Ethereum has been experiencing a difficult month, with its worth approaching a 17-month low at $1,802 on the time of writing. Regardless of this continued downtrend, it has despatched ETH into the naked market, however key buyers stay optimistic.

As Ethereum approaches these essential ranges, many market individuals consider that worth rebounds could also be on the horizon.

Ethereum buyers are making the most of low costs

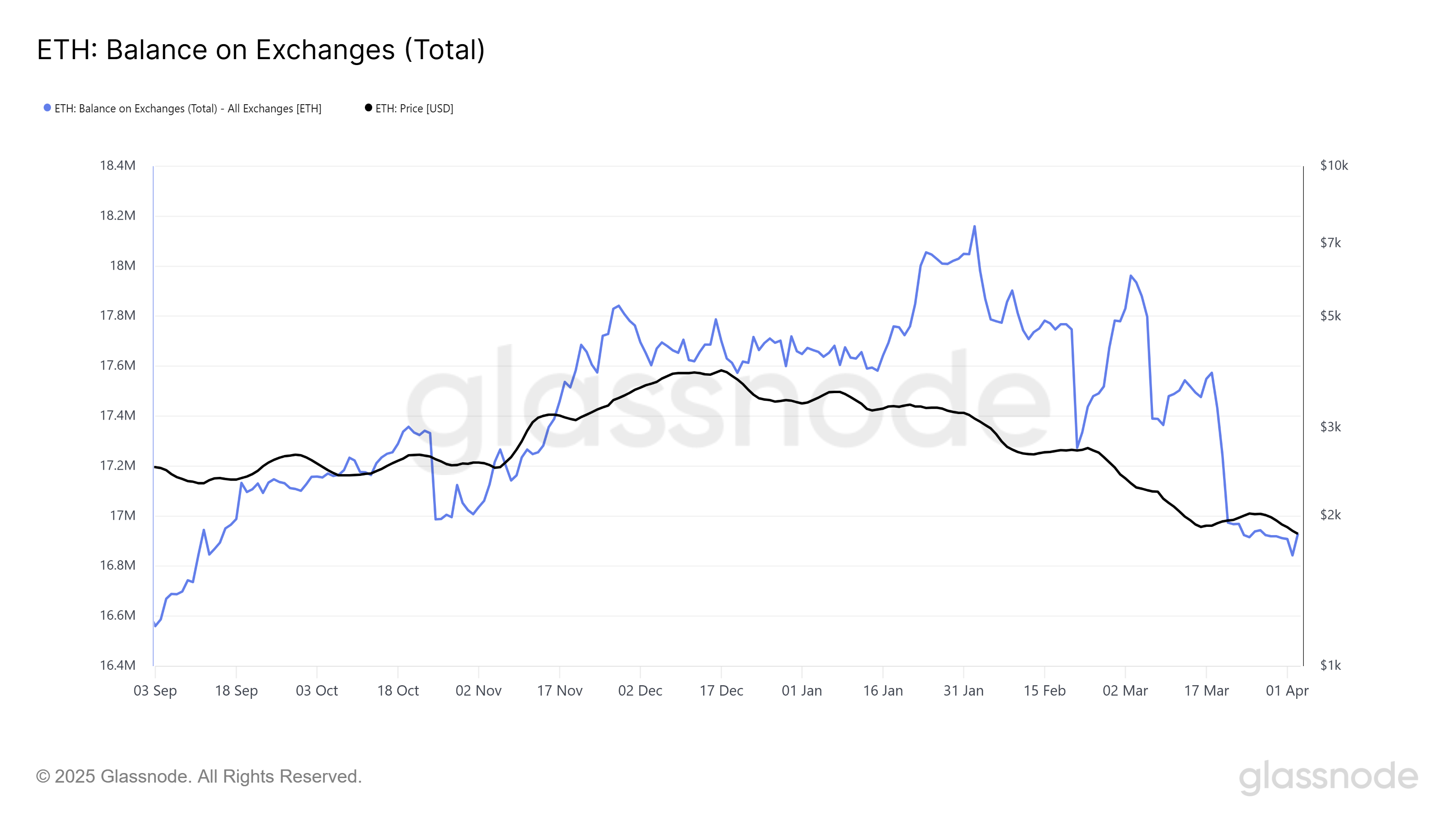

Ethereum’s alternate provide has fallen to a six-month low, indicating buyers are more and more holding property from the market. This decline in alternate provide is usually seen as an indication of bullishness because it means that long-term holders (LTHs) accumulate extra ETH at these low worth ranges and predict future worth will increase.

These buyers are unwilling to promote and present sturdy perception within the long-term worth of Ethereum. A lower in alternate steadiness additionally signifies much less short-term buying and selling exercise. This means that many buyers are ready for the worth to rebound earlier than they transfer.

