On-chain knowledge exhibits that enormous Ethereum buyers have not too long ago added to their holdings.

Ethereum Giant Holders Netflow has been constructive recently

In a brand new put up on X, market intelligence platform IntotheBlock spoke about developments in large-scale house owners of Ethereum, Netflow. This metric measures the web quantity of cryptocurrency coming and going right into a pockets managed by a big proprietor.

The analytics firm defines three classes: retailers, buyers and whale buyers. Retail members maintain lower than 0.1% of provide, buyers members maintain between 0.1% and 1%, and whales members maintain greater than 1%.

At present change charges, 0.1% of the ETH provide, a cutoff between retailers and buyers, is price greater than $214 million, a really substantial quantity. Which means that the tackle you’ll be able to qualify for is already very giant.

Due to this fact, the massive house owners, the precise cohort within the present dialogue, have included each of those teams. Due to this fact, giant holder Netflow tracks transactions associated to buyers and whales.

A constructive worth for this metric signifies that a large-scale investor on the community is receiving web deposits of their wallets. In the meantime, being beneath the zero mark means that these main house owners are collaborating within the web gross sales.

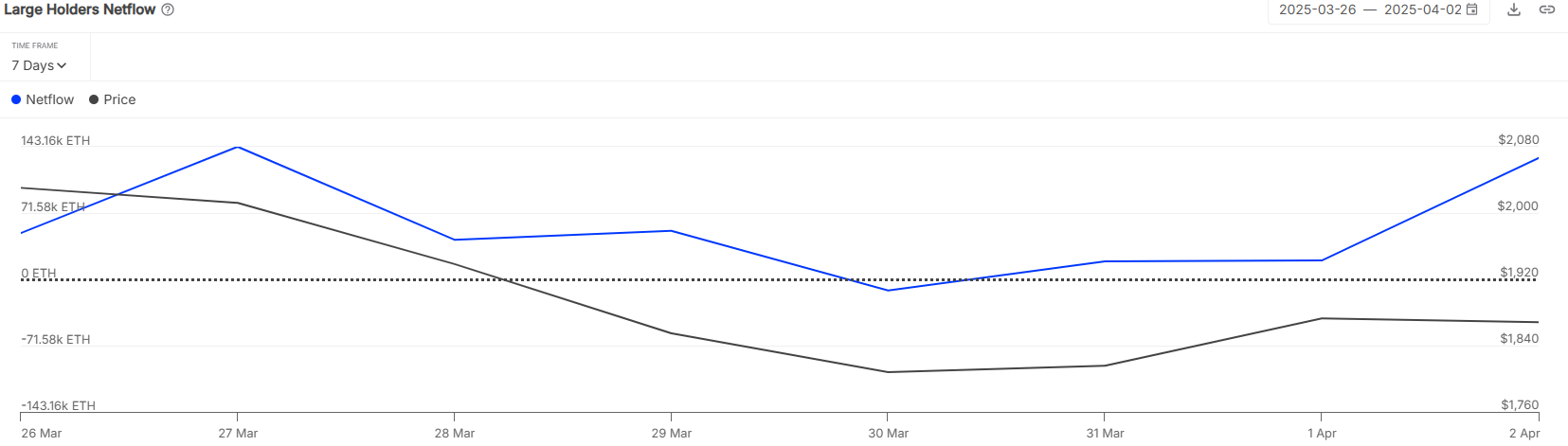

Properly, here is the chart shared by Intotheblock, exhibiting the developments of final week’s Ethereum Giant Holders Netflow.

The worth of the metric seems to have been constructive in latest days | Supply: IntoTheBlock on X

As seen above, Ethereum’s giant holder netflow stays virtually totally within the constructive area throughout the graph. Which means that buyers and whales are accumulating. Within the second of the month alone, these main entities had been loaded at 130,000 ETH (roughly $230 million).

With a big web inflow of holders occurring whereas cryptocurrencies are falling, this cohort could consider that latest costs present worthwhile entries into property. At the moment, it stays to be seen whether or not this accumulation will assist ETH attain its backside.

In another information, because the analytics firm factors out in one other X-post, Ethereum charges have fallen to the bottom ranges because the quarter.

The modifications that occurred in key ETH metrics in the course of the first quarter of 2025 | Supply: IntoTheBlock on X

Following a pointy decline of 59.6%, Ethereum’s complete transaction charges fell to $208 million. In keeping with IntotheBlock, this pattern is “primarily pushed by elevated gasoline limits and transactions shifting in the direction of L2.”

ETH Worth

Ethereum noticed a restoration of over $1,900 early within the week, however it seems the bullish momentum has already run out as Coin returns to $1,770.

Seems like the value of the coin has plunged not too long ago | Supply: ETHUSDT on TradingView

Dall-E featured photographs, charts on IntotheBlock.com and tradingView.com

Enhancing course of Bitconists concentrate on delivering thorough analysis, correct and unbiased content material. We assist strict sourcing requirements, and every web page receives a hard-working overview by a group of high expertise specialists and veteran editors. This course of ensures the integrity, relevance and worth of your readers’ content material.