Ethereum tokens have misplaced virtually half of its worth within the first quarter of 2025 for the previous few months, however have misplaced virtually half of its worth.

Apparently, these commerce tariff suspensions didn’t have a a lot bullish impact on “King of the Altcoin,” which couldn’t maintain above the $1,600 degree up to now days. The shortcoming of this Ethereum worth to make a compelling restoration underscores the token battle in latest months.

Is the worth beneath ETH?

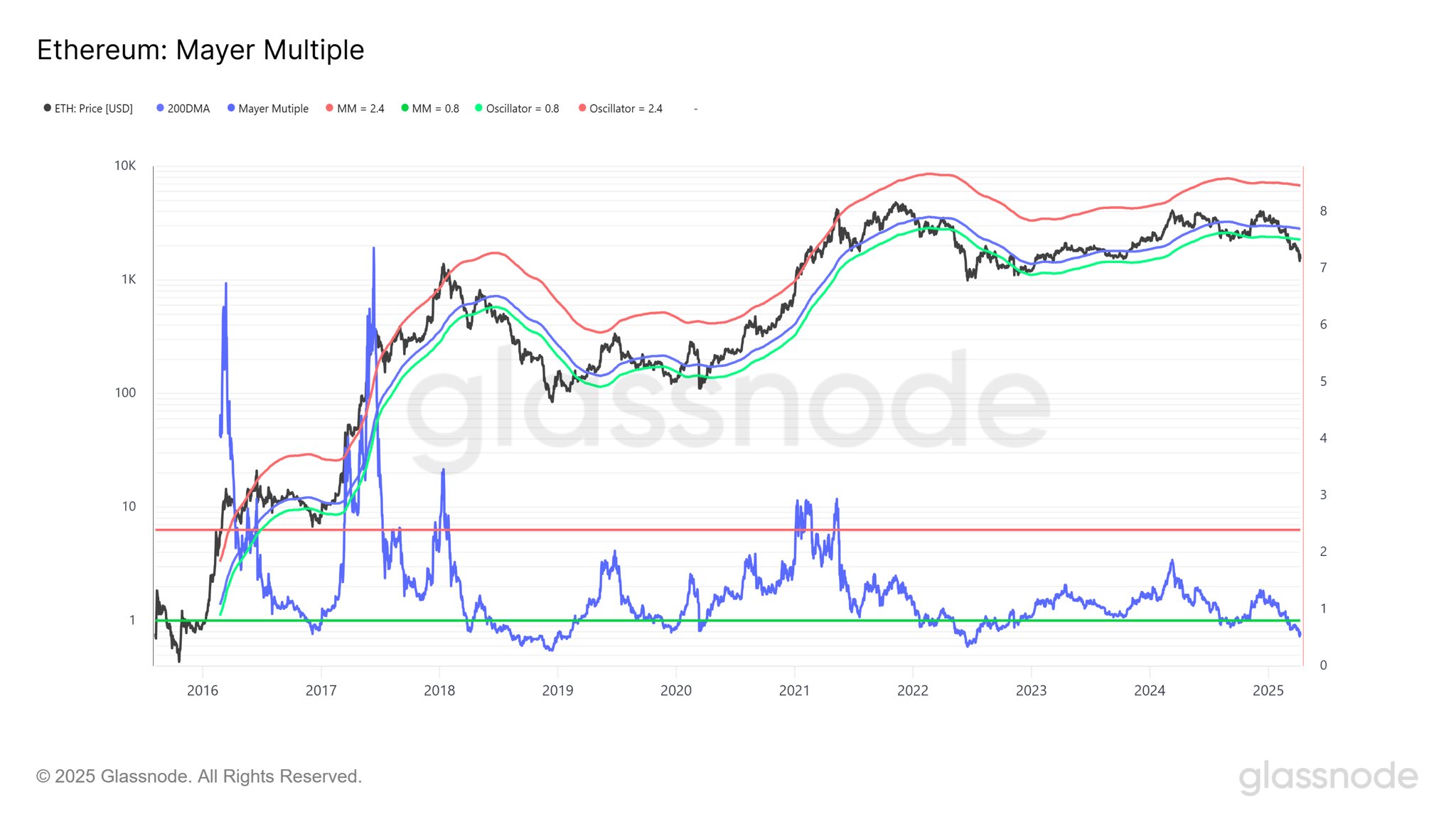

Pseudonymous Cryptollica shares recent on-chain insights in its X platform publish, suggesting that Ethereum costs could possibly be at a pivotal level of bullish reversal. This projection relies on the Mayer A number of Indicator, which measures the ratio of asset costs to the 200-day shifting common (MA).

The 200-day MA represents the long-term common worth of an asset. Mayer a number of estimates the precise worth distance of an asset from this common to find out the circumstances which can be oversold and extra. The metric exhibits the highest of the overheating market circumstances and potential costs when its worth exceeds the two.4 mark.

On the again, Mayer A number of Values under 0.8 are bought, indicating that the asset’s worth could have hit a backside. In the end, this metric is used to find out the macrobull or to resist him when analyzing periodic worth adjustments.

Supply: @cryptollica on X

In accordance with the GlassNode chart shared by Cryptollica, the Ethereum Mayer a number of has not too long ago slipped beneath the 0.8 mark. This means that ETH costs could also be at backside, with a possible bullish inversion on the horizon.

Moreover, Mayer A number of Indicator fell this low in 2022, as Ethereum costs rebounded above $4,000, making its present cycle worth increased. As historical past repeats itself, the second largest cryptocurrency might embark on one other journey to $4,000 (a gathering that exceeds 150% from its present worth vary) over the subsequent few months.

Ethereum costs are at a look

On the time of writing, ETH priced round $1,550, reflecting simply 1% soar over the previous 24 hours. Regardless of slight enhancements in market sentiment, Altcoin’s efficiency within the weekly time-frame stays roughly the identical. In accordance with Coingecko information, Ethereum costs have fallen virtually 15% over the previous seven days.

The value of ETH on the each day timeframe | Supply: ETHUSDT chart on TradingView

ISTOCK featured photographs, TradingView chart

Enhancing course of Bitconists deal with delivering thorough analysis, correct and unbiased content material. We assist strict sourcing requirements, and every web page receives a hard-working overview by a crew of high expertise specialists and veteran editors. This course of ensures the integrity, relevance and worth of your readers’ content material.