Provide of Ethereum on the alternate. Supply: GlassNode

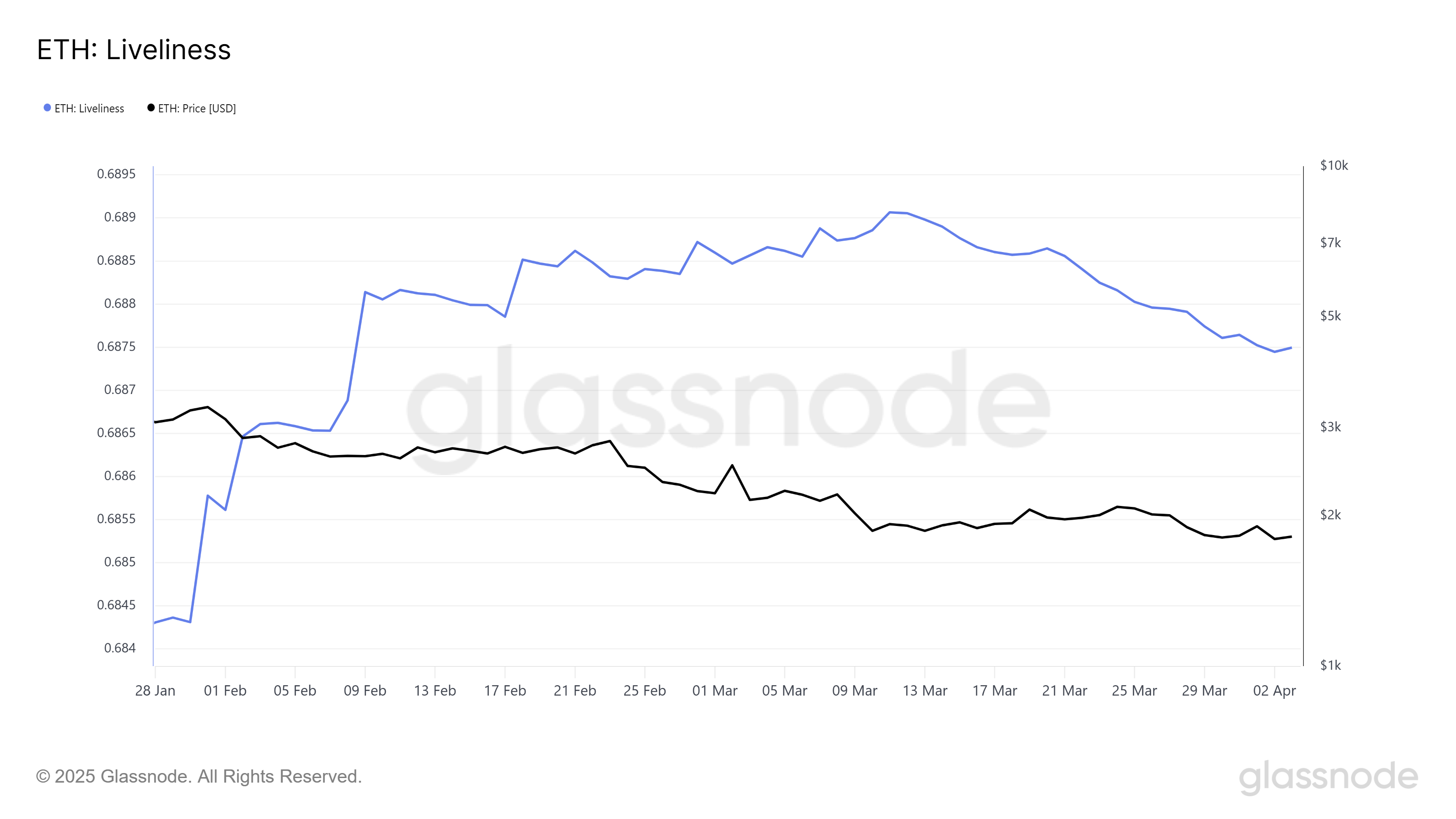

Over the previous month, Ethereum’s vibrancy indicators have declined, indicating a weakening of gross sales stress. Vitality measures long-term holder exercise, whereas decline signifies accumulation quite than promoting to the general public.

The decline displays rising sentiment amongst long-term Ethereum buyers, who hope to extend their holdings and get better future costs. The decline in vibrancy means that many individuals are assured within the foundations of Ethereum and are much less involved about short-term fluctuations.

This accumulation stage means that market sentiment in Ethereum could also be altering. LTHS belief, which has a serious affect on asset costs, can result in sturdy upward momentum as market situations enhance.

The vibrancy of Ethereum. Supply: GlassNode

ETH costs require nudges

Ethereum is at the moment buying and selling at $1,802 slightly below the $1,862 resistance degree. Costs have been caught underneath this barrier for six weeks and proceed the downtrend, which defines lots of the current worth measures. Nevertheless, if Ethereum exceeds $1,862, it might point out the top of the downtrend and the beginning of a worth restoration.

Given present market sentiment and accumulation by key house owners, Ethereum might proceed to realize upward momentum. If Ethereum efficiently infiltrated the $1,862 resistance, it might transfer in direction of the $2,000 mark, recouping a number of the losses from previous weeks.

Ethereum worth evaluation. Supply: TradingView

In the meantime, if bearish sentiment intensifies, Ethereum costs might drop even additional to a 17-month low of $1,745. Failure to safe assist at this degree can result in even larger losses. This might lengthen the current downward development and expose many buyers to a long-term bear market.