Causes to belief

Strict enhancing coverage specializing in accuracy, relevance and equity

Created by trade consultants and meticulously reviewed

The best commonplace for reporting and publishing

Strict enhancing coverage specializing in accuracy, relevance and equity

The soccer value for the Lion and Participant is gentle. I hate every of my arcu lorem, ultricy youngsters, or ullamcorper soccer.

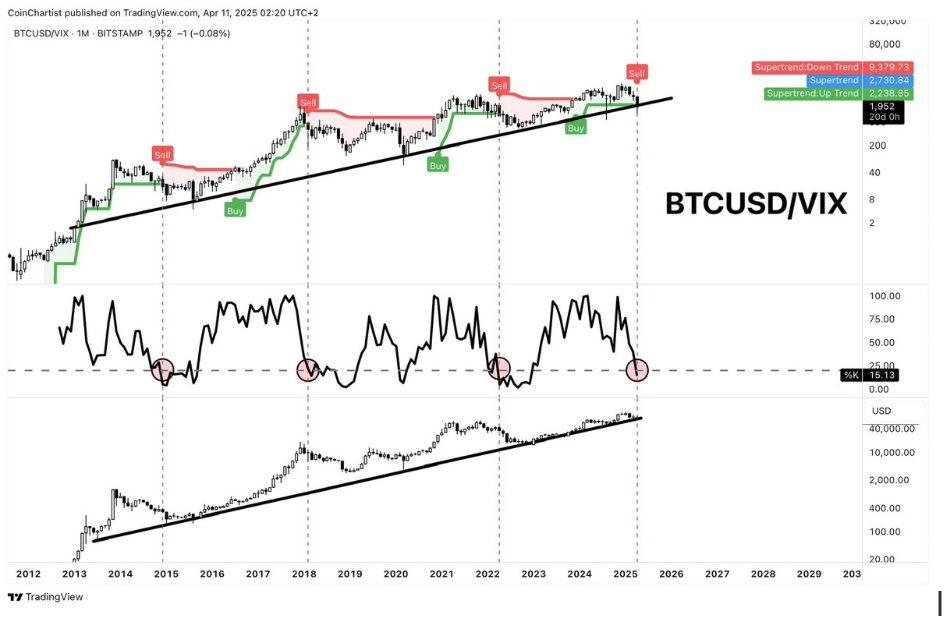

Technical consultants Tony Severino Bitcoin/VIX warns that it isn’t as bullish as market members consider. As a substitute, consultants revealed that the present indicators level to the flagship code being within the bear market.

Bitcoin/VIX refers back to the Bear Market: Analyst

in xPostSeveno warned that Bitcoin/VIX shouldn’t be bullish as some crypto influencers might draw it. He stated that technical evaluation of it means that present alerts are typically seen by market members. Bitcoin Bear Market. Nevertheless, consultants identified that the month wasn’t over but. This implies that these indicators may nonetheless be bullish.

Severino beforehand highlighted some the explanation why he’s now not bullish about Bitcoin and different crypto property. On the time, he hinted on the BTC charts. Elliott Wave Principle Different technical indicators additionally confirmed that flagship ciphers are most likely on the high of this market cycle.

Severino beforehand highlighted some the explanation why he’s now not bullish about Bitcoin and different crypto property. On the time, he hinted on the BTC charts. Elliott Wave Principle Different technical indicators additionally confirmed that flagship ciphers are most likely on the high of this market cycle.

In Seveno’s warning, crypto analysts like Stated offered a extra bullish outlook for Bitcoin. Saeed, this repair is merely a Wholesome retracement And the broader pattern in flagship cryptography continues to be bullish. Analysts highlighted $85,000 as the extent of Bitcoin must be crushed on high to succeed in the brand new excessive.

The macro facet appears bullish for Bitcoin in the meanwhile. The most recent CPI and PPI inflation information launched have been decrease than anticipated, and shortly elevated the hopes of the Federal Reserve’s price discount. In line with a latest report, Boston Federal President Susan Collins additionally ensured that the US Central Financial institution is able to stabilize the market as wanted.

With the President of the US Donald Trump’s tariffs Lasting, the US Federal Reserve might must step in instantly. That is bullish for Bitcoin and different crypto property.

