Ethereum is struggling practically $1,600 as whales surge in ETH and derivatives. Does ETH crash for below $1,400?

and Ethereum, a stagnant Bitcoin, practically $84,000 Unable to set off trendline breakout rally. ETH is presently buying and selling at $1,581 following the formation of every day Doji candles.

As Ethereum continues to sluggish efficiency, the whales started offloading this week, with the community recording new lows. Can Ethereum keep a help stage of $1,400 inside these circumstances?

Ethereum is at a crossroads: do bears management?

Ethereum can’t bounce throughout the falling channel patterns of every day charts. Confronted with opposition from the newly fashioned resistance development line throughout the channel, ETH costs have did not exceed $1,600.

The current rejection of upper costs in every day candles with lengthy wicks warns that potential drops are forward. Nonetheless, technical indicators counsel an optimistic alternative.

Day by day RSI strains present sideways actions hovering simply above the bought boundary after a slight enhance. Moreover, MACD and sign strains nonetheless present aggressive crossovers, though inside detrimental territory.

These technical alerts point out the opportunity of new bullish waves throughout the ongoing decline.

Based mostly on the Fibonacci stage, the breakout rally may initially goal a Fibonacci stage of 23.60%, near $2,000. If the Bulls handle to interrupt previous the cap, the subsequent worth goal is a 38.20% stage, practically $2,400.

Conversely, Ethereum reveals sturdy help of round $1,400. Day by day closings under this stage could cause a possible drop to $1,000.

Will the Ethereum off-road season start?

Over the previous week, Ethereum has skilled a gentle surge adopted by stagnation, prompting whales to exit. Based on a current tweet by Crypto analyst Ali Martinez, Ethereum Whales offloaded 143,000 ETH, valued at over $226 million.

This substantial offload diminished the steadiness of wallets holding 100-1,000 ETH from 94325 million to 9.2894 million. One notable case stands out.

The Whale offloaded 143,000 #ethereum $eth final week! pic.twitter.com/n8cmwyuper

– Ali (@Ali_Charts) April 17, 2025

One excellent case: Two years later, the long-term whale returned to the market and deposited 1,161.77 ETH (valued by $1.84 million) with Kraken.

The entity realized a revenue of 480K. Initially, the whales retracted 943 ETH (value on the time $111 million) from Binance, and later positioned 253.73k USDC at 146.59 STETH.

By staking Ethereum, the whales earned an extra 72 ETH.

Lowest Ethereum buying and selling prices in 5 years

Amid the decline in ETH costs, the community has been buying and selling charges 5 years decrease. Based on Santiment, Ethereum’s common community charges are under $0.17 for the primary time since Could 2020. At present, the typical transaction value is just $0.168.

The decline in charges suggests weakening demand and decrease consumer exercise. Each potential precursors decrease the valuation of the ETH market.

Unter extension: Ethereum charges are the bottom in 5 years, and presently trades at simply $0.168. That is the most affordable every day value to create a $ETH switch since Could 2, 2020. We’ll break this down simply with the most recent insights. https://t.co/fg5cfrgshn pic.twitter.com/qllwyzdm1f

– santiment (@santimentfeed) April 16, 2025

As Ethereum struggles with whales’ wobbling confidence and intersections, the derivatives market has recorded an enormous inflow. Traditionally, main influx spikes in Ethereum derivatives have resulted in main crashes.

On March twenty sixth, the inflow of ETH of practically 65K folks diminished by 13% over 4 days. An identical spike final week marked a drop of practically 20%.

On April sixteenth, the most important spike ever – ETH above 77k brought on a deeper correction horror.

As Ethereum struggles to carry its bullish place, a rise in influx spikes may result in $1,000 in leveraged-driven downfalls.

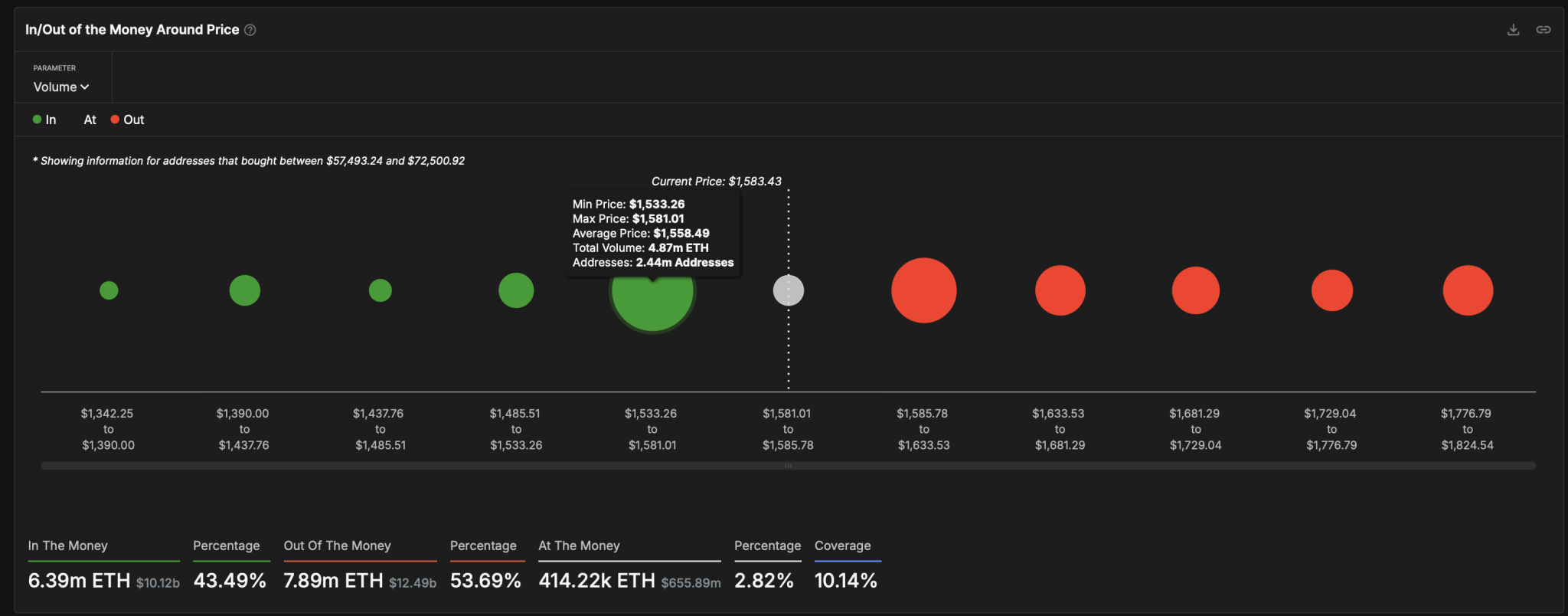

Based mostly on in/out of Cash Indicator Intotheblockthe help zone between $1,533 and $1,581 is the ultimate line of protection. This demand zone holds 4.82 million ETH with addresses of two.44 million. If costs fall under this vary, the next help will likely be between $1,390 and $1,437.

Ethereum GIOM indicator

Conversely, the important thing resistance stays within the provide zone between $1,585.78 and $1,633.53, with 2.89 million ETH throughout 3.62 million addresses.

A profitable breakout may trigger your ETH to rise to a $1,700 stage.