Bitcoin costs have been on a gradual downtrend because the finish of February, and have been struggling persistently over $85,000.

Latest value actions have proven that Bitcoin is steady at this necessary stage, however key buyers stay uncontrollable. Regