Bitcoin posted certainly one of its worst first quarter returns in 2025. Ethereum bought worse, with a drawdown of over 45% in value. Ethereum costs have been declining for the reason that Dencun improve in March 2024. The downfall of Ethereum seems to be pushed by Layer 2 protocols accumulating giant transaction volumes and passing a share of income to the ETH chain.

Ethereum (Eth) has grown its crypto ecosystem over 2025, rooted in its function as a blockchain that underlies safety infrastructure and Layer 2 protocols.

desk of contents

Ethereum Powers Layer 2 Scaling, Mainnet loses traction

Ethereum started with the aim of turning into a worldwide decentralized pc, and since ICO, the chain has generated worth and rose to a peak of $4,878 in November 2021. ETH has since eliminated 71% in 4 years.

Probably the most notable shift, thought of a catalyst for reducing ether costs, is the Layer-2-centered scaling mannequin. Ethereum shifted from its essential function to a sequence that aggregates values and powers layer 2 scaling. The motion pushed by DenCun upgrades that diminished transaction prices for the Layer 2 chain has reshaped Ethereum’s ecosystem dynamics.

Utilizing Ethereum as a base chain has considerably diminished Layer 2 and Layer 3 initiatives, powering a big defi ecosystem. Base by Coinbase raised $94 million in earnings and paid Ethereum a small portion of its bills, $4.9 million.

The profitability of the Layer 2 chain has sparked debate about whether or not Layer 2 is both squeezing worth from Ethereum, deriving safety and fostering partnerships that move income to the ETH blockchain.

Dencun improve ETH worth declined, buying and selling income declined

With the Dencun improve, Layer 2 funds at the moment are cheaper sufficient to decrease the entry barrier for the Defi protocol. Ethereum totals over $44 billion in locked property, and the discount in charges collected by the community has disrupted its aim of turning Altcoin right into a “Deflationary.”

Ethereum is just not deflationary as a result of low quantity of charges collected by the chain, however in keeping with ultrasound cash trackers, provide is anticipated to be beneath an annual share level. X and dealer crypto consultants throughout the alternate have questioned Ethereum’s worth proposition in mild of a altering enterprise mannequin.

Pectra upgrades, the subsequent key replace of the Ethereum ecosystem, may replenish the worth of the chain if it stimulates demand.

