The Bitcoin (BTC) market has confirmed to be fairly turbulent up to now week after a value drop beneath $75,000 rebounded by greater than $83,000. With the most effective cryptocurrencies displaying indicators of a sustained upward development, blockchain analytics agency Cryptoquant has recognized two doubtlessly essential zones of resistance which might be within the ready record.

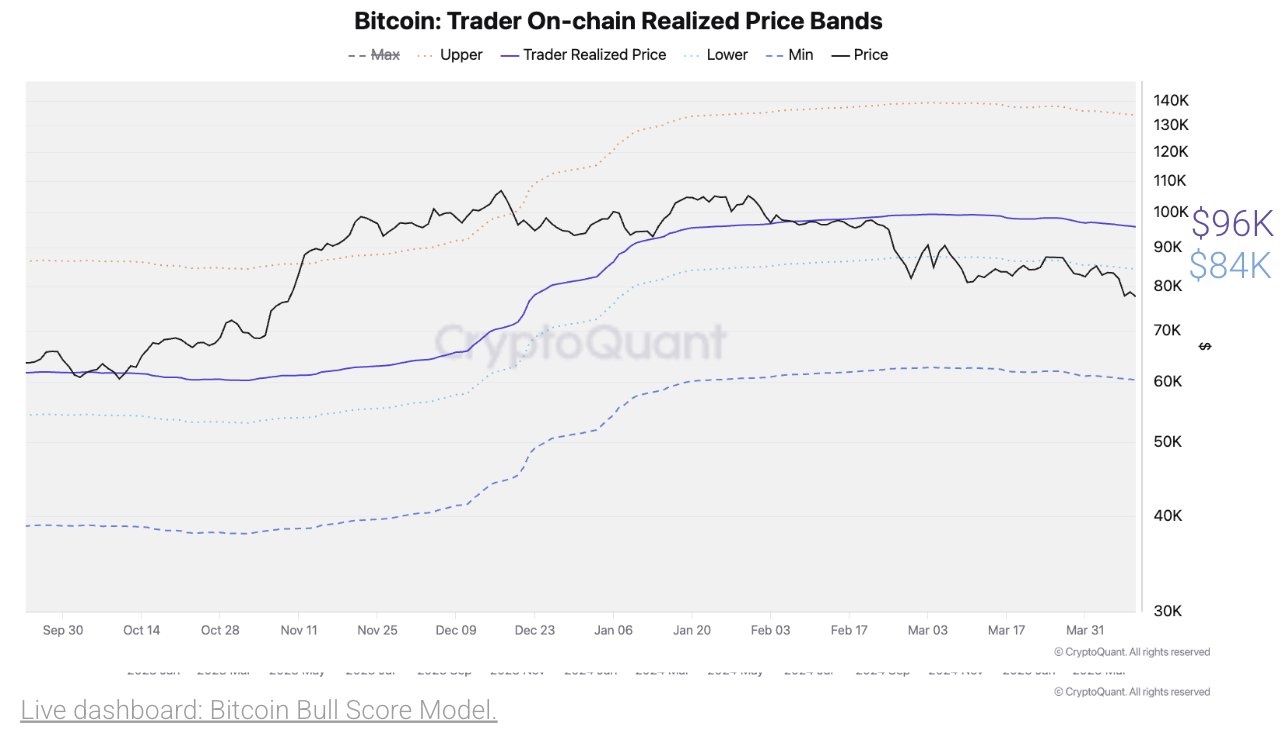

Bitcoin reveals a possible sturdy barrier with costs of $84,000 and $96,000

In an X submit on April eleventh, Cryptoquant shares an on-chain report on the BTC market, displaying two main resistances and potential encounters of $84,000 and $96,000 if Bitcoin maintains its present upward trajectory. These value obstacles are revealed by realised value metrics that mirror the common value that determines the general market price base, reflecting the common value that has final moved BTC’s present provide.

When Bitcoin trades above this stage, it exhibits a wholesome bullish momentum wherein nearly all of its homeowners make income. Conversely, if BTC is beneath the brink, most buyers maintain losses, suggesting underwater sentiment. Subsequently, realized costs usually function essential market pivots that act as sturdy help in bull markets, and are intense resistance on the bear stage. In line with Julio Moreno, Cryptoquant’s analysis director, the realisation value for BTC’s present chain is $96,000, whereas the instant low value vary is $84,000.

Apparently, these two value ranges function key help zones throughout the early bullish levels of the present market cycle. Nevertheless, each zones might act as resistance amid ongoing market corrections. Nevertheless, if Bitcoin can transfer past $84,000 and $96,000, it might imply a reopening of a bull market, the place the most effective cryptocurrency could possibly be $130,000. This projected revenue represents a 55% enhance in present market costs.

BTC value overview

On the press convention, Bitcoin continues buying and selling at $83,180, reflecting its 3.65% revenue over the previous day. In the meantime, day by day buying and selling volumes fell 11.99%, equal to $391.9 billion.

Amid the continuing macroeconomic improvement pushed by US authorities tariff adjustments, the crypto market continues to indicate a robust stage of uncertainty, and property are unable to ascertain clear momentum. Nevertheless, Blockchain Analytics GlassNode reviews that Bitcoin buyers have shaped a robust help zone at $79,000 and $82,080, with over 40,000 BTC and 51,000 BTC respectively.

With the emergence of downtrends, each value ranges provide short-term help and forestall additional value drops. Its market capitalization is $1.66 trillion, and Bitcoin is the biggest digital asset with over 60% of its crypto market capitalization.

CNN featured photos, charts on tradingView.com

Modifying course of Bitconists concentrate on delivering thorough analysis, correct and unbiased content material. We help strict sourcing requirements, and every web page receives a hard-working overview by a workforce of high know-how specialists and veteran editors. This course of ensures the integrity, relevance and worth of your readers’ content material.