Causes to belief

Strict enhancing coverage specializing in accuracy, relevance and equity

Created by trade specialists and meticulously reviewed

The best normal for reporting and publishing

Strict enhancing coverage specializing in accuracy, relevance and equity

The soccer value for the Lion and Participant is gentle. I hate every of my arcu lorem, ultricy youngsters, or ullamcorper soccer.

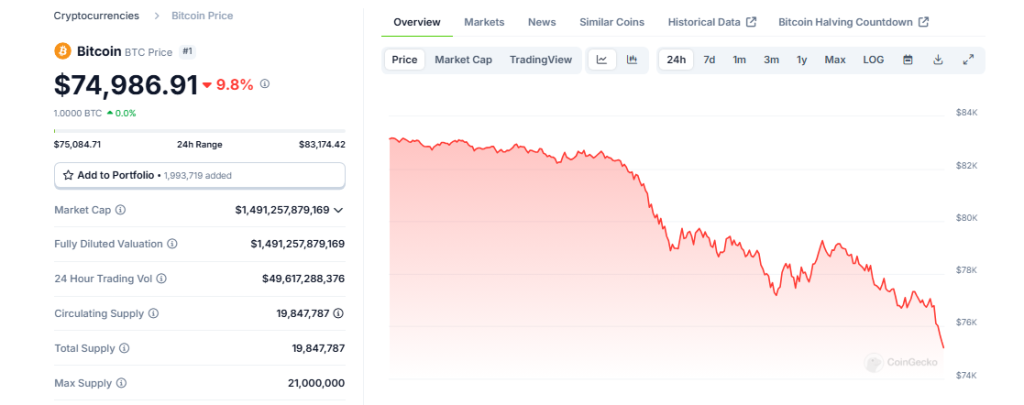

Bitcoin costs fell beneath $75,000 on Monday, April seventh. That is the bottom since mid-March, as buyers responded to tensions in US-China commerce relations. Digital forex dropped round 6% in 24 hours, CoinmarketCap information revealed.

Associated readings

The US-China commerce struggle causes market panic

A pointy decline happens after President Donald Trump just lately positioned tariff hikes and Beijing measures in place. Commerce tensions despatched Shock waves passing via the worldwide market, Wall Road is struggling in its worst fall because the Covid-19 pandemic. On Friday, April 4th, the S&P 500 fell 6%, the Dow Jones industrial common fell 5.5%, and the high-tech NASDAQ composite fell 5.8%.

Market commentator Charles Gasparino warned on Twitter that “Monday is the last word day of ache,” and warned buyers that they need to put together for additional gross sales strain when the market is open this week. That forecast seems to be realised as Bitcoin is buying and selling between $74,000 and $75,000, and is far decrease than final week’s degree.

Destruction: One main market analyst mentioned, “Monday is starting to turn into the last word day of ache.” One other: “There are some actually good individuals, particularly in finance.” As they are saying, disagreements turn into markets! The story growth

– Charles Gasparino (@cgasparino) April 6, 2025

Ethereum and Altcoins take a extra tougher blow than Bitcoin

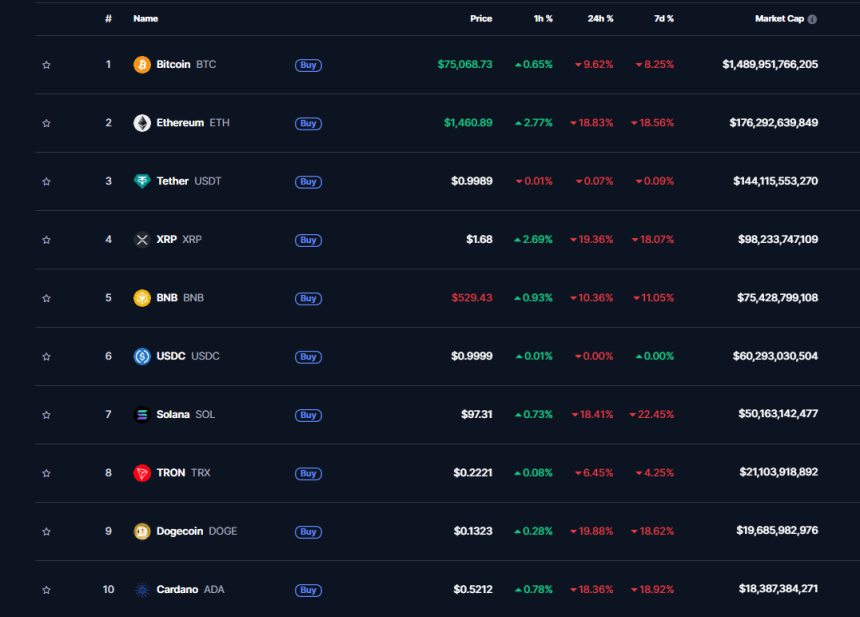

When bitcoin is misplaced considerably, Different cryptocurrencies have plummeted It is even deeper. Ethereum, the second largest cryptocurrency by market capitalization, misplaced 13%. Different well-known altcoins fell likewise arduous, with Sol and Doge dropping greater than 10% in at some point. The ADA fell by 10.40%, whereas XRP and BNB misplaced 7% and 6%, respectively.

The worldwide cryptocurrency market capitalization is at the moment at $2.62 trillion, as many of the prime cash can not discover assist. Even with costs falling, Bitcoin’s 24-hour buying and selling quantity jumped to $26 billion (a rise of 80% during the last 24 hours) exhibits a robust degree of market exercise through the sale.

Buyers flip to authorities crypto reserves for potential bailouts

Market disruptions have silver lining. In keeping with Edul Patel, CEO and co-founder of Mudrex, US authorities companies are revealing crypto property at present. “A big-scale affirmation might result in a reduction rally,” Patel mentioned.

Associated readings

Market sentiment stays weak with concern and grasping indicators in the direction of knowledgeable terminology “Extraordinarily scary.” This indicator implies that panic-filled gross sales management latest market traits reasonably than wholesome funding decisions.

In keeping with a report from Market Observers, Bitcoin has vital technical checks. “Bitcoin must take the $80,000 degree, or we’ll retest about $74,000 earlier than,” Patel added. This file excessive, beforehand welcomed as a milestone, is the extent of assist that merchants might hope to cease costs from falling additional.

Gemini Pictures, TradingView charts