Ethereum costs fell 56% this 12 months from the November excessive.

Ethereum (ETH) efficiency has deteriorated in comparison with different high cryptocurrencies comparable to Bitcoin (BTC) and Solana (SOL). The truth is, Ethereum falls to a document low towards Sol, hovering at its 2020 low towards BTC.

This efficiency has led some traders and analysts to query whether or not Ethereum is useless. In a YouTube video on Thursday, Cardano (ADA) founder Charles Hoskinson predicted that Ethereum wouldn’t exist for the following 15 years.

He pointed to the expansion of Layer 2 networks comparable to Base, Optimism, Kinkai and Polygon, which proceed to achieve market share. These chains primarily retrieved customers from Ethereum. This can be a chain recognized for its gradual speeds and excessive transaction prices.

You may prefer it too: Analysts can flip to shares as Bitcoin is approaching the prime quality.

Nonetheless, a more in-depth take a look at high community knowledge reveals that Ethereum is way from heading in the direction of its remaining mise. Its distributed trade protocol has processed greater than $57 billion in volumes during the last 30 days, making it the second largest chain after Solana, and that protocol processed $61.3 billion over the identical interval.

Ethereum can be the biggest chain when it comes to locked whole values. TVL is $107 billion and has a market share of 57%. The $124 billion Stablecoin market capitalization accounts for 51% of the market share. That is the biggest chain within the inappropriate token trade.

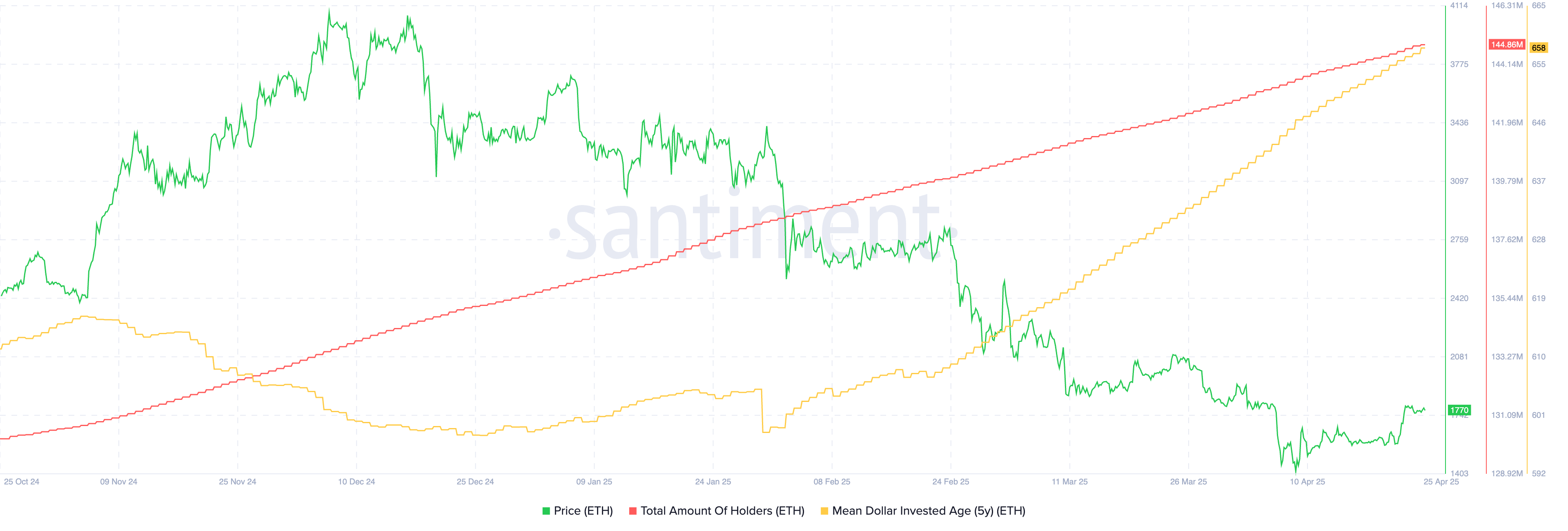

Moreover, Santiment knowledge exhibits that the variety of Ethereum holders continues to extend. At the moment, there are over 144.8 million holders, up from 130 million in October final 12 months. Moreover, the typical funding age over the 5 years has elevated to 658, indicating that older holders will not be promoting.

ETH Holder and MDIA | Supply: Santiment

Ethereum Technical Evaluation: $2150 is a key value to look at

ETH Worth Chart | Supply: crypto.information

The each day chart exhibits the ETH value bouncing off after being held to the underside of $1,383 earlier this month. It rebounded to $1,787, the very best degree since April sixth.

The coin has moved above the higher restrict of the falling channel, which has been fashioned since November final 12 months. It additionally jumped above the 25-day transferring common, forming a small bullish flag sample.

An awesome oscillator is about to maneuver above the zero line. Lastly, in November it surpassed that degree and triggered a 40% leap.

So the necessary Ethereum value degree to look at is $2,150, the bottom level for final August and September. A break above that degree might present extra earnings, doubtlessly $3,000. Not exceeding that degree is harmful because it presents a break-and-retest sample.

You may prefer it too: Pengu Worth breaks out with 40% surge and $0.015 earlier than Eyes $0.015 ETF approval