Key takeaways

- You possibly can request a credit score line improve with Uncover by filling out a type on-line or by way of the issuer’s cell app, or by calling the quantity on the again of your bank card.

- Uncover takes quite a lot of elements into consideration when deciding to approve or deny your request, together with your credit score profile, earnings degree and housing info.

- Earlier than you request a credit score line improve from Uncover, ensure your earnings degree and credit score rating are in place and your Uncover account is in good standing.

Your credit score restrict is a significant component in your credit score well being. When you use your bank cards responsibly, you might be typically rewarded with larger credit score limits and extra buying energy. When you’re caught with low credit score limits, you won’t have the flexibility to make as many purchases, earn as many rewards or use your out there credit score to spice up your credit score rating.

A lot of right this moment’s greatest bank cards repeatedly supply credit score restrict will increase — however if you happen to haven’t acquired a credit score restrict improve shortly, you may all the time request one. Understanding the best way to improve your credit score restrict offers you the flexibility to fund main bills, earn rewards like money again on these purchases and construct your credit score rating.

In case you have a Uncover bank card, you may request a credit score restrict improve on-line or over the cellphone. There isn’t a acknowledged Uncover card most credit score restrict, which implies you may all the time ask for somewhat bit extra — however when do you have to ask for a credit score improve with Uncover, and the way a lot credit score do you have to ask for?

Let’s check out every part that you must find out about requesting a Uncover credit score restrict improve, together with what you need to do earlier than you make your request and what you need to do in case your Uncover credit score restrict improve request is denied.

Who’s eligible for a credit score line improve from Uncover?

When do you have to apply for a credit score improve? Many individuals ask for a credit score improve if they’re planning to make a giant buy or are hoping to make use of their credit score restrict improve to spice up their credit score rating.

However not everybody who requests a credit score improve from Uncover will be capable to get one. Uncover says that those that are eligible for a credit score line improve would seemingly embrace:

When you meet a minimum of one of many standards on Uncover’s record, you is perhaps eligible for a Uncover credit score restrict improve.

What to do earlier than you apply for a credit score improve

Uncover desires to know that it is possible for you to to deal with your new credit score restrict responsibly and received’t use it to run up a bunch of debt that you could’t repay. That’s why it’s a good suggestion to time your credit score restrict improve request with a rise in your monetary stability. In case you have not too long ago elevated your earnings or improved your credit score rating, for instance, you is perhaps extra prone to see your credit score restrict improve request authorized.

Right here’s what to do earlier than you request a Uncover credit score restrict improve:

Know your present credit score restrict

Earlier than you request a credit score line improve, you need to know your present credit score restrict, in addition to your present credit score utilization ratio. That approach, you understand how a lot credit score Uncover has already authorized in your bank card and the way a lot of that credit score you’re at present utilizing.

Log in to your Uncover on-line account or Uncover cell app to view your credit score restrict, which ought to seem on the high of the display screen.

Determine precisely how a lot credit score you need

Growing your out there credit score can increase your credit score rating and enhance your buying energy, so that you is perhaps tempted to ask for a considerable amount of credit score directly — however don’t make a request that’s so massive it’s prone to be declined. In case you have a $5,000 credit score restrict, it’s higher to request a rise to $6,000 than it’s to request a rise to $10,000.

To provide you an concept of how a lot of a rise you may get, you may examine your credit score report on the time you got your unique credit score restrict to your present credit score report. Your credit score is a significant component in how issuers decide your credit score restrict if you apply for a card, so this might offer you reference level.

Verify over your credit score rating and your Uncover account

It is best to know your credit score rating and ensure your account is in good standing earlier than you contact Uncover. In case your credit score rating has fallen because you first utilized for the bank card, Uncover won’t need to elevate your credit score restrict. Likewise, if you happen to’ve missed funds or have carried out different issues to place your account in unhealthy standing, Uncover won’t need to take the danger of providing you extra credit score.

Tips on how to apply for a credit score line improve on-line or by way of cell app

Requesting a credit score line improve from Uncover is a comparatively easy course of. Simply observe these steps:

Attain out to the issuer

When you’re utilizing the Uncover app, choose “Companies” from the underside toolbar, adopted by “Credit score Line Improve.”

