when the Securities and Change Fee (SEC) authorised a number of spot trade commerce funds (ETFs). The transfer is predicted to extend liquidity, appeal to consideration from institutional buyers, and solidify Ethereum’s place as a significant cryptocurrency.

Nevertheless, the smaller market capitalization in comparison with Ethereum’s Bitcoin means additionally it is susceptible to Gunmask Ease, which will increase the chance of buyers. Beincrypto consulted Derivatives buying and selling consultants and representatives from Falconx, Bingx, Komodo Platform and Gravity to investigate the potential influence of this new attribute.

Ethereum ETF choice is SEC authorised

The Ethereum group was happy earlier this month when the SEC authorised a transaction for its present Ethereum ETFs. This approval is a vital regulatory improvement of digital property.

This week marks the official debut of buying and selling choices for US Spot Ethereum ETFs. BlackRock’s Ishares Ethereum Belief (ETHA) was the primary to listing the primary choices to begin buying and selling on Nasdaq ISE.

Shortly thereafter, a wider vary of choices adopted, together with these of the Grayscale Ethereum Belief (ETHE) and Grayscale Ethereum Minitrust (ETH) and people of the Bitise Ethereum ETF (ETHW), all started buying and selling on the CBOE BZX Change.

The transfer will permit a wider vary of buyers past crypto merchants to profit from hedging and hypothesis alternatives in Ethereum costs by means of acquainted funding automobile choices comparable to direct ownershipless ETFs.

The timing of this information is especially optimistic as Ethereum has misplaced some place available in the market not too long ago.

Choices buying and selling to strengthen Ethereum’s market place

The sharp decline in market confidence surrounding Ethereum this week reported that Beincrypto plunged to the bottom value level since March 2023.