BTC’s bullish technical evaluation

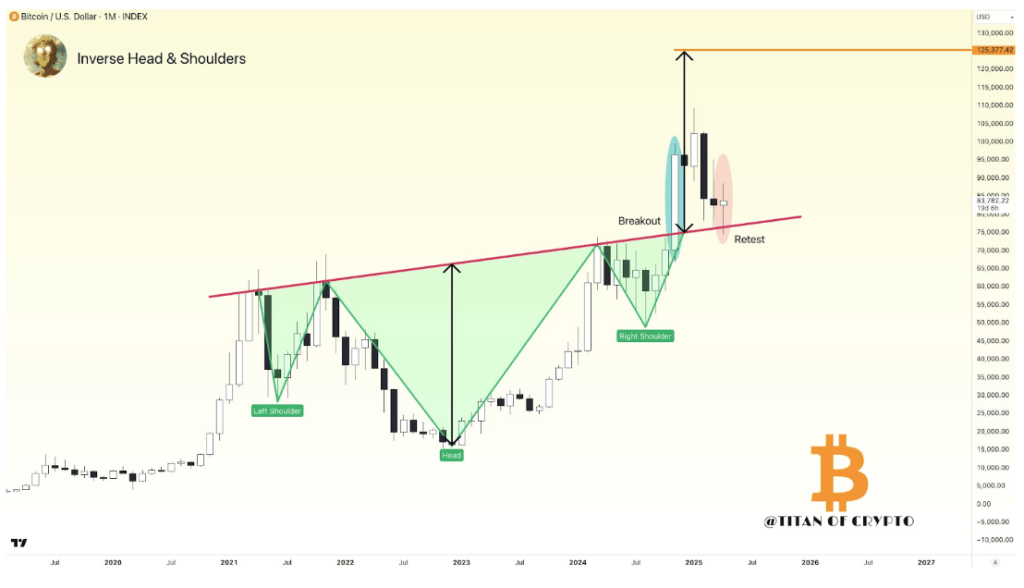

In a latest X put up, Crypto Analyst Titan of Crypto It has revealed that Bitcoin types a reverse head and shoulder sample, however for now it seems to be like a clear retest. He stated if this sample was unfolded, the flagship code may attain $125,000 this 12 months, marking the brand new all-time excessive (ATH).

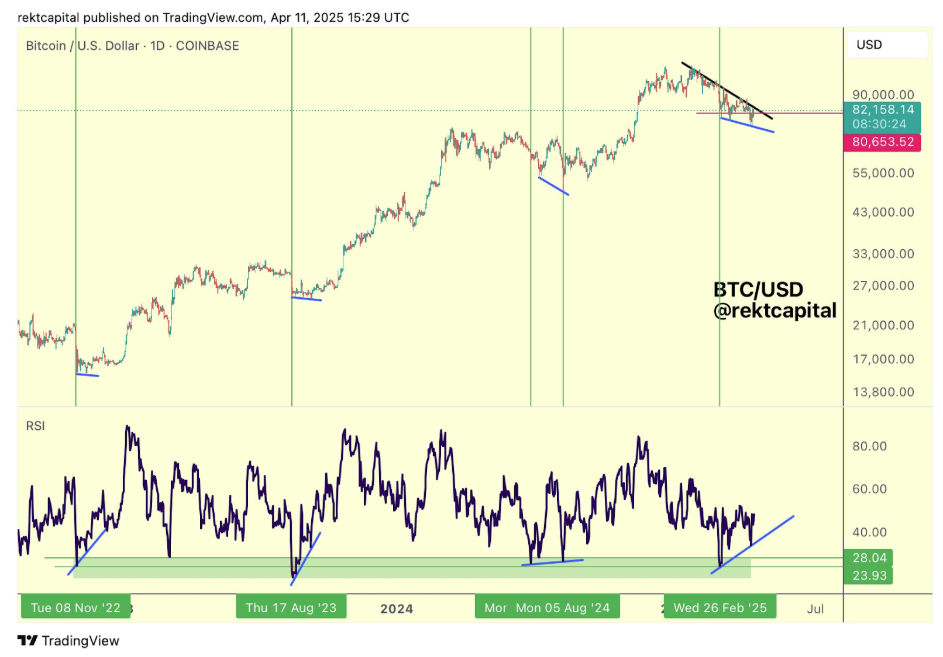

In the meantime, Crypto analyst Rekt Capital revealed that Bitcoin is creating one other larger, decrease improvement of the relative power index (RSI), whereas forming a lower cost low. He famous that the BTC was fashioned all through the cycle. A daring launch This can be a few instances. That is optimistic for the flagship code. Every divergence at all times precedes an inverse reversal, indicating that BTC can once more rise shortly.

Associated readings

On the time of writing, Bitcoin costs are buying and selling at round $83,400, a rise of over 3% over the previous 24 hours. information From CoinMarketCap.

Pexels featured pictures, TradingView charts