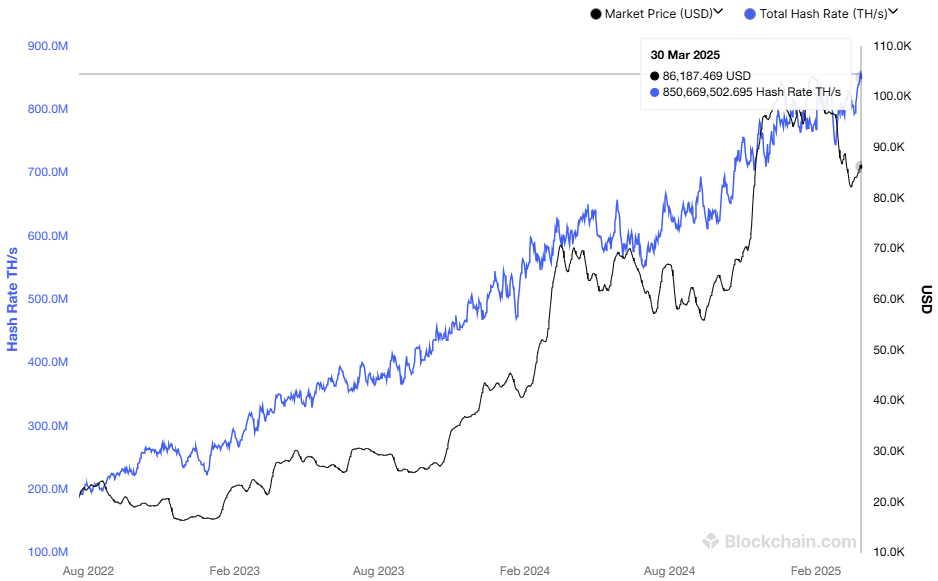

As community hashrates attain all-time highs (ATH), bitcoin mining is turning into more and more aggressive. On the finish of March 2025, Bitcoin hashrate hit 850 million individuals.

However along with this spectacular development, the business is scuffling with rising manufacturing prices and new tariff limitations, particularly within the US. These elements put lots of stress on mining firms and will reshape the way forward for the sector.

Hashrate surges and mining prices skyrocket

Bitcoin hashrate measures the whole computational energy utilized by miners to guard the community and validate transactions. That is expressed as terrahash per second, representing the variety of hash calculations that the community performs per second.

Bitcoin hashrate exceeded 850 million Th/s in March, in keeping with BlockChain.com. This improve displays a rise in miners taking part within the community and elevated belief in Bitcoin’s worth and safety.

Bitcoin hashrate. Supply: BlockChain.com

“Each time a community turns into stronger, Bitcoin turns into harder to assault, tougher to disregard, and extra justified to order the next score. That is greater than only a code. It is financial gravity. – Thomas Jeegers, CFO & COO of Relai commented.

Regardless of this surge in hashrates, mining earnings haven’t risen accordingly. Based on a Macromicro report, the price of mining a single Bitcoin has doubled since early 2024, now reaching $87,000. The principle drivers of this improve are rising electrical energy costs and the excessive working prices {of professional} mining {hardware} (ASICs).

With the value of Bitcoin fluctuating, many mining firms threat working at loss except they optimize effectivity. This problem is especially extreme for small miners who lack the benefits and entry of scale to the cheap electrical energy that enormous companies get pleasure from.