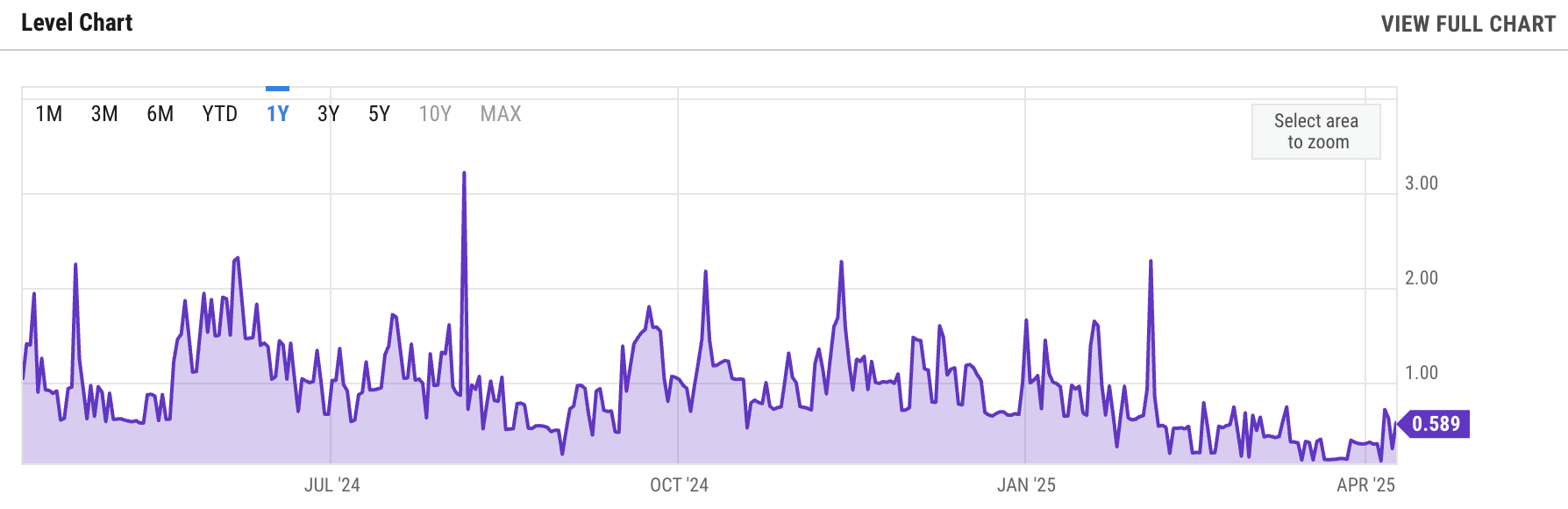

Ethereum Common Transaction Payment Chart | Supply: Yahoo Finance

You would possibly prefer it too: Bitcoin, Ethereum, XRP and altcoin costs rose as US inflation lurked

Ethereum returns and ETH costs are more and more linked to charges and burns

Ethereum homeowners and merchants have checked out metrics akin to the overall worth of property locked within the chain, in addition to buying and selling quantity, relevance, and demand for figuring out ETH costs beforehand. Ethereum is now more and more valued for the charges generated by the chain, token burns and costs generated by the web income.

