This can be a section of the 0xResearch publication. Subscribe to learn the total version.

Once you ask the common crypto particular person what issues the business is dealing with right this moment, it shortly exhibits up as a normal criticism, saying, “Too many chains, lack of apps.”

This criticism is spectacular alongside the early Web period.

Throughout the dot-com increase of the late 90s and early 2000s, skeptics likewise criticized overinvestment of extra infrastructure, significantly in fiber optics.

Telecommunications firms (World Crossing, Worldcom, AT&T) have spent billions of {dollars} laying submarine cables and long-range fiber networks based mostly on the idea that web visitors will develop exponentially.

Even web pioneers criticized Bob Metcalf for this perceived overinvestment, claiming that there was merely no want for it.

Within the luxuries of hindsight, we now know that Metcalf was improper (Metcalf actually ate his phrases in 2006 after he admitted his mistake).

The explosive surplus of bandwidth makes wonderful merchandise like YouTube, cloud computing, Netflix and extra attainable right this moment.

Netflix, for instance, was a mail-based DVD rental enterprise for a few years earlier than it slowly started its transition to streaming in 2007.

Briefly, the wager that “we construct it, demand comes” finally proved true for the web, nevertheless it took ten years, nevertheless it required chapter for web infrastructure firms like World Crossing.

Ethereum is now chipping on comparable bets.

With every rollup-centered roadmap, right this moment’s Ethereum L1 truly provides up the working price for the L2S.

Nevertheless, Ethereum plans to learn from knowledge availability (DA) charges by future upgrades to finally broaden its DA provide. The concept is that Ethereum DA will ultimately turn out to be very plentiful and induce final person demand.

Identical to early Web builders, Ethereum researcher Justin Drake believes, “If we construct it, there shall be demand.”

Drake’s Moonshot arithmetic appears like this: At 10 million TP, every transaction pays Ethereum $0.001 in DA price, making it $1 billion per day for Ethereum.

(This assumes that L2 makes use of Ethereum L1 for the DA, versus various DA layers akin to Celestia and Eigenlayer.

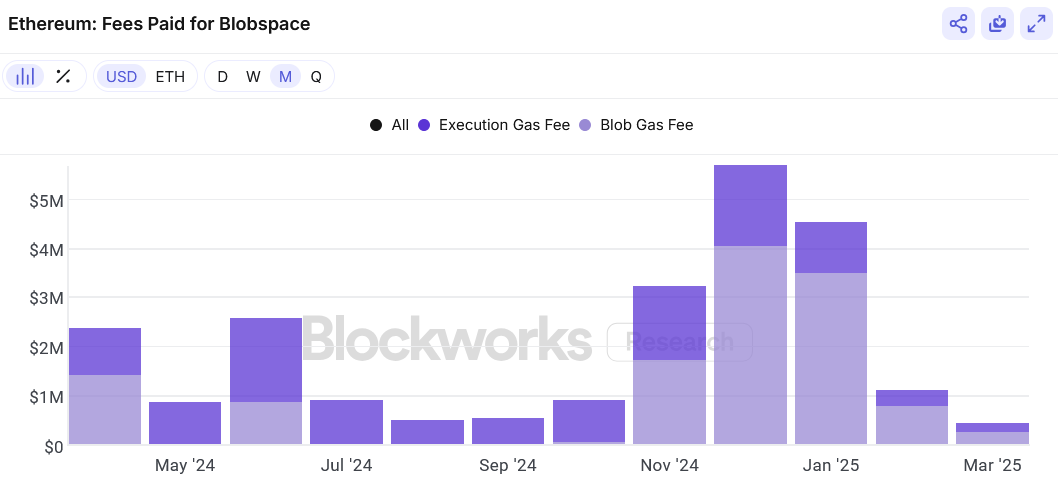

Contemplating right this moment’s DA consumption, it is a daring paper. Ethereum’s Blob fuel price reached simply $272,000 in March.

Ethereum Bulls could imagine that Web3 will revive similar to Web2’s historical past, however Ethereum doesn’t exist within the silo and faces robust competitors from different chains.

Additionally, there may be little hypothesis but in regards to the sort of on-chain functions that govern blockchain use. It’s essential on this planet that What’s the availability of a whole lot of knowledge?

However I am off observe. The declare that “too many chains” could finally be true. However it was within the early days of the Web, so it is too early to inform it.

If true, the market will assist to curb wasteful spending much more. Appropriate Case: L1 Premium is quickly compressed.

The L1’s $300 million improve from $500 million has ended. The 2024 L1/L2 blockchain ranged from $14 million (early) to $100 million (belachine) and $225 million (Monad).