EXPAND

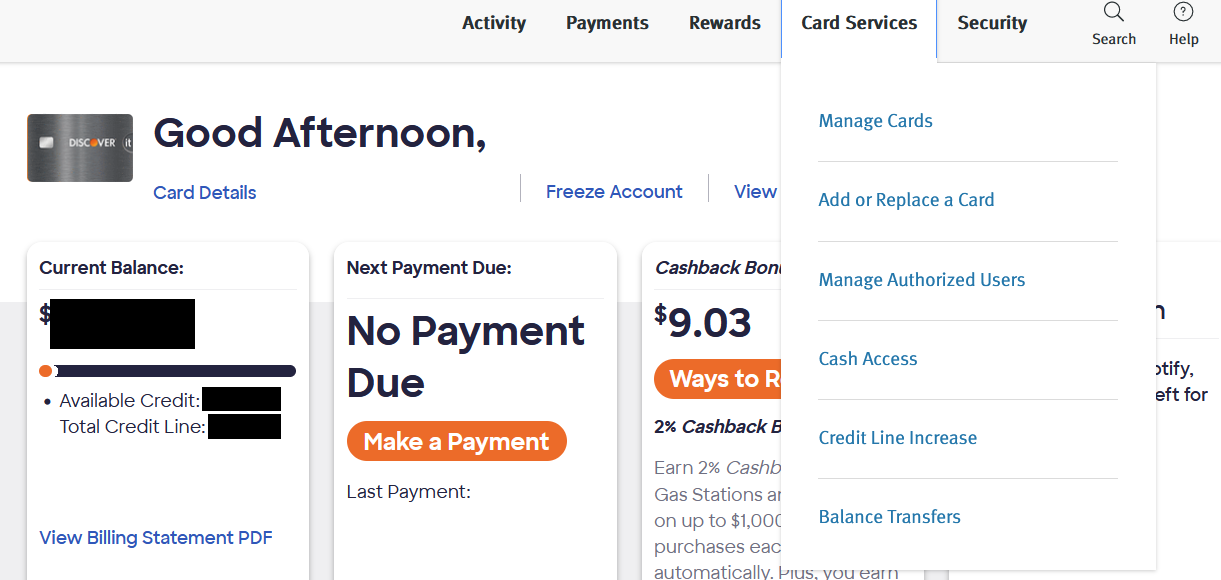

When you’re requesting a Uncover credit score restrict improve on-line, choose “Card Companies” from the web page menu on the high, adopted by “Credit score Line Improve.”