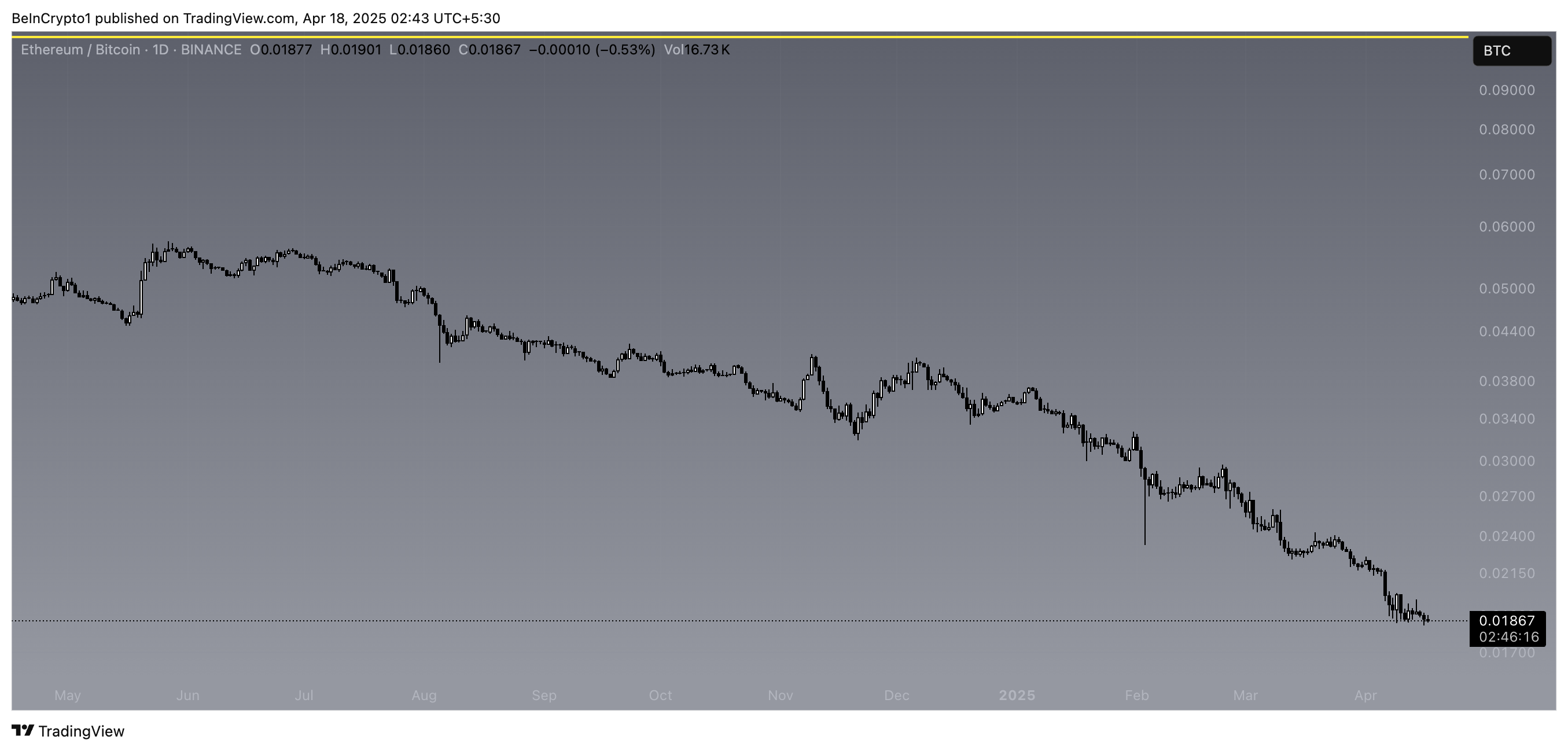

This bearish sentiment-fueled ETH/BTC ratio has hit its lowest stage in 5 years, highlighting Bitcoin’s rising benefit over Ethereum.

ETH/BTC ratio. Supply: TradingView.