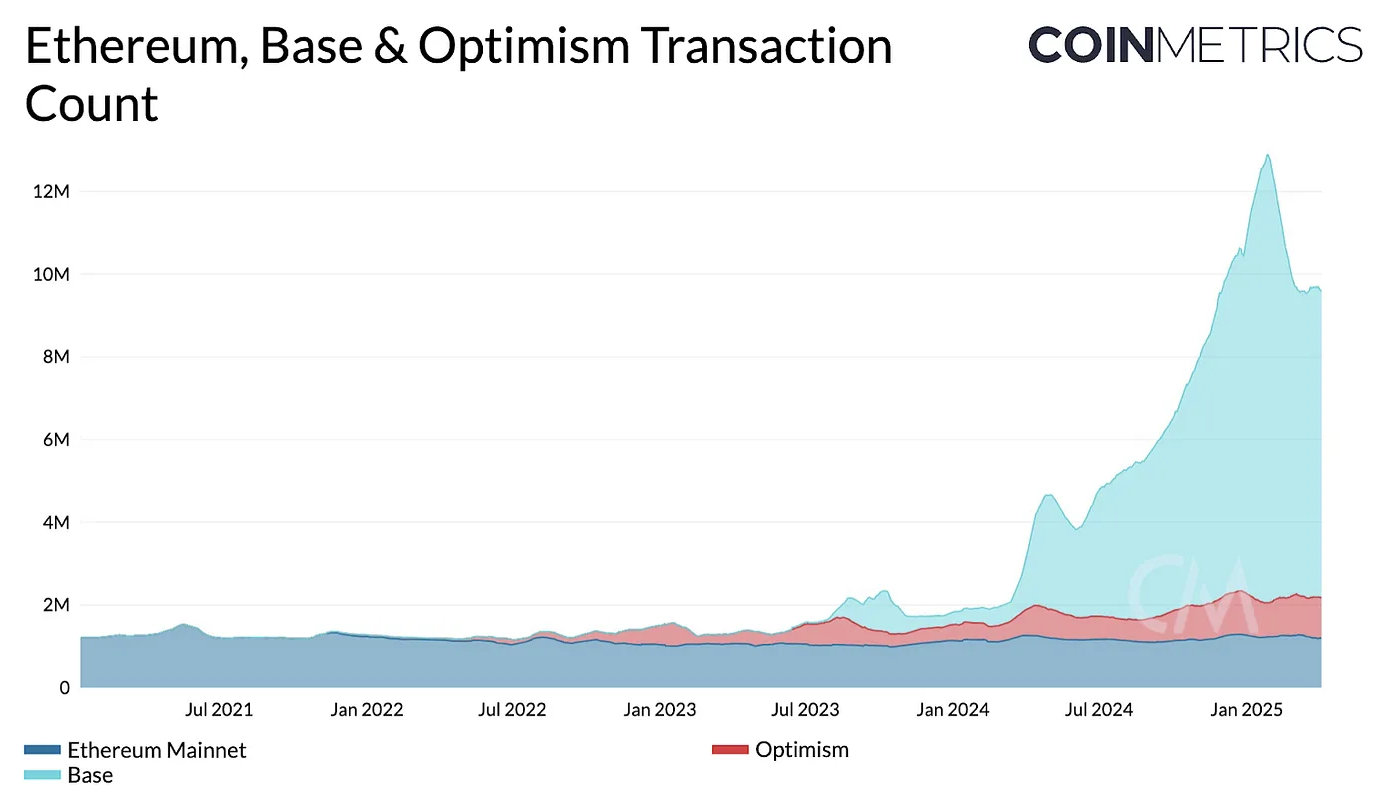

The variety of transactions in Ethereum exhibits a pointy decline as a result of key metrics of devaluation and transitions to the 2-second layer two layer and the variety of values and transactions.