EXPAND

Present Uncover with any obligatory info

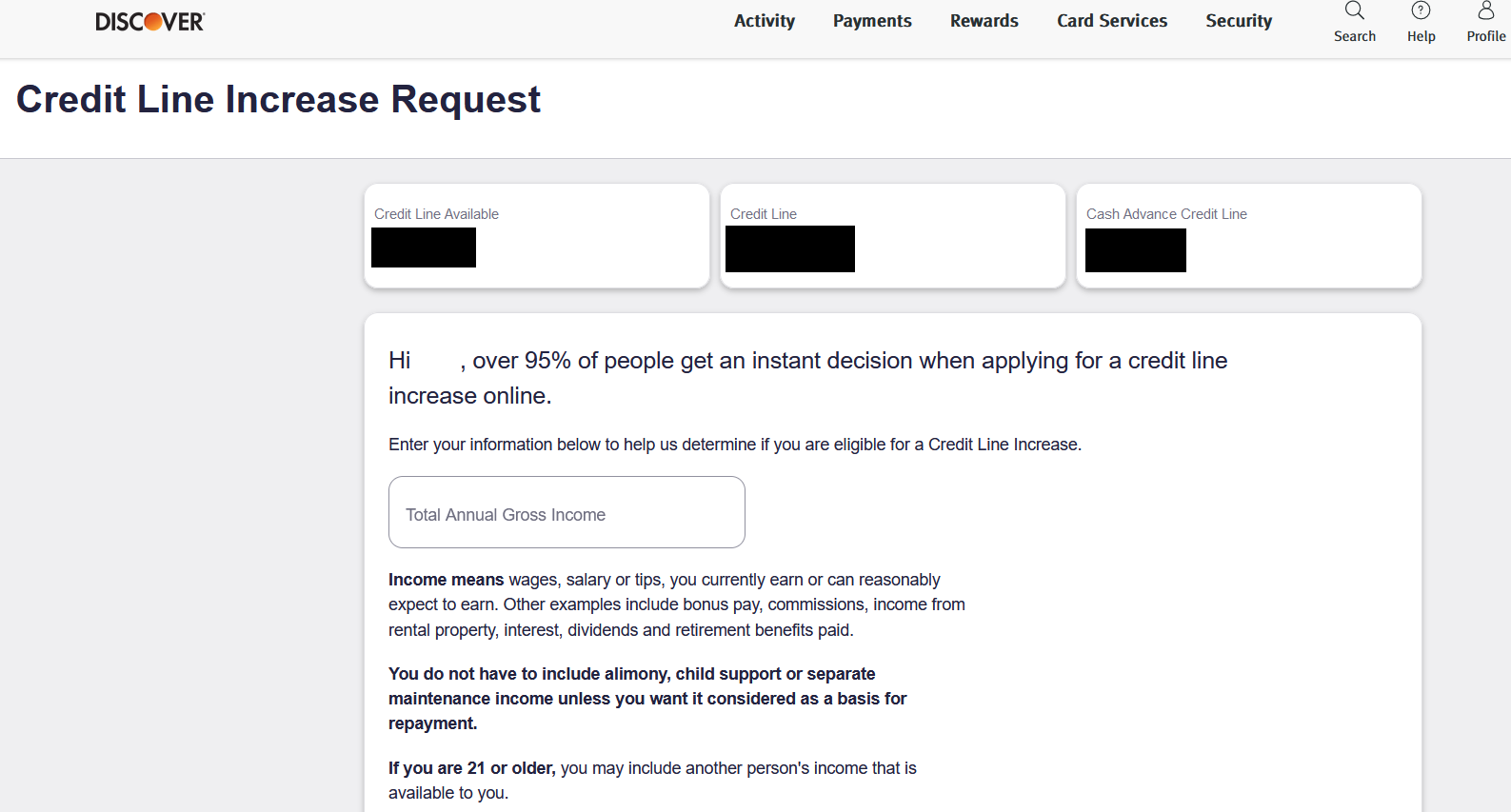

When you’re requesting your credit score line improve on-line or by way of the cell app, you’ll be directed to a Credit score Line Improve Request type. This way will ask you for info like your complete annual gross earnings and your month-to-month housing cost.

EXPAND

Give Uncover permission to carry out a tough credit score inquiry if wanted

A Uncover credit score restrict improve request may contain a tough credit score inquiry, which may drop your credit score rating by a number of factors, however Uncover will solely proceed with that a part of the appliance after receiving your consent. In lots of instances, Uncover will proceed along with your request by doing a gentle credit score inquiry as an alternative, which received’t impression your rating.

Tips on how to apply for a credit score line improve over the cellphone

Requesting a credit score line improve over the cellphone is fairly easy. You simply need to:

- Name customer support. Name the quantity on the again of your bank card or their customer support line at 1-800-347-2683.

- Confirm your identification. The Uncover consultant may ask you to confirm your identification earlier than continuing.

- Reply the consultant’s questions. Chances are you’ll be requested why you need Uncover to extend your credit score restrict. You must also be ready to supply your complete annual gross earnings, in addition to your month-to-month housing/hire cost.

- Submit your request. The consultant may have further info from you, equivalent to consent to carry out a tough inquiry, earlier than processing your request.

How lengthy does a Uncover credit score line improve take?

Whereas there isn’t an official assertion on how lengthy a Uncover credit score line improve takes to course of, Uncover does present steerage on how lengthy it would take to get authorized. “Over 95% of individuals get an on the spot choice when making use of for a credit score line improve on-line,” in line with Uncover’s Credit score Line Improve Request type. In some instances, it could take a number of days to be taught whether or not your credit score restrict request will likely be authorized (and you might have to reply further questions on your funds earlier than Uncover could make the ultimate choice).

Many credit score line improve requests are applied by issuers as quickly because the request is authorized. So, if you happen to request a Uncover credit score restrict improve and get authorized, your new credit score restrict may take impact that very same day.

