Ki Younger Ju, CEO of Blockchain Analytics Platform Cryptoquant, has declared that Bitcoin Bull Cycle has ended. Specifically, the most effective cryptocurrencies have struggled to determine a sustained uptrend since reaching a brand new all-time excessive of round $109,000 in January, elevating questions in regards to the viability of the present Bull Run.

Bitcoin’s unresponsive worth vary begins the market

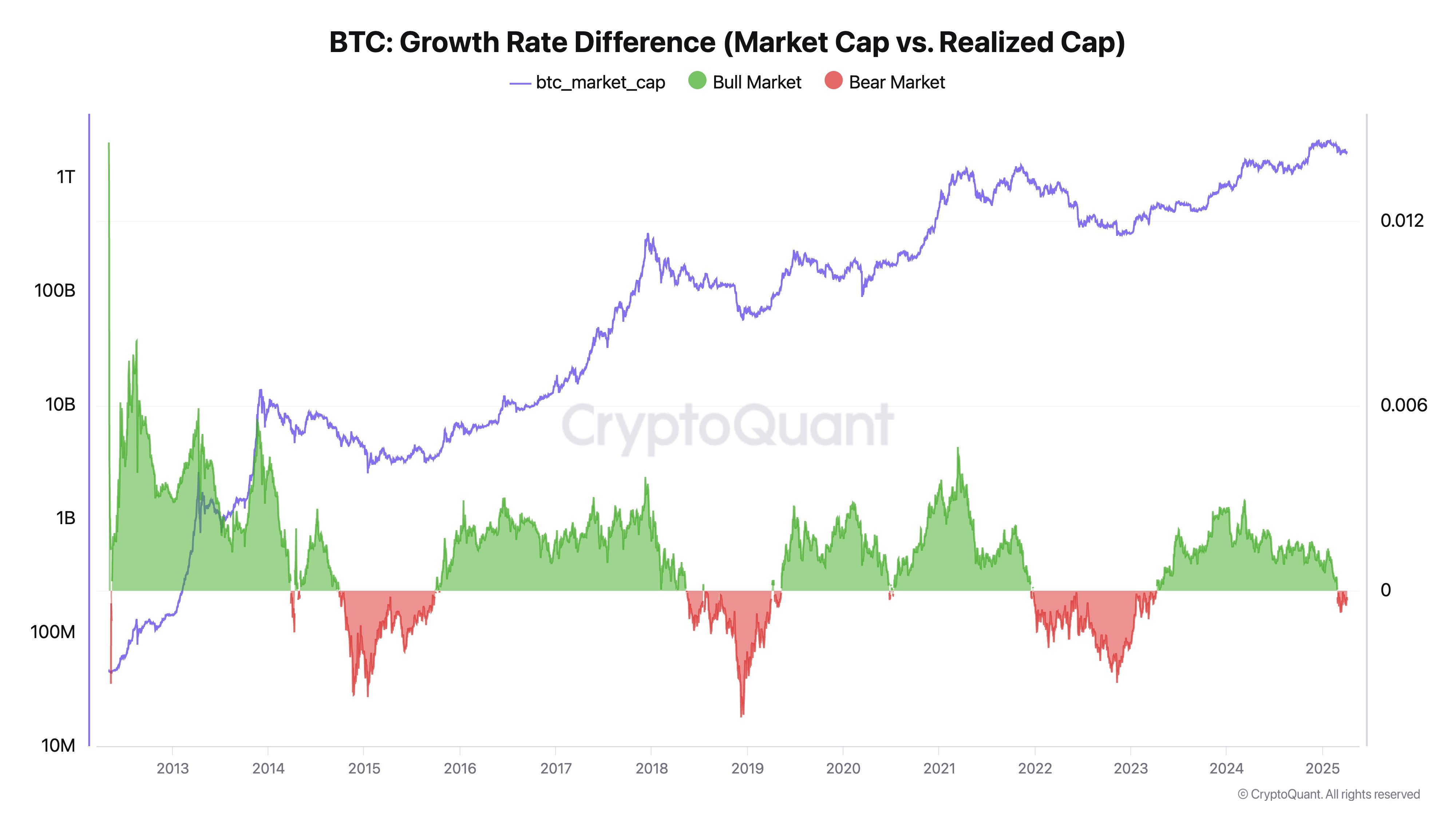

In an X put up on April fifth, Ki Younger Ju shared an attention-grabbing principle about why Bitcoin concluded the present Bull Run. The well-known cryptographic diagrams are primarily based on this assumption and on the chain’s idea of information on realised caps and market capitalization.

Younger Ju describes the cap realized as the full capital flowing into the BTC market, as revealed by precise on-chain actions. The realized cap reveals a extra correct measurement of the BTC community by summing the value every coin final moved.

Market capital, in the meantime, gives a valuation of the BTC community primarily based on the most recent trade transaction costs. Cryptoquant CEO explains that market capitalization/worth won’t rise or lower proportionally with the scale of the transaction, primarily based on common misconceptions, relying on the stability of buying and selling strain.

Younger Ju mentioned small shopping for might result in rising costs and market capitalization amidst low promoting strain. In the meantime, the market is made up of a lot of sellers, so huge bitcoin purchases might not end in a constructive worth response throughout excessive promoting pressures.

each ideas, it’s understood that the realized cap measures capital inflows into the BTC market, and market capitalization signifies a worth response to those inflows. Thus, the encrypted boss explains that the elevated caps achieved presents a traditional bearish sign because the market cap doesn’t fall or change, whereas the value can’t reply positively regardless of new investments.

Alternatively, stagnant realisation caps with elevated market caps are bullish alerts reflecting low-level sellers. Subsequently, a small quantity of latest capital could cause important worth will increase.

Ki Younger Ju says that the earlier scenario is at present unfolding within the Bitcoin market, with costs failing to rise in flows, as proven by on-chain knowledge in exchanges, ETF markets and custody pockets actions. This improvement suggests the existence of a bear market. Younger JU says present gross sales pressures might wander at any time, however historic knowledge helps a reversal interval of at the least six months.

Bitcoin worth overview

On the time of urgent, Bitcoin was buying and selling at $83,700, reflecting a 0.94% decline over the previous day.

TheStreet featured pictures, TradingView charts

Enhancing course of Bitconists give attention to delivering thorough analysis, correct and unbiased content material. We help strict sourcing requirements, and every web page receives a hard-working assessment by a group of high know-how consultants and veteran editors. This course of ensures the integrity, relevance and worth of your readers’ content material.