In response to Crypto Rover, funding firm BlackRock has bought $54 million price of Ethereum (ETH). The transaction serves as a serious institutional approval from the world’s largest asset managers, creating short-term market modifications and strengthening ETH’s enchantment to institutional buyers.

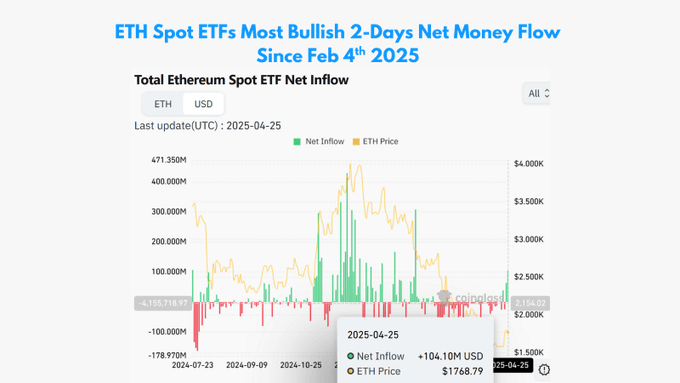

The surge in spots in Ethereum ETF inflow coincides with altering US regulatory reforms. Analysts see this shift as an indication of optimism. Spot Ethereum ETF inflows proceed to extend, with buying and selling volumes rising sharply according to the optimistic week of ETF inflows that haven’t been seen since February. Market contributors are monitoring Ethereum’s skill to take care of a essential help space of $1,800 and set up a large market restoration.

Ethereum buying and selling exercise and market indicators will probably be strengthened

Ethereum (ETH) traded at $1,807.19 at press, indicating each day market development of 1.38%. The asset’s market capitalization reaches $21.816 billion, with 24-hour buying and selling quantity reaching $17.08 billion, with a excessive development charge of 29.95%. This surge in exercise usually signifies a surge in ahead volatility, warnings for bulls and bears.

Associated: Ethereum Whale borrows 4,000 ETH at Aave to start out a brand new quick place

Ethereum’s short-term outlook depends on its skill to carry greater than $1,800. If this help is achieved, additional testing will probably be potential for $1,830, and maybe $1,850. However, if there’s a essential break under $1,790, ETH may very well be uncovered to additional draw back danger to $1,760 or $1,720.

The strategic timing of Blackrock amid political change

The BlackRock acquisition exhibits rising curiosity from institutional buyers in buying Ethereum-based funding merchandise. SOSOValue knowledge exhibits the primary optimistic pattern since February, Spot Ethereum ETFS, which recorded a internet influx of $157.1 million the earlier week, hitting $104.1 million on Friday.

sauce: Coinglass

BlackRock’s ETHA merchandise recorded an inflow of $54.43 million, surpassing Feth’s efficiency from Constancy and Grayscale’s Ethe’s efficiency. And extra about President Trump’s gentle rhetoric on Chinese language tariffs and the appointment of crypto-friendly determine Paul Atkins, because the SEC chairman has considerably improved sentiment amongst institutional buyers.

Associated: The Ethereum Whale stacks 449k eth in in the future, however holds a $1,895 resistance firmly

The brand new SEC chair Atkins has adopted a supportive strategy to digital property and plans to develop “rational and focused” regulatory tips. The political shift in the direction of encryption-friendly laws creates excessive expectations for the SEC’s SPOTETF approval and its staking capabilities.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version just isn’t answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.