Different methods to extend your credit score restrict with Uncover

Requesting a credit score restrict improve in your Uncover bank card is one technique to improve your credit score restrict with Uncover, nevertheless it isn’t your solely possibility. Listed here are some further methods to extend your credit score restrict:

Apply for a brand new Uncover card

If you wish to improve your out there credit score with Uncover, you don’t essentially need to request a credit score restrict improve on an current Uncover bank card — you may as well apply for a brand new Uncover card.

Taking out a brand new Uncover card offers you an extra line of credit score, which can assist you improve your complete out there credit score and doubtlessly increase your credit score rating. A brand new Uncover card also can allow you to entry further bank card rewards.

In case you have a money again rewards card just like the Uncover it® Money Again, for instance, you may need to take into account making use of for the Uncover it® Miles. That approach, you may earn each money again rewards and journey rewards in your purchases.

Look out for an computerized credit score restrict improve

Uncover might routinely improve your credit score restrict relying in your account historical past and creditworthiness. When you constantly make on-time funds in your Uncover card account, for instance, you is perhaps extra prone to obtain an computerized credit score restrict improve than somebody who repeatedly misses funds.

If you need an computerized credit score restrict improve from Uncover, do your greatest to apply good credit score habits and preserve your credit score rating as excessive as attainable.

What to do in case your Uncover request is denied

In case your Uncover credit score restrict improve request is denied, it’s a good suggestion to attend earlier than requesting one other credit score restrict improve. In actual fact, Uncover suggests ready a number of months earlier than submitting a brand new request. Listed here are a number of actions you may take whilst you wait:

Enhance your credit score rating

Uncover is extra prone to improve your credit score restrict in case your credit score rating improves. If you wish to enhance your credit score rating as shortly as attainable, concentrate on making on-time funds on your whole credit score accounts and paying down your excellent debt.

Since your cost historical past makes up 35 p.c of your FICO credit score rating and your credit score utilization ratio makes up 30 p.c, making on-time funds and paying off your bank card balances may give your credit score rating a major increase.

Have in mind: Your creditworthiness won’t be the first motive why your credit score line improve request was denied. Many credit score issuers tighten credit score limits throughout financial downturns, for instance, making it more durable for particular person cardholders to entry larger credit score limits.

Improve your earnings

Uncover is extra prone to improve your credit score restrict if you happen to can show that your earnings has gone up. It is perhaps time so that you can tackle a aspect hustle or begin trying to find a brand new job. You must also reevaluate your present earnings — perhaps you didn’t issue within the suggestions you make at work, or perhaps you haven’t been together with your yearly bonus. This stuff may give Uncover a extra correct concept of your earnings.

After you’ve elevated your earnings, ensure to replace your Uncover account along with your new gross annual earnings. When you’re utilizing the Uncover app, observe these steps:

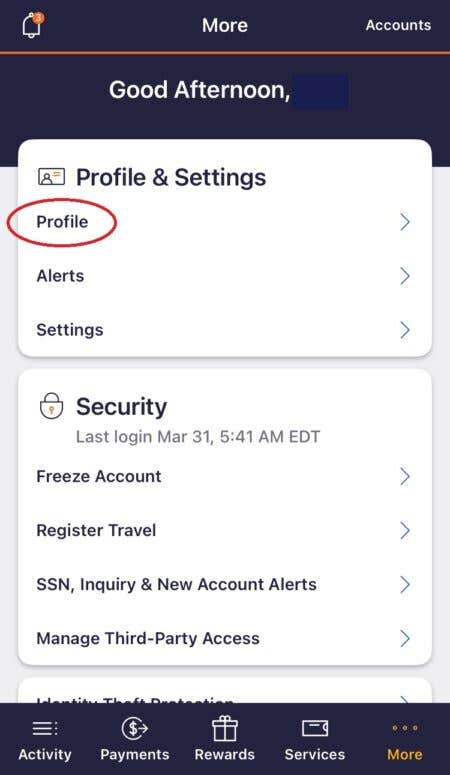

- Choose “Extra” from the toolbar on the backside of the display screen.

- Choose “Profile.”

