Ethereum costs proceed to wrestle in April as they barely maintain the $1,600 degree this weekend. Regardless of its overwhelming efficiency, some traders are nonetheless maintaining a tally of the cryptocurrency, the second largest by market capitalization. So, common crypto dealer X on social media platforms assumes that it might be time to purchase Ethereum tokens once more.

Have ETH costs reached the underside?

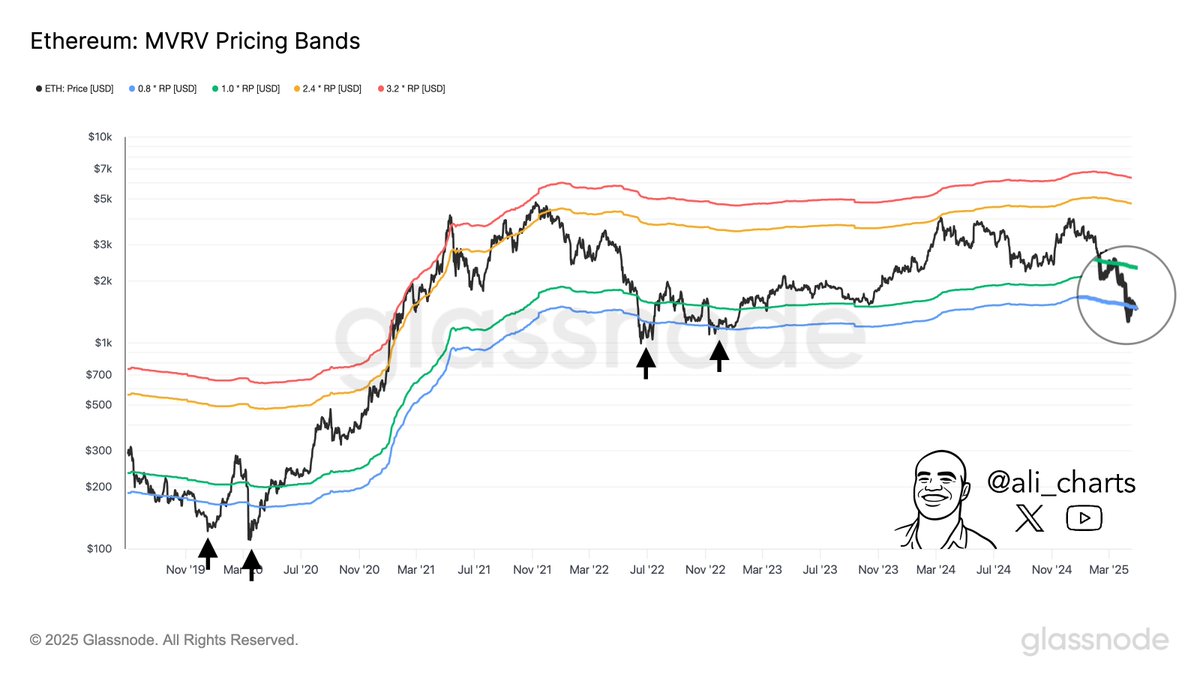

In a submit on April nineteenth on X, famend crypto analyst Ali Martinez revealed that Ethereum has reached a essential on-chain degree. This on-chain commentary revolves round market worth and revolves across the value vary of realized worth (MVRV). It’s often primarily based on a set of MVRV values that describe the extremes of the market cycle.

The MVRV (from market worth to realised worth) ratio is an indicator that tracks the ratio of the market capitalization and the realised cap of a coin. If the worth of this ratio is above 1, it signifies that extra traders are presently thought of to be worthwhile.

Sometimes, MVRV ratios present perception into how traders’ worth (market capitalization) is measured in opposition to the worth they put into (realization cap). Then again, value ranges may also help you estimate the extremes of the coin’s market cycle. Excessive ranges present excessive unrealized positive factors, whereas low ranges present excessive unrealized losses.

Within the context, a excessive MVRV worth is taken into account the highest sign of the value, as merchants are often extra prone to offload property when they’re on the inexperienced. Then again, a low MVRV ratio signifies that the market cycle has reached its backside.

Supply: @ali_charts on X

The blue value vary represents a really low degree with an MVRV beneath 0.8 on roughly 5% of the buying and selling day. Then again, the pink value band is at a really excessive degree, with MVRV values trending above the two.4 mark at round 6% of buying and selling date.

As proven within the chart above, Ethereum costs have fallen beneath the blue pricing band over the previous few days. Traditionally, each time ETH costs drop to this very low degree, that signifies that Altcoin could also be at a backside and making ready to show the pattern round.

Ethereum costs are at a look

On the time of this writing, ETH costs had been simply above $1,610, reflecting a 1.4% enhance over the previous 24 hours. In line with Coingecko information, Altcoin has fallen by 2% over the previous seven days.

The value of ETH on the day by day timeframe | Supply: ETHUSDT chart on TradingView

ISTOCK featured pictures, TradingView chart

Modifying course of Bitconists deal with delivering thorough analysis, correct and unbiased content material. We assist strict sourcing requirements, and every web page receives a hard-working assessment by a staff of prime know-how specialists and veteran editors. This course of ensures the integrity, relevance and worth of your readers’ content material.