BlackRock, the world’s largest asset supervisor, made an excellent greater transfer by buying $240 million price of Bitcoin. This strategic acquisition marks a powerful restoration with BTC costs bounced again from 85.3K to present stage of 94.3K. Many merchants and analysts imagine they’re gaining momentum Bitcoin value forecast If the pattern continues, $10,000,000, may quickly develop into a actuality.

BlackRock doubles with Bitcoin

In one of the spectacular Bitcoin information this week, BlackRock confirmed its $240 million new Bitcoin purchases. The transfer strengthens our long-term conviction in BTC as a key asset in our diversified portfolio, notably after the profitable launch of the Bitcoin ETF earlier this 12 months.

Institutional confidence led by BlackRock and different monetary giants continues to function a stable spine for Bitcoin’s ongoing rally. Every main buy signifies to the broader market that property are now not fringed investments, however mainstream monetary devices.

BTC costs will probably be rebound strongly

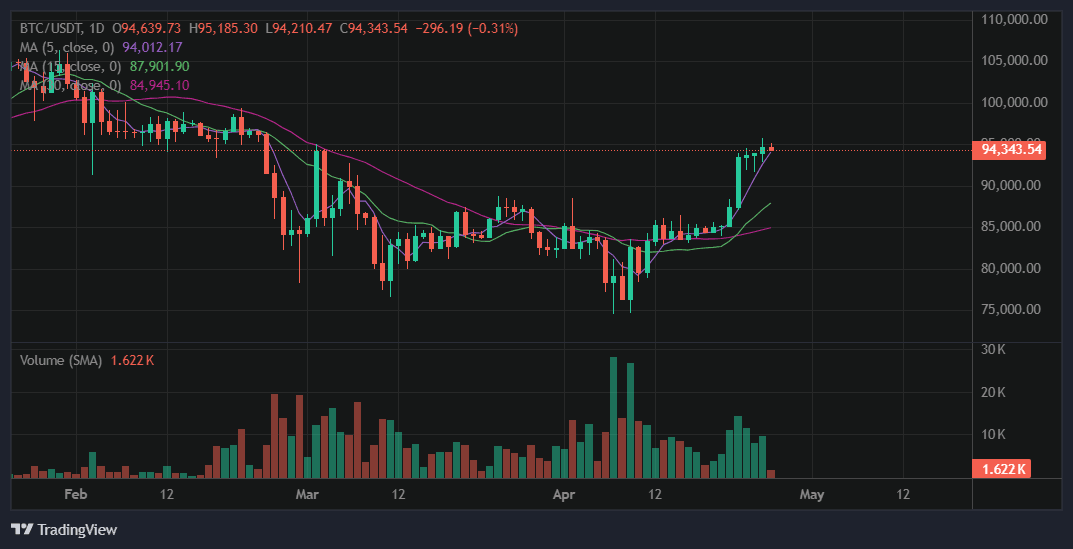

After immersing in $85.3k throughout a interval of market uncertainty, Bitcoin confirmed responsive resilience. The value of the BTC returned to 94.3k inside days, spurring each the establishment’s purchases and up to date retail income.

The present trajectory means that bullish momentum shouldn’t be solely intact, but additionally bolstered. Historic traits present that new all-time highs usually observe when Bitcoin rebounds from main dips with sturdy quantity and institutional help.

BTC/USDT 1 day chart, TradingView Above BitGet

Is $100,000 Bitcoin proper there?

Given the present setup, the $100,000 Bitcoin value prediction is now not a distant dream. Momentum metrics and pattern patterns recommend that BTC may shortly break by means of the six-man determine, particularly if shopping for stress continues on the present tempo.

A number of elements may speed up the transfer to $10,000:

- Institutional accumulation: Steady purchases by giants like BlackRock add a gradual demand.

- ETF Movement: Bitcoin ETFs are seeing an rising inflow and are providing further help.

- Constructive feelings: Market sentiment stays bullish and merchants are hoping for a breakout.

- Macro Circumstances: Inflation considerations and world uncertainty proceed to direct traders in direction of Bitcoin as a hedge.

If BTC costs stay on an upward trajectory, the psychological $100k barrier may act not as a resistance however as a magnet that raises the value.

Bitcoin Value Prediction: Bitcoin Subsequent Transfer

As BlackRock provides one other $240 million price of Bitcoin to its holdings, confidence in BTC’s long-term worth proposition continues to be strengthened. The present rebound is 85.3K to 94.3K$94.3K, highlighting the market’s resilience and setting the stage for the anticipated push to $10,000.

Brief-term volatility is at all times attainable, however the broader pattern stays bullish. For now, the trail to bitcoin to 6 numbers shouldn’t be solely attainable, however it’s inevitable if momentum applies.