The Bitcoin (BTC) market was extraordinarily bullish final week, with costs leaping over 10%. On this optimistic improvement, there may be outstanding investor exercise, which refers to indomitable demand that may help sustained worth will increase.

BTC Provide Shake Up: Lengthy-term Holders Enhance, New Patrons Step Over 92K

In a latest X publish, the favored Crypto Pundit Axel Adler Jr. shared some attention-grabbing on-chain insights into the Bitcoin market.

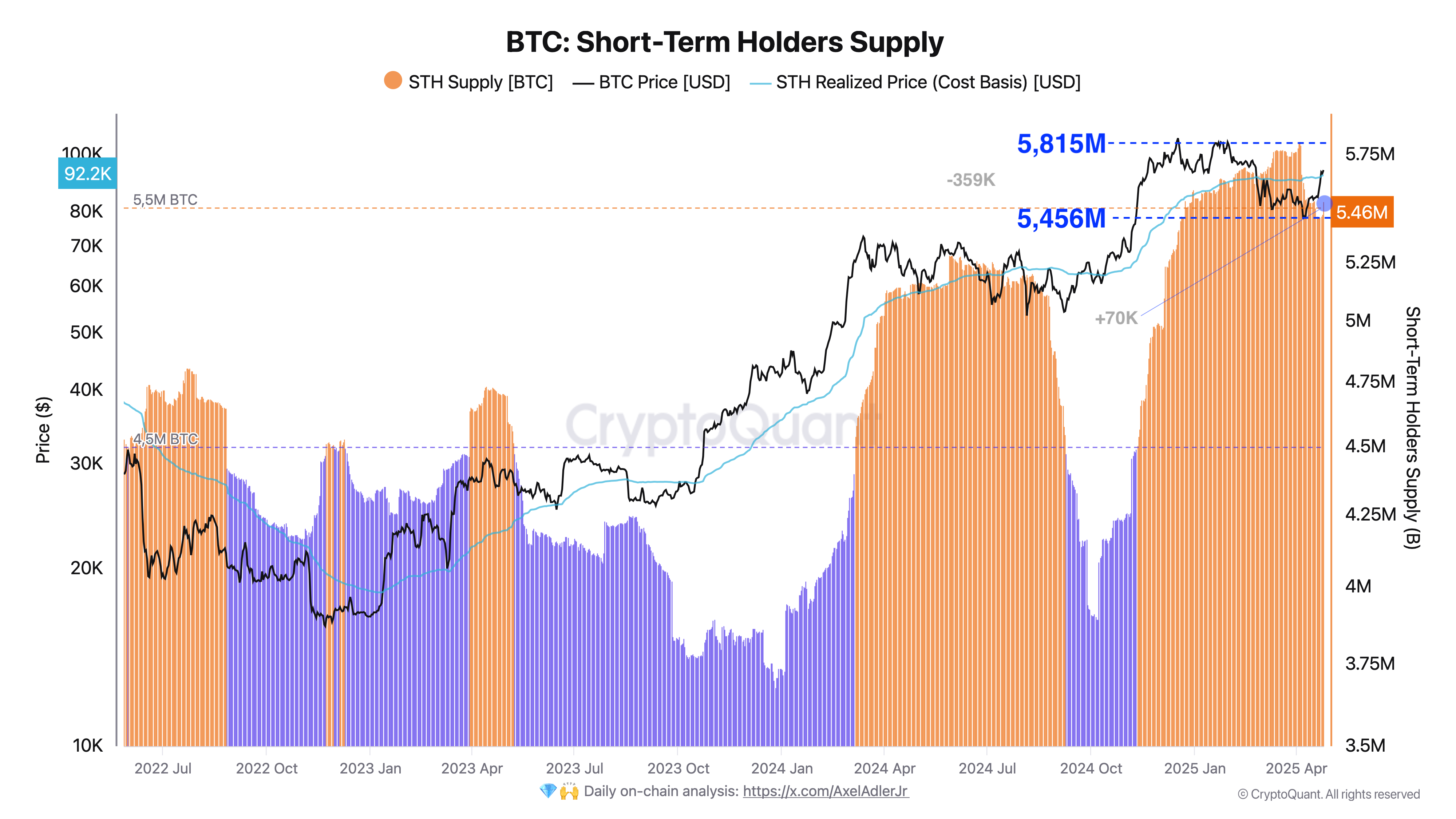

Utilizing Cryptoquant knowledge, Adler experiences that short-term holder market provide fell by 359,000 BTC, valued at $33.84 billion over 16 days between April 4 and 21. Curiously, this decline was as a consequence of coin maturation moderately than gross sales strain, which resulted in a transition to the long-term holder class.

It is a optimistic market sign that signifies that holders are assured in Bitcoin’s long-term outlook. By selecting to oppose gross sales, house owners are strengthening the underlying market demand and offering a strong basis for future worth will increase.

In one other attention-grabbing improvement, Axel Adler JR mentioned the provision of short-term BTC holders has elevated by 70,000 BTC, amounting to $65.9 billion within the final two days after Bitcoin’s newest worth rally.

Analysts clarify that the rise is attributable to revenue beneficial properties from long-term holders by means of redistribution. As costs rise. Importantly, short-term holders successfully soak up this new provide, indicating sturdy demand within the Bitcoin market.

This demand is closely mirrored in Bitcoin’s skill to exceed $92,200, a value foundation for short-term holders, representing the typical acquisition worth of the holdings. This reveals strong market confidence as new patrons are actively moving into the market and increasing their STH cohort.

Total, the mix of great coin maturation, wholesome redistribution, and Bitcoin’s resilience above the associated fee base of short-term holders highlights structurally sturdy market demand. BTC seems to be appropriate for sustained upward momentum within the medium to medium time period, because it demonstrates that long-term holders can successfully soak up provide by belief and new demand.

Bitcoin worth overview

On the time of writing, Bitcoin was buying and selling at $94,408, reflecting a 0.78% decline on the final day. Nevertheless, every day asset buying and selling quantity has declined by 55.53%, suggesting participation in a declining market.

However, it seems that BTC is about as much as preserve worth will increase. This has moved main resistance ranges at $91,000, supported by different bullish developments, together with a revival of ETF inflows totaling round $3.06 billion over the previous week.

The subsequent resistance is $96,000, and shifting by means of the previous may additional elevate costs to round $100,000. Nevertheless, a worth rejection may help you return to round $92,000, which may successfully create range-bound actions.

Financial Instances featured pictures, TradingView charts

Enhancing course of Bitconists deal with delivering thorough analysis, correct and unbiased content material. We help strict sourcing requirements, and every web page receives a hard-working evaluation by a crew of prime know-how consultants and veteran editors. This course of ensures the integrity, relevance and worth of your readers’ content material.