Bitcoin has panic throughout the worldwide market, denounced the greenback, threatening President Donald Trump to fireplace Federal Reserve Chairman Jerome Powell.

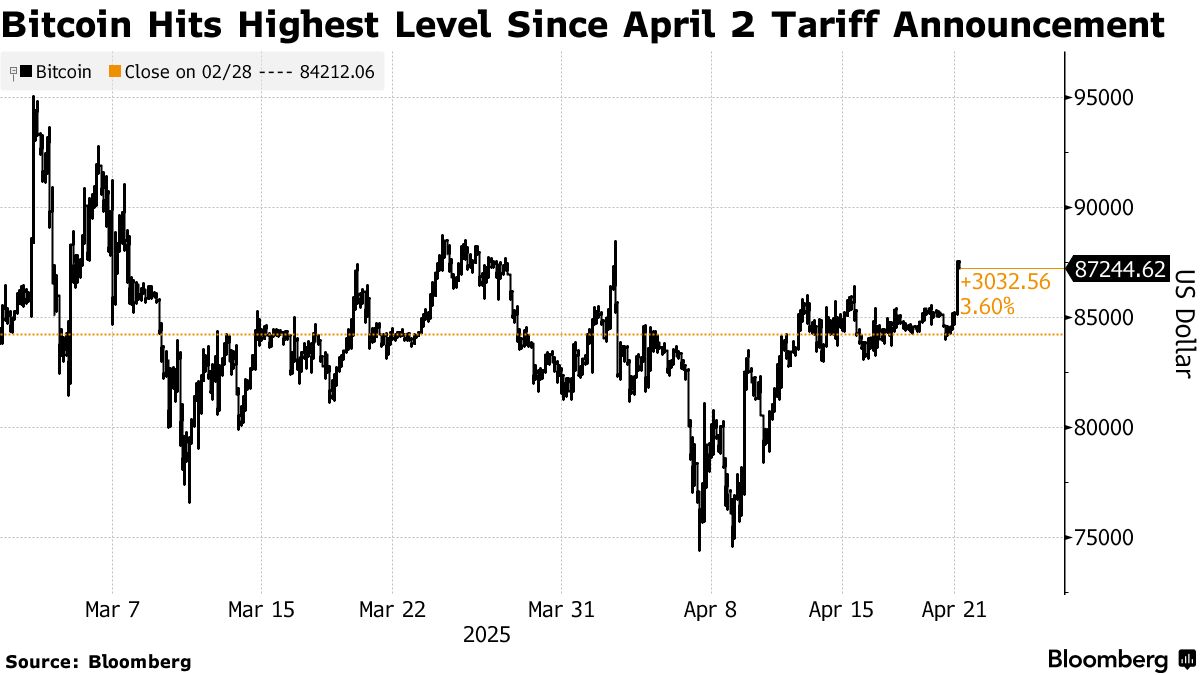

The three% enhance in Bitcoin worn out virtually all injury from April 2, the day Trump introduced a brand new spherical of retaliatory tariffs.

Supply: Bloomberg.

Bitcoin wasn’t the one one flying round. Gold reached the best ever excessive as folks started to run in direction of safer locations to park their cash. Crypto and metals have been the place panic cash went because the greenback’s bleeding and belief in central coverage collapsed.

Market the place shares bleed after a 3rd loss in 4 weeks

The rally got here when US inventory futures have been hammered and the greenback reached its lowest since January 2024. After Kevin Hassett, who runs the Nationwide Financial Council, strain started to construct up.

That single remark pushed the dollar to the bottom, straightforwardly questioning the Fed’s independence. Trump himself stated concerning the true society:

“Too late” Fed Jerome Powell is at all times too late and fallacious, however yesterday he printed one other, typical, complete “complicated!” report. Oil costs are falling, and groceries (eggs) are additionally falling.

On Monday morning, S&P 500 futures fell 0.79%. NASDAQ-100 futures fell 0.82%. The Dow Jones crashed 318 factors, down 0.81%. It went on for 3 consecutive weeks, this time it was an enormous hit. A small conflict occurred on Thursday, however the S&P 500 nonetheless lowered its week of shortened vacation by 1.5%.

The Dow and Nasdaq composites each sank greater than 2% in the course of the 4-day stretch. The US market was not even open on Friday as a result of Friday, however gross sales rapidly elevated.

The deal on Thursday was merciless. UnitedHealth misplaced greater than 22% after slicing its full-year forecasts and decreasing revenues weaker than anticipated. That single stock tanked the Dow.

After that, Nvidia felt extra ache. The chip big has already misplaced 7% early within the week earlier than its shares fell practically 3%. On Tuesday, Nvidia admitted that it could want a $5.5 billion hit within the subsequent quarter because it controls transport its H20 GPU chips to China and different nations.