Causes to belief

Strict enhancing coverage specializing in accuracy, relevance and equity

Created by business consultants and meticulously reviewed

The best customary for reporting and publishing

Strict enhancing coverage specializing in accuracy, relevance and equity

The soccer value for the Lion and Participant is gentle. I hate every of my arcu lorem, ultricy youngsters, or ullamcorper soccer.

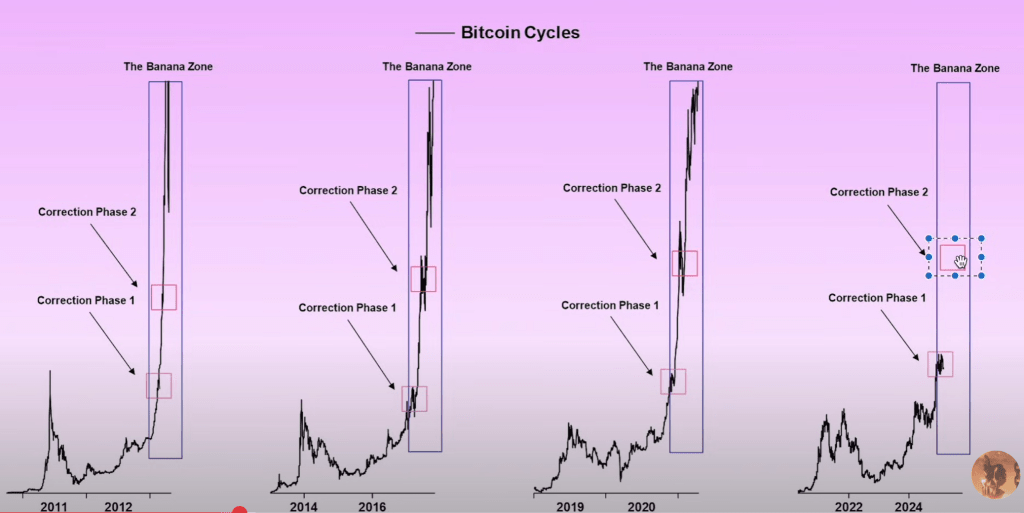

Market updates say that famend crypto commentator Rekt Capital examines the earlier Bull Cycle lens by means of Bitcoin’s newest DIP and claims it is vitally just like the sample of a number of revisions in 2017 alongside the way in which to the parabolic prime. Is the analyst “Bitcoin Banana Zone”? – In a video titled “Replace,” he known as “Banana Zone” “the time period of affection within the parabolic stage of the cycle, in terms of Bitcoin value motion.” He described the present retracement as a pure however expanded revision, emphasizing that regardless of many merchants’ disappointment, he’s “nonetheless on observe.”

Will Bitcoin enter the “Banana Zone” once more?

Rekt Capital is a similarity between present DIP and historic market habits, highlighting the round development that Bitcoin experiences two or extra revision durations when Bitcoin enters a brand new historical past excessive. Quote 2017 assemblyhe famous that earlier than reaching the final word peak, there have been instances of pullbacks from “34% to 38% to 40%”, which is not less than a complete of 4.

He additionally referred to the bumpy ascension in 2013, opposed the value motion right this moment, explaining that “invading the brand new all-time highs could cause a little bit of bumpy.” Regardless of the present 32% (most top) drawdown, he claimed that “as we have now seen up to now, we’ll see an extra the wrong way up after this revision interval,” classifying the present place of the market as the primary a part of two potential revisions within the present value discovery part.

Associated readings

All through his evaluation, Rekt Capital highlighted the significance of perseverance, noting that what could really feel like a long-term drawdown shouldn’t be the “uncommon” factor to endure on the way in which to a number of levels of traditionally rising and its peaks. “What’s regular?” he mentioned. “It means it is taking extra time, however it can permit for uptrends of subsequent value discovery sooner or later.”

He offered historic background by trying again at mid-2017 and different phases when Bitcoin repeated its recurring surroundings starting from round 30% to 40%. He says these corrections usually deepen because the cycle progresses, however the final one earlier than the subsequent main transfer will be shallow.

Analysts additionally delve into technical metrics such because the 21-week and 50-week exponential shifting averages, suggesting that Bitcoin costs have began to be led as “snagged between 21-week EMA and 50-week EMA.”

He in contrast it to mid-2021, when an identical layer preceded a 55% draw back motion and ultimately erupted into one other bullish part. “We supported that interval with a 21-week EMA weekly closing and breakout retest,” he mentioned, predicting {that a} related scenario might be seen by Bitcoin Rally. In direction of $93,500 If actions above 21 weeks of EMA are maintained.

Associated readings

In addressing considerations that the market is getting into the bear cycle, Rekt Capital insisted that “it isn’t a bear market, as everybody says.” He acknowledged the emotional sacrifice of huge pullbacks and the prevalence of conflicting indicators inside the media, however he maintains a stage of heading and focuses on highly effective indications reminiscent of shifting common confluence, historic correction ranges, and “we belong to this primary value discovery correction.” Based on his outlook, crypto costs nonetheless proceed to be complete Blueprint set by earlier Bull Runeven when it is “a little bit deeper” and disappoints merchants who need extra speedy parabolic momentum.

Rekt Capital concluded his commentary by highlighting that the re-accumulation part is a part of a long-lasting bull framework, fairly than an onset of a long-term downtrend.

On the time of urgent, BTC traded for $85,914.

Featured photographs created with dall.e, charts on tradingview.com