Bitcoin has proven some resilience because the inventory market drops as a result of US tariffs on most buying and selling companions. Unchained consultants clarify why.

US shares have seen a few of their worst performances over time. Nevertheless, Bitcoin (BTC) has proven relative resilience. That is nice information for institutional investments, explains Joe Burnett, director of market analysis at Crypto Monetary Companies Unchained.

Trump’s tariffs are right here, US shares are crashing, and China is retaliating.

Now could also be among the finest instances to construct significant Bitcoin places.

It is not monetary recommendation. pic.twitter.com/rf9z01wrhm

– Joe Burnett, MSBA (@iicapital) April 4th,

On April 4, the Dow Jones industrial common drove over 2,200 factors, including to the 1,679 factors decline on Thursday. This was the worst two-day efficiency in historical past, and plenty of inventory buyers had been nervous in regards to the weekend.

You may prefer it too: Merchants Holding Bitcoin regardless of Market Panic: Binance

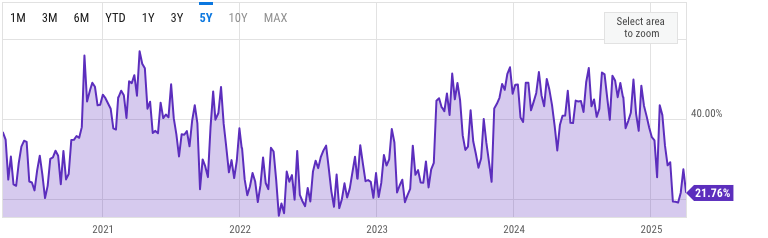

On the similar time, Bitcoin confirmed relative resilience and started to start recovering, really recording a 2.2% enhance within the final 24 hours. Burnett steered that it is a recurring sample since 2020, when Bitcoin costs led to a market restoration.

Recalling in March 2020, Bitcoin rapidly ran out of inventory and first recovered (earlier than US shares).

As a consequence of Bitcoin’s excessive volatility, Burnett mentioned that first asset buyers usually promote when liquidity is dry. Nevertheless, as a result of selloffs are normally quick and aggressive, Bitcoin usually runs out of shares.

This might additionally point out that the inventory is approaching the underside. Supporting this view is the AAII Investor Sentiment Survey. This fell to 19.11% on March thirteenth, the bottom stage because the pandemic. This excessive destructive outlook might imply that the inventory is about to inverted.

Nonetheless, Burnett warned that this doesn’t assure that Bitcoin is out of hazard.

After all, if shares proceed to fall aggressively over the following few weeks, it is affordable to anticipate Bitcoin to expertise one other leg too.

You may prefer it too: Bitcoin costs might rise as US bond yields, worry and grasping indicators drop