Skybridge Capital founder Anthony Scaramucci has lengthy been one among cryptocurrency’s most vocal supporters.

In 2017, throughout Trump’s first time period, Scaramucci was appointed Director of White Home Communications. Nevertheless, his political tenure was short-lived. He was dismissed simply 10 days later after a really publicly revealed dispute with the supreme faction of employees on the time, Reis Pliebas.

As a longtime Bitcoin (BTC) Bull, Scaramucci allotted greater than 50% of its portfolio to main cryptocurrencies. He additionally invested in Solana (SOL), Avalanche (Avax), and Polkadot (DOT).

Speak about Bankless Early January podcast Scaramucci highlighted Solana as the most suitable choice among the many layer 1 blockchains, citing its pace and low transaction prices as key benefits. His outlook for Bitcoin final yr predicted that BTC would surge in demand for Bitcoin Alternate Funds (ETFs), predicting it might exceed $100,000 in 2024.

Wanting forward, Scaramucci believes that pro-crypto insurance policies below a brand new administration might push Bitcoin’s worth even greater, probably doubling by 2025. Nevertheless, he stays catasious concerning the broader macroeconomic panorama, warning that Donald Trump’s proposed protectionist commerce insurance policies, particularly a blanket tariff technique, might set off recessionary pressures within the US financial system, an end result that will weigh closely on investor sentiment, together with in crypto market.

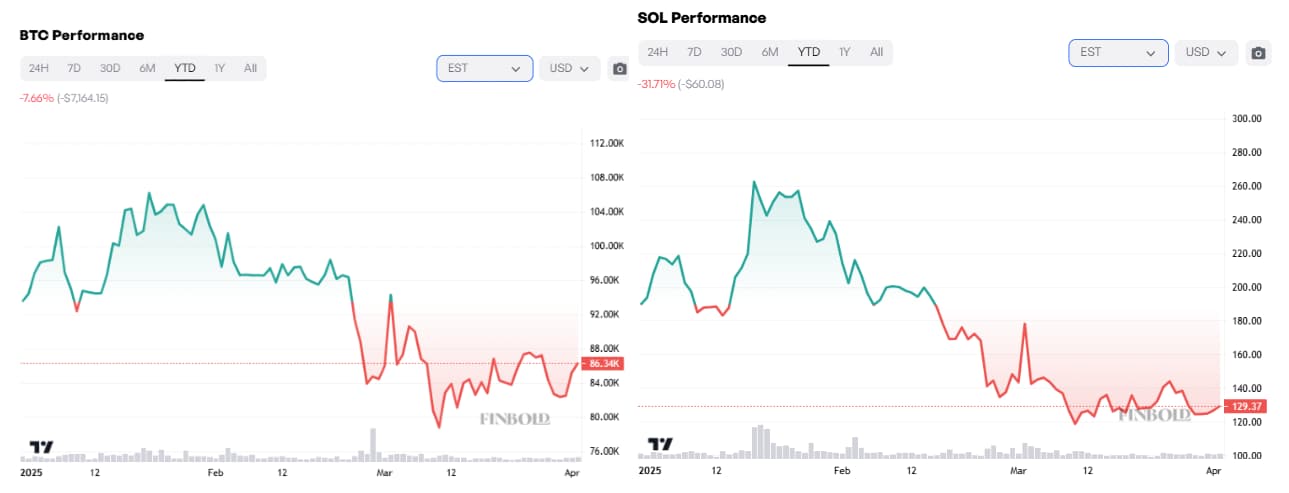

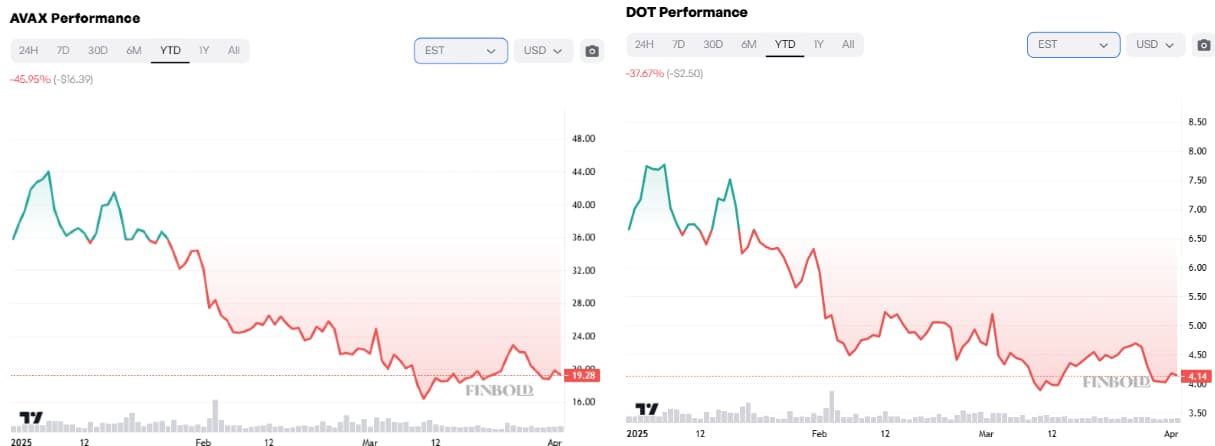

Anthony Scaramucci’s first quarter 2025 portfolio efficiency

Within the first quarter of 2025, Scaramucci’s Crypto portfolio suffered a pointy loss. Traders who invested $1,000 evenly in his technique on January 1st had their portfolio worth decreased to about $700, dropping 30% in simply three months.

The yr started with a cautious and optimistic notice, however the market-wide sale on February 1 was triggered by the formal announcement of Trump’s swept tariffs, sending shockwaves via dangerous property.

On the time of writing, Bitcoin, which makes up greater than half of Scalamucci’s portfolio, has fallen 7.9% for the reason that begin of the yr, buying and selling at $86,538. Solana, most well-liked by each Scaramucci and Skybridge capitals over Ethereum (ETH), additionally plummeted to 31% to $129.

In the meantime, Avax and Dot have surged by 45% and 37% respectively for the reason that begin of the yr, incomes even heavier hits.

Scaramucci’s excessive conviction guess on Bitcoin and high-choice Altcoins has supplied nice income in previous bull markets, however the current recession reveals the vulnerability of such a narrowly centered technique. If market sentiment adjustments, such excessive publicity positions can shortly erode income.

In distinction, a extra balanced strategy that entails stubcoins and a variety of crypto property might present higher safety towards volatility, serving to buyers survive the sharp corrections with out absorbing the complete affect of a sector-wide drawdown.

Featured Photos from ShutterStock