Regardless of weekly income within the crypto market, ChainLink (Hyperlink) is underneath important bear strain printing losses over a number of time frames. Since peaking native costs at $29.28 in December, Altcoin has since fallen trending above 56%. Amongst this damaging efficiency, high Crypto analyst Ali Martinez may quickly expertise short-term value will increase.

Hyperlink restoration is dependent upon assist for necessary trendlines

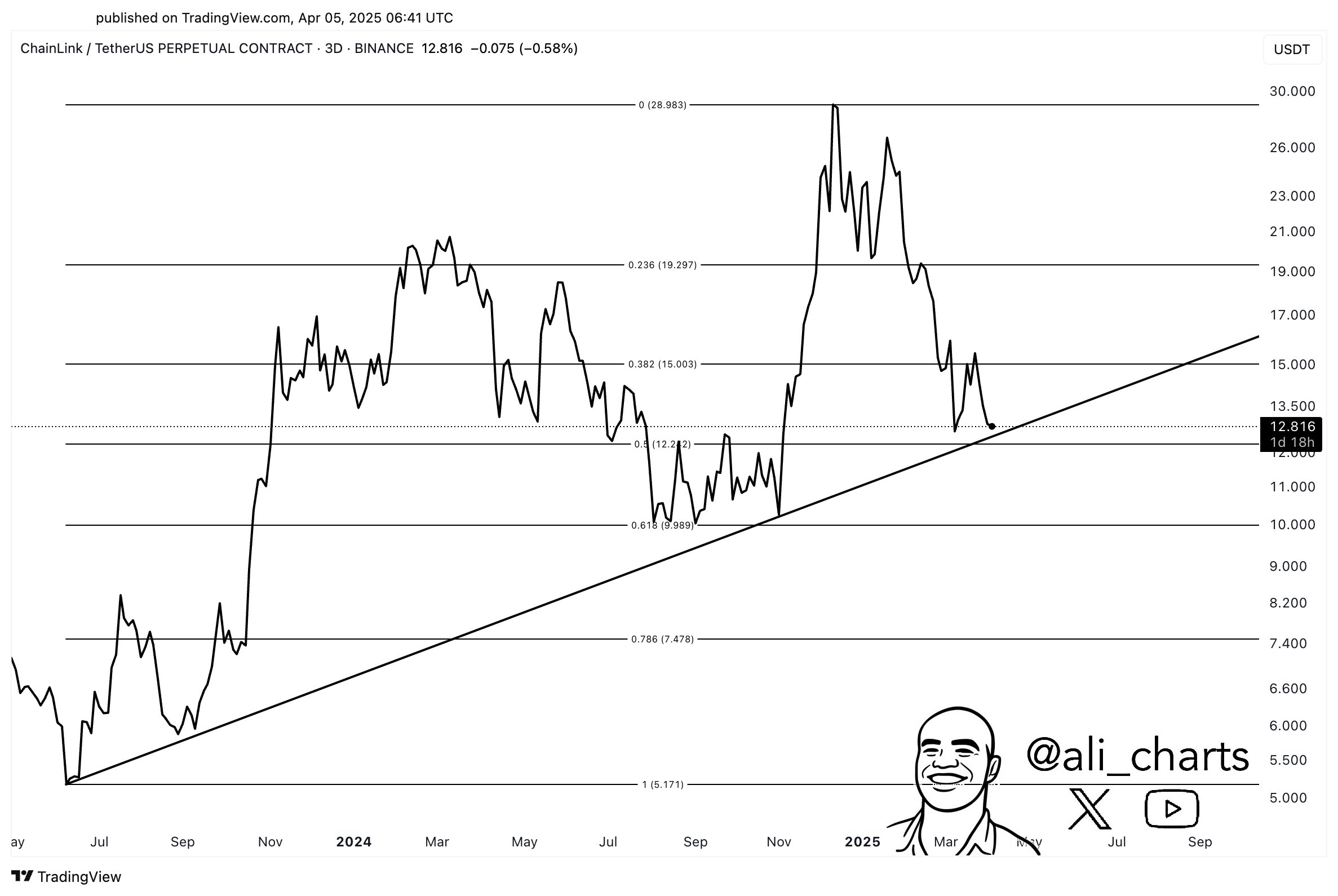

in Latest Posts In X, Martinez shares a constructive technical outlook on the hyperlink. This value forecast is predicated on a key ascending pattern line that has been serving as value assist since mid-2023, making certain a constant formation of upper lows and better highs.

Based mostly on Martinez’s buying and selling chart, ChainLink is presently heading for a retest at $12.00 with an recognized trendline near the 0.5 Fibonacci retracement stage. If Hyperlink Bulls can surge demand sufficiently at this stage, the subsequent value leap may ignite a bullish turnaround. Wanting on the historic value patterns, such priced gatherings can increase the worth of chain hyperlinks to round $19. This represents the next resistance zone:

If strong buying strain is current, Altcoin may even rise as a lot as $30, suggesting that costs may rise at 147% of the present market value. Alternatively, if you cannot exceed $12.00, the preliminary value will drop to about $10.00, which may end in a low $5.00 transaction.

ChainLink built-in into PayPal’s ecosystem

In different information, the famend American cost platform PayPal Holdings has introduced the inclusion of ChainLink in Crypto’s merchandise. in assertion Launched on April 4th, PayPal stated that customers will have the ability to buy, retain, ship and obtain ChainLink and Solana (SOL) in each PayPal and Venmo wallets.

This growth tells us a key step in mainstream integration of crucial hyperlinks to drive future token demand. Along with each tokens, PayPal gives entry to customers Bitcoin (BTC), Ethereum (eth)Litecoin (LTC), and Bitcoin Money (BCH).

At Press Time, the hyperlink continues to commerce at $12.91, reflecting a 0.62% decline over the previous 24 hours. Within the bigger timeframe, the token will stay bearish with losses of 5.03% and 21.81% over the past 7 and 30 days, respectively.

Based on Knowledge from CONCODEXtraders’ emotions for the hyperlink market stay very bearish together with 26 signalling worry and grasping indicators. Nevertheless, the corporate’s analysts predict a rebound value just like Martinez with a five-day forecast of $15.32 and $17.46 a month.