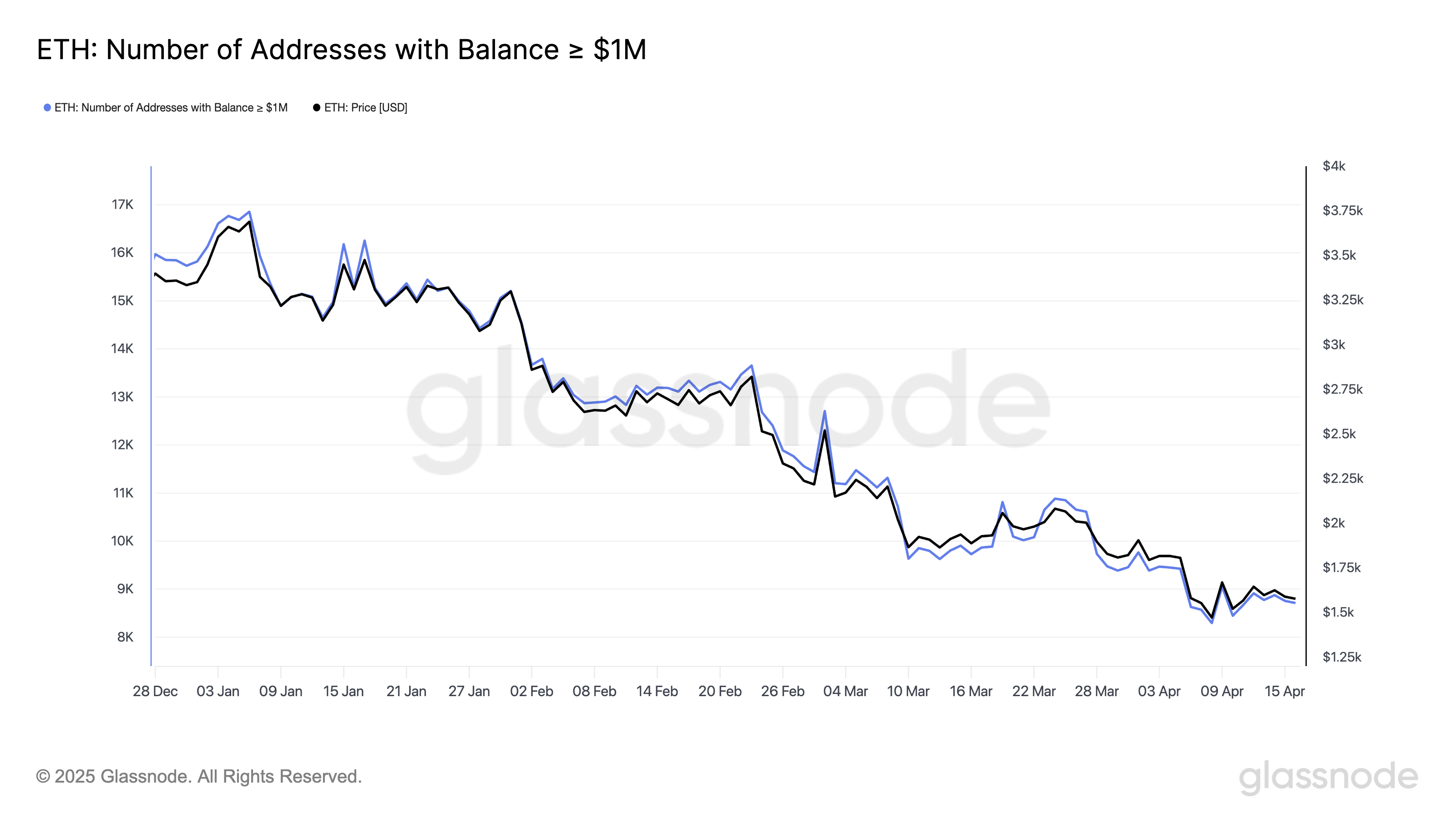

In the meantime, massive Ethereum holders are more and more promoting a major amount of cash, placing downward strain on costs. Ethereum’s worth has declined 51.3% because the starting of 2025, and buyers’ belief is declining, as evidenced by a decline in addresses holding at the least $1 million in ETH.

Holders with at the least $1 million value of ETH. Supply: GlassNode.

Consultants anticipate that choices buying and selling that extra merchants can entry will enhance Ethereum’s market place.

“ETH is leaking management and packing a sub 17%. Choices give institutional gravity. Fund methods make it programmable. Extra instruments imply extra use circumstances.

This new accessibility of choices buying and selling creates extra alternatives for buyers and the broader Ethereum ecosystem.

Improved investor entry and liquidity

The SEC approval of Ethereum ETF in July 2024 was necessary as conventional buyers have been capable of enter the crypto market with out instantly retaining property. These advantages are anticipated to be even better as choices buying and selling can be obtainable now.

“It affords extra alternatives for portfolio diversification and will increase the trail of ETH-based merchandise. Choices past the restricted Bitcoin ETF providing permit buyers to rethink how they allocate their funds.

The Ethereum ETF market turns into extra liquid naturally with elevated participation by means of choices buying and selling.

Excessive buying and selling quantity and hedging demand

The SEC’s new approval for choices buying and selling for Ethereum ETF buyers means that the market is prone to expertise excessive buying and selling volumes first. In consequence, market makers must be ready.

To extend name choices, the company’s market producers might want to hedge hedges by buying extra Ethereum to fulfill demand.

“This can be a standardly accepted choice market dynamic, bringing higher liquidity to the market in the direction of the spot,” defined Spinoff Dealer Gordon Grant.

Ethereum additionally ensures its distinctive benefit of accelerating its perceived high quality and selling optimism amongst key market members, notably in facility buying and selling.

“ETH has gotten a critical institutional tailbone. With choices at the moment being performed, Ether is approaching BTC by way of tradable tools. This will increase the legitimacy and usefulness of ETH in hedging methods and narrows down the gaps in Bitcoin’s dominant narrative.

Nevertheless, a speedy surge in choices buying and selling can have unintended penalties on Ethereum costs, notably within the brief time period.