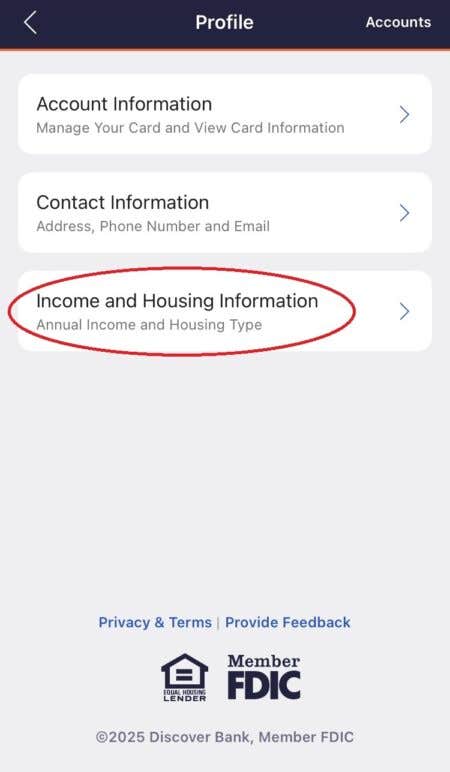

- Choose “Revenue and Housing Data” and replace no matter must be modified.

EXPAND

EXPAND

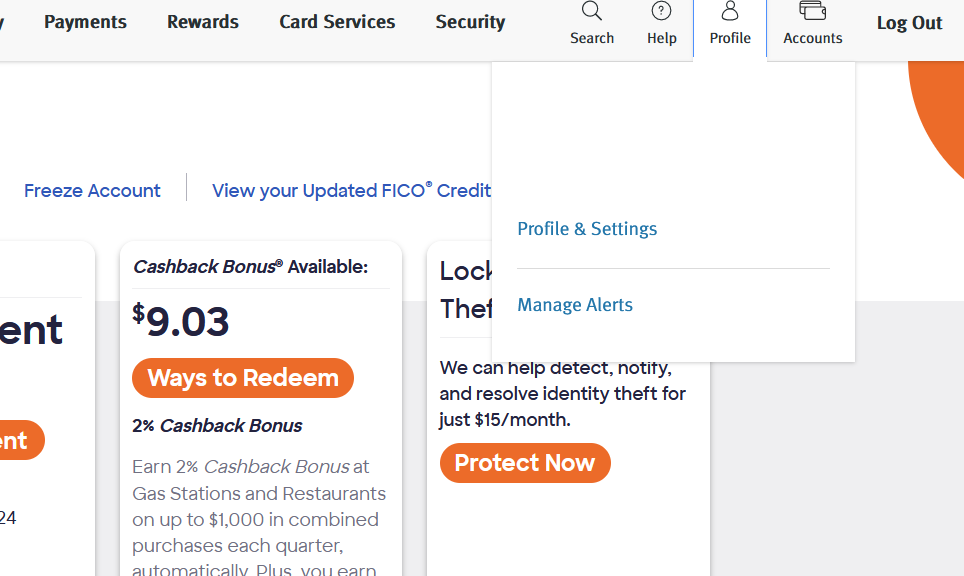

When you’re logging into Uncover via an internet browser, observe these steps:

- Choose “Profile” within the high proper nook of the house display screen.

- Choose “Profile & Settings” from the dropdown.

- Scroll right down to the Revenue and Housing Data part and choose “Edit Revenue and Housing Data.”

EXPAND

As soon as your earnings info is up to date, you is perhaps able to request one other credit score line improve — or Uncover may improve your credit score restrict routinely.

Apply for a bank card from a unique issuer

As a substitute of requesting one other Uncover credit score line improve or making use of for a brand new Uncover card, you may need to take into account a bank card from a unique issuer.

Bank card issuers have completely different strategies of setting bank card limits, and also you may be capable to get the credit score you want by making use of for a bank card that isn’t issued by Uncover. If you have already got a bank card issued by one other main lender, that issuer may be extra prone to grant your subsequent credit score restrict improve request.

The underside line

You possibly can request a credit score restrict from Uncover on-line, via the issuer’s cell app or over the cellphone by calling the quantity on the again of your bank card.

Nonetheless, your potential to efficiently be authorized for a credit score restrict improve — whether or not from Uncover or one other issuer — all comes right down to your potential to handle your credit score accounts responsibly. In case your credit score habits aren’t nice, you’re most likely going to have a more durable time growing your credit score limits. When you apply good credit score habits, bank card issuers are prone to reward you with further credit score.