- Ethereum costs are near key development strains and will bounce or slice $1,800 excessive.

- The whales have bought 449,000 ETH, decreasing the trade stability.

- The $1,670 and $2,000 ranges appear essential to see if costs are bullish or fall additional.

Ethereum (ETH) exhibits indicators of serious power regardless of continued bear market stress. Not too long ago, on-chain information exhibits that long-term buyers nonetheless maintain 449,000 ETH whereas they nonetheless endure losses, indicating confidence in ETH’s additional progress. According to the development of customers transferring property off the trade and holding them of their private wallets, the trade reserves fell additional to an ETH of 19.1 million.

Supply: Cryptoquant

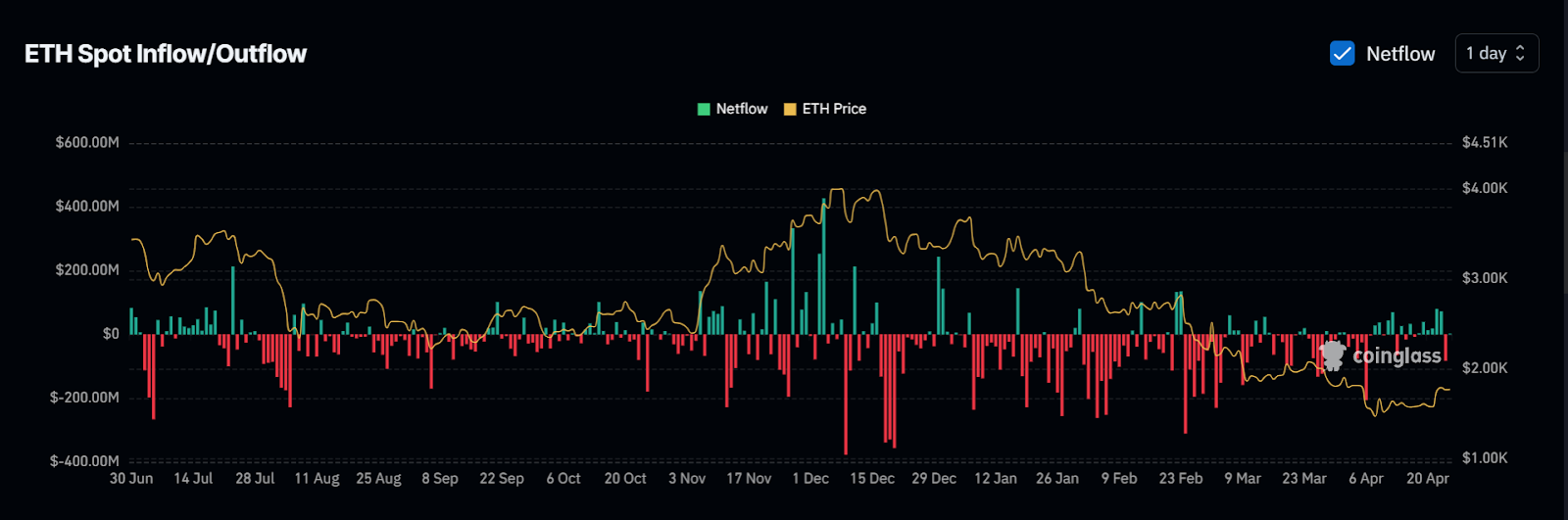

Netflows, alternatively, stays largely destructive. Knowledge obtained from Coinglass reveals that ETH has recorded extra outflows than they’ve since February. A sustained spill can accumulate on the client’s facet, that means ease of gross sales stress and improve worth rebounds.

Supply: Coinglass

Nevertheless, buying and selling volumes have fallen by 19.18% over the previous 24 hours, indicating a decline in short-term demand. On the time of writing, ETH traded at $1,775.60, a rise of 1.12% over the previous day. Final week, it received 12.12%, growing its market capitalization to $214.3 billion.

Necessary ranges to observe: $1,895 resistance and $1,540 help

Varied technical evaluation reveals a essential zone of resistance near $1,895, with a stage of extraordinarily excessive $2,142 for additional improvement that would have a bullish affect on mass Ethereum. The Bollinger Bands present that Ethereum is within the strategy of crossing the highest of the midline, however has not but been decided. The RSI is near 53.7,9, so impartial momentum is required whereas focusing on hostile breakouts previous 60. This might point out short-term continuance.

Based on dealer Donald, ETH ought to reclaim $2,000 in help to confirm the bigger turnaround. He recognized $1,670 as the present short-term pivot, suggesting that he was bearish to not maintain it past this stage. If the worth falls under impulse degradation at $1,540, a bearish sample seems to disprove the present construction.