Will buyers undergo from most cancers masks ease?

Ethereum costs naturally rise as market makers rush to amass lots of their primary property when there are a lot of choices calls. This example can result in a outstanding most cancers masks ease.

When a market maker hedges his place on this state of affairs, the ensuing buy strain creates a optimistic suggestions loop. Retail buyers will really feel like they’re extra seemingly to participate in hoping to make cash from rising costs on Ethereum.

The that means of this state of affairs is especially pronounced for Ethereum, provided that its market capitalization is especially small than that of Bitcoin.

A proactive buy of outlets’ ETHA name choices may power market makers to hedge by buying underlying ETHA shares, doubtlessly having a extra pronounced influence on ETHA costs and, in flip, Ethereum.

“We predict that choice sellers are typically dominant over the long run, however within the brief burst, retail momentum merchants have turn out to be massive consumers of ETHA calls and have been capable of create gun masks ease results much like meme coin shares like GME,” Falconx instructed Beincrypto.

In the meantime, Grant predicts that arbitrage-driven flows will additional exacerbate value fluctuations.

A attainable arbitrage alternative is predicted to emerge

An investor with expertise in choices buying and selling could pursue arbitrage to earn earnings and scale back danger publicity.

Arbitrage entails leveraging the worth distinction between the identical or almost equivalent property in several markets and kinds. That is finished by shopping for in cheaper markets and promoting in dearer markets.

Based on Grant, merchants more and more exploit these value variations as markets for ETH choices on numerous platforms are developed.

“Whereas extra arbitrary motion is predicted between Delibit CME and Spot ETH choices, one-sided flows throughout all three markets might be briefly unstable, better fluidity by means of numerous venues ought to in the end dampen the extremes that place drive actions and frequency of such dislocations. The decline of the post-intro of IBIT choices,” he defined.

Arbitrage’s actions are anticipated to enhance pricing and liquidity throughout the Ethereum Choices market, however property proceed to function underneath the shadow of Bitcoin’s established market management.

Will approval of landmark choices assist Ethereum fill the Bitcoin hole?

Ethereum achieved a significant landmark this week, however faces competitors from its main rival, Bitcoin.

Within the late fall of 2024, Choices Buying and selling launched with BlackRock’s Ishares Bitcoin Belief (IBIT) and have become the primary US Spot Bitcoin ETF to supply choices. Although lower than a yr has handed since its authentic launch, choices buying and selling at Bitcoin ETFs have skilled robust buying and selling volumes from retail and institutional buyers.

Based on Kadan Stadelmann, chief expertise officer at Komodo Platform, choices buying and selling for Ethereum ETFs is comparatively overwhelming. Bitcoin is the cryptocurrency of selection for buyers.

“In comparison with Bitcoin’s spot ETF, Ethereum’s ETFs haven’t seen such cussed demand. Possibility buying and selling provides institutional capital, however Bitcoin stays Crypto’s first mover, having fun with the general market capitalization. It does not go anyplace.

In consequence, his outlook doesn’t embrace Ethereum’s market place being instantly surpassed by Bitcoin.

“There’s nonetheless no flipping of Bitcoin’s market capitalization that was as soon as marketed by Ethereum. Conservative and extra buyers could favor Bitcoin as it’s perceived as it’s safer than different crypto property, together with Ethereum.

It might be true, however choices buying and selling doesn’t hurt Ethereum’s outlook. It solely strengthens them.

Can Ethereum’s choices buying and selling period benefit from alternatives?

Ethereum is at the moment the second cryptocurrency with SEC approval for choices buying and selling in ETFs. This single transfer additional justifies the establishment’s digital property, will increase its presence in conventional markets, and will increase total visibility.

Regardless of the current main blow to Ethereum’s market place, the information is a optimistic improvement. It will not be sufficient to outperform your main rivals, but it surely represents a step in the correct route.

As buyers turn out to be accustomed to this new alternative, their stage of participation will reveal how helpful it might be for Ethereum.