Tariff Challenges and China’s dependence on {hardware}

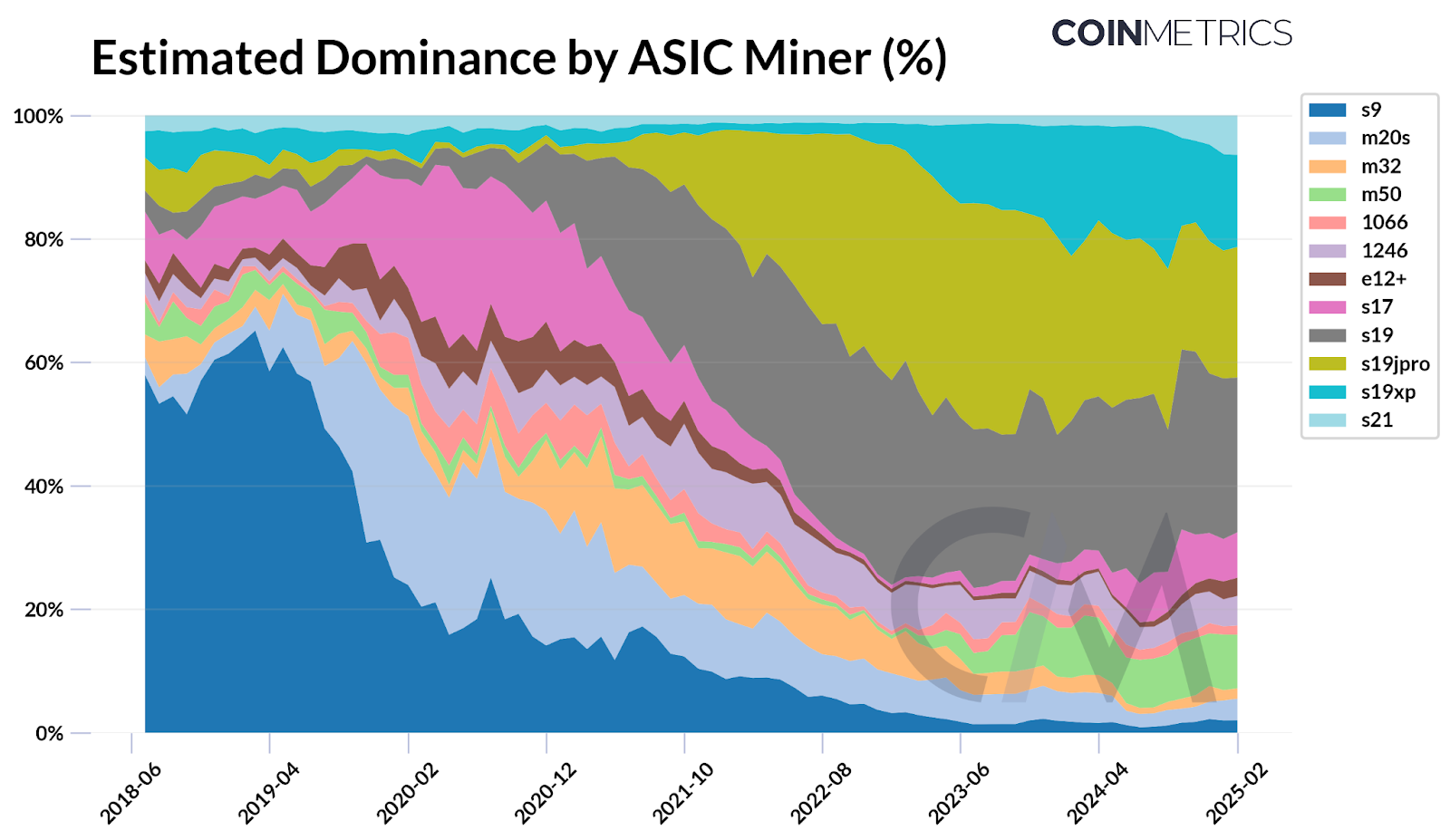

One other main impediment to Bitcoin miners is commerce restrictions, significantly within the US. Based on Coinmetrics, ASIC Miner, manufactured by Chinese language firm Bitmain, accounts for round 59% to 76% of Bitcoin’s complete hashrate.

Estimated domination by ASIC Mainer. Supply: Coinmetrics.

Bitmain has lengthy been the dominant participant in mining {hardware}, and well-liked fashions such because the Antminer S19 and S21 are identified for his or her excessive effectivity. Nevertheless, in early 2025, some US mining firms skilled delays following Bitmain shipments because of customs administration and new duties on Chinese language imports.

“Regardless that Bitmain is a big a part of Bitcoin’s community hashrate, reliance on a single producer poses potential dangers, even though Bitmain distributes its provide chain. As Bitmain is based totally in China, its benefit highlights how geopolitical dependence impacts the soundness of mining operations,” reported Coinmetrics.

These tariffs usually are not new. The US has imposed a most of 27.6% obligation on imported mining from China since 2018, in keeping with SCMP.

Nevertheless, latest measures have proven elevated regulatory scrutiny and commerce pressures, additional rising {hardware} mining prices. This will increase operational prices for US-based miners, disrupt provide chains and limits their skill to scale as world hashrates rise.

Not too long ago, Hut 8 Corp., a Bitcoin Mining and Excessive-Efficiency Computing Infrastructure Agency, has partnered with Eric Trump and Donald Trump Jr. to ascertain American Bitcoin Corp.

The corporate goals to turn out to be the biggest and best Bitcoin mining operation globally whereas constructing a powerful strategic Bitcoin reserve. The transfer highlights the rising curiosity from institutional buyers in aggressive mining.