Monetary metrics for March reveal that Bitcoin Miner’s revenues have contracted by $20 million in comparison with February. On the identical time, hash pris (theoretical each day yield of 1 peta hash per second) is up 3.93% from the benchmark in early March.

Hashprice’s 3.93% slide meets 862 EH/S Frenzy

Contemporary information collected through HashrateIndex.com on April 1, 2025 reveals a descent of Hashpris from $48.84 per PH/s on March 1st to the present $46.92. This diagram encapsulates the hypothetical each day returns of mining manufacturing at 1 pH/s. Regardless of the moon’s downward orbit, the Hashpris vibrated dramatically, climbing to its $54.38 peak in early March, and by March tenth it had eroded a $44.05 trough.

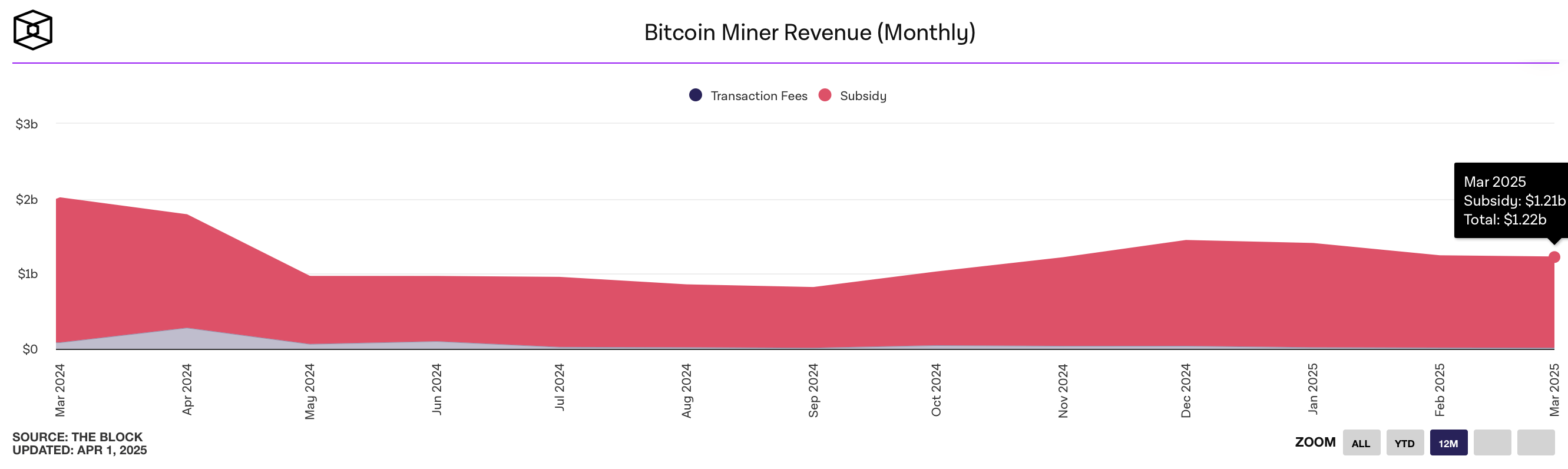

1 PH/s revenues have been contracted 3.93% for the reason that begin of March, however have rebounded 6.52% since March tenth. The evaluation revealed that Bitcoin Miner had a $20 million shortfall in income in March in February, in line with the information set from TheBlock.co. In February, miners earned $1.24 billion in income, of which $1.22 billion got here from the subsidies. Information for March displays a $1.22 billion accumulation, leading to $1.21 billion from block grants.

Onchain charges donated $16.45 million to the entire in February, and recorded $1511 million from the stream in March. Moreover, Bitcoin hashrate reached an unprecedented peak in March, surged to 862 exahashes per second (EH/S). The block interval is clipped at a Brisker tempo than the 10-minute benchmark, which is anticipated to have the problem adjustment anticipated on April 5, 2025.

In the meantime, on the finish of March and early April, on-chain transaction throughput was suppressed, with blocks under intraday capability. This lull compressed on-chain charges to simply 1-4 Satoshu per digital byte (SAT/VB). Translate slimmer revenue margins for mining operations.