Ethereum, Base and Optimism Transaction Rely | Supply: Coinmetrics

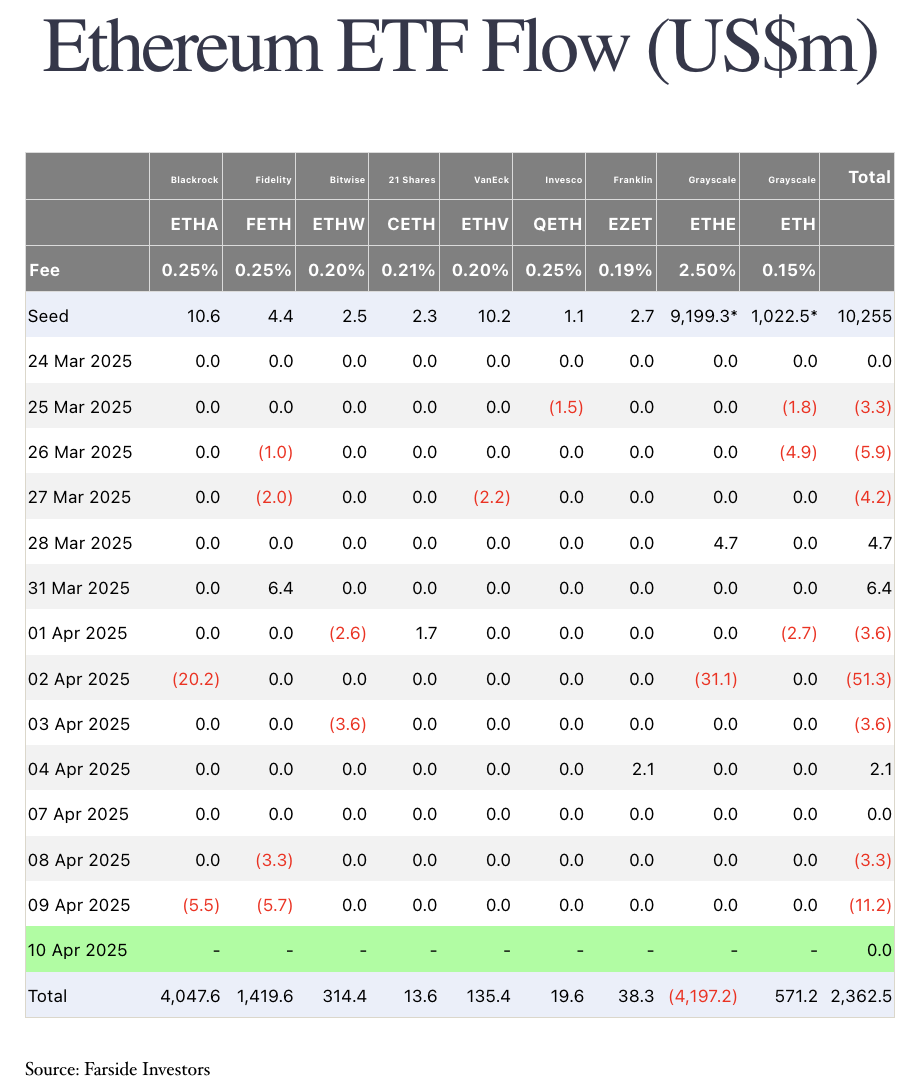

Worse, the establishment has misplaced curiosity in ether, probably as a result of pivot of the chain’s enterprise mannequin, and the Ethereum Basis has persistently offered ETH over the previous few months, elevating considerations amongst merchants.

The US-based Ethereum ETF has been unable to draw consideration from institutional buyers and has been slowing down inflows all through 2025.

Ethereum ETF Move | Supply: Farside Buyers

What do you count on from a Pectra improve?

Pectra upgrades will have an effect on validators and stakers within the Ethereum ecosystem. Pectra introduces Ethereum Enchancment Protocol, which streamlines validator administration, reduces chain congestion, improves the effectivity of the Valetter deposits, and provides increased management to stakers past the exit of the verification system.

The improve is full of technical updates associated to blockchain builders, however the modifications are anticipated to drive increased worth to Ethereum.

Pectra upgrades have a big influence on Ethereum validators and stakers, streamline validator administration, scale back community congestion, enhance validator deposition effectivity, and introduce EIPs that enable for extra management over the exits of the verification system.

You would possibly prefer it too: Ethereum value rally stalls as economists hold the chances of the recession at 60%

Professional commentary

Graphite Community’s CTO Marko Ratkovic, enterprise-ready monitoring instruments and layer 1 blockchain, advised crypto.information.

“Pectra is anticipated to have a constructive influence on the expansion of L2 community customers. As two new EIPs goal instantly for this, EIP-7691 will improve the variety of blobs per block, and EIP-7623 will improve the price of name information.

Total, in keeping with Ratkovic, Pectra is a big step ahead.

The manager explains within the instance EIP-7702:

“For instance, use EIP-7702. You may ship transactions with out the necessity for a local token. This solves a long-standing situation that requires workarounds like fuel station networks, however is now addressed natively on the protocol degree.

On the identical time, Ethereum upgrades stay technical in nature and don’t instantly tackle the broader hole between Tradfi and Defi. Whereas Ethereum focuses on streamlining onboarding, overhead reductions and enhancing throughput, institutional gamers are excited by authorized readability, consumer verification, and stopping unlawful flows. ”

Chains like graphite can resolve the challenges confronted by institutional buyers and help your entire ecosystem.

Dr. Shawn Dawson, head of analysis at Derive.xyz, a decentralized on-chain possibility platform, advised crypto.information.

“As volatility continues to skyrocket, the implicit volatility (IV) of the ETH soar is from 71.5% to 122%, reflecting the worry of market uncertainty and additional disruption.

Going ahead, the chance that ETH will fall beneath $1,400 by Might 30 virtually doubled from 18% to 33% as of April 8, indicating a rise in bearish sentiment out there.

In brief, we’re collaborating in bumpy rides and volatility might stay excessive as each conventional and digital markets proceed to reply to these macroeconomic shocks. Merchants and buyers must help extra uncertainty in a number of weeks because the market navigates these disrupted waters. ”

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.