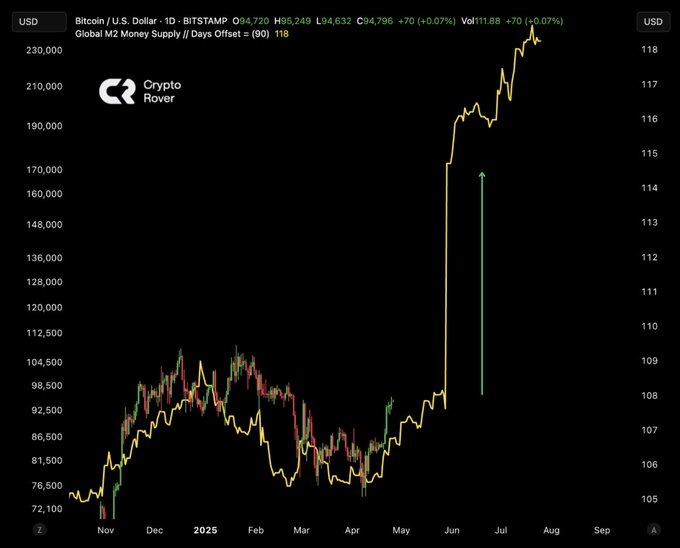

Bitcoin is approaching a key worth vary of $96,000. It is a stage of resistance that has repeatedly challenged upward momentum in the course of the integration section. Nevertheless, sentiment amongst analysts stays firmly and bullish, supported by a quickly increasing world cash provide.

Crypto Analyst Rover mentioned “world liquidity is exploding” as the amount of round finance capital continues to develop. Digital property expertise elevated demand attributable to rising market liquidity, leading to a rise in Bitcoin costs. The influx of capital into the market creates favorable circumstances for Bitcoin to doubtlessly outperform its $96,000 resistance mark throughout a sustained breakout.

sauce: x

Bitcoin faces vital resistance at $96,000

Earlier makes an attempt at Bitcoin exceeding the $96,000 resistance stage have attracted a whole lot of consideration amongst buyers. The market has proven help on this zone, making costs troublesome to interrupt by means of.

Associated: Crypto marketing campaign encourages Swiss Nationwide Financial institution to diversify with Bitcoin reserves

The subsequent main objective for Bitcoin’s upward motion after a possible break of $96,000 is $101,000, adopted by $111,000, suggesting a unbroken bullish sample. If Bitcoin cannot exceed $96,000, its worth may fall.

sauce: x

Bitcoin’s market sentiment is closely depending on funding charges with rising liquidity. When nearly all of futures merchants open up brief positions and mirror bearish emotions, their funding charges go unfavorable. Traditionally, such unfavorable funding intervals have preceded the rise in Bitcoin costs, indicating that present tendencies may result in an upward motion.

Institutional earnings strengthen the outlook for Bitcoin

Elevated demand for Bitcoin ETFs has led to a dramatic improve in revenue ranges from monetary establishments to Bitcoin. BlackRock’s current $240 million Bitcoin buy, together with the establishment’s belief, means a constructive outlook for Bitcoin. Rising institutional help and elevated liquidity counsel that the potential for Bitcoin’s digital property stays sturdy, supporting favorable worth tendencies over the subsequent interval.

Associated: Coin Share: Bitcoin All-in Mining Prices reached 137K for listed miners within the fourth quarter

The market worth of Bitcoin is instantly correlated with world monetary growth, together with rising demand for liquidity-driven cryptocurrency. The cryptocurrency market exhibits that Bitcoin outweighs the important thing obstacles on the trail to producing substantial worth will increase.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version just isn’t answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.