Supply: x

Standard dealer Crypto Caesar additionally famous that property are in areas the place property could also be set as much as bear bullish breakouts by means of long-term descending development strains. I am going to learn the tweet, “$eth is about to interrupt out. You want a very excessive top…”

Supply: x

On-chain exercise indicators present combined feelings

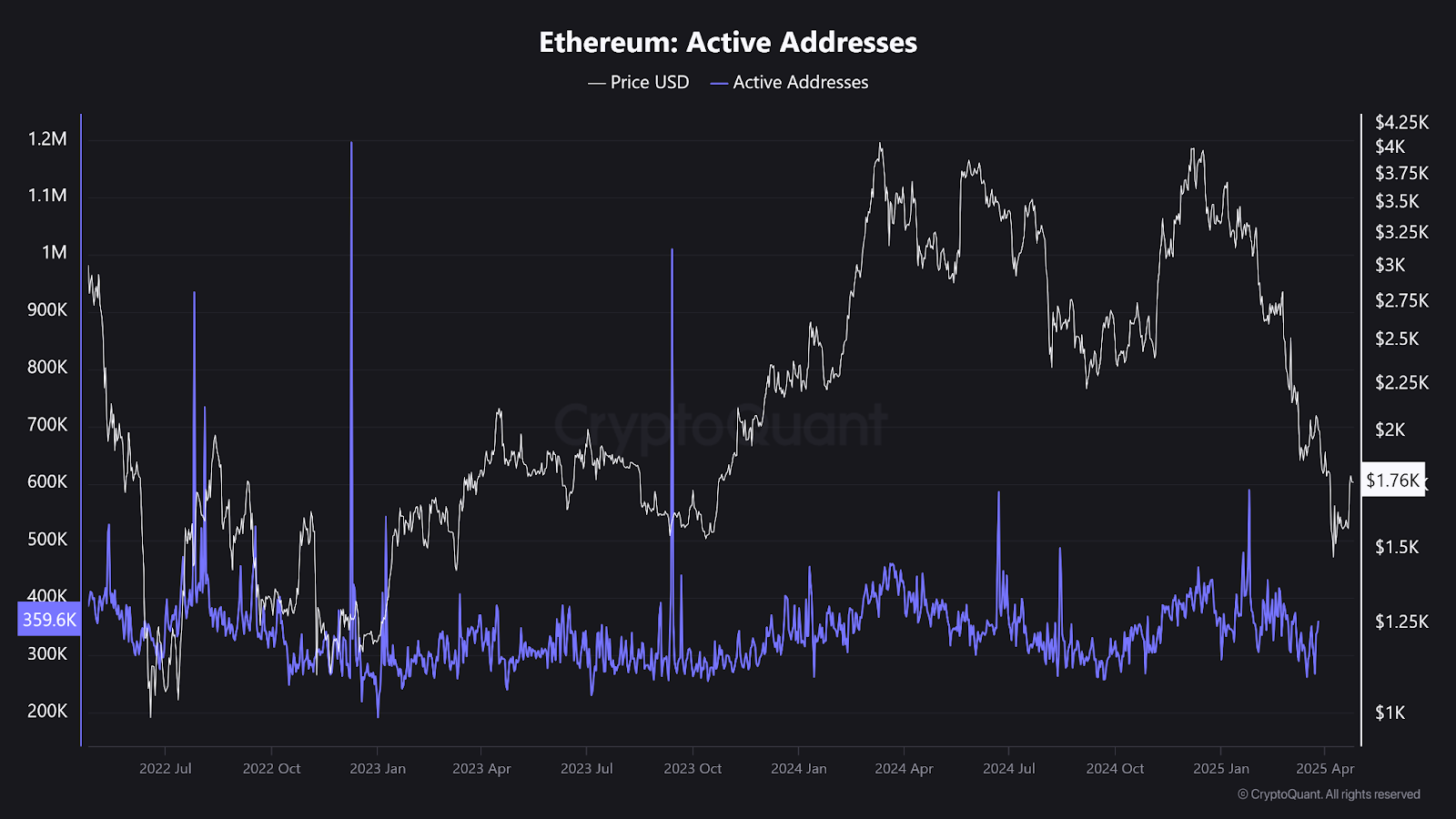

Ethereum’s lively deal with and transaction rely information tells a delicate story. The lively deal with is about 359,600 hoverings, which nonetheless has a sample with no improve. Which means that person engagement is kind of stagnant whereas costs are rising.

Supply: Cryptoquant

The whole variety of transactions is roughly 1.3 million per day. Due to this fact, general Ethereum use stays constantly excessive even inside bearish domains. It isn’t on the bull market stage, however it’s far above the low level on the naked market stage.

The downtrend for alternative additional strengthens the sign and means that extra ether is being withdrawn from the trade pockets, which broadly implies accumulation. These reserves have reached 30 million since 2022, and have been halved to about 19 million since 2022, a 37% decline over two years. These counsel that there’s usually resistance amongst buyers to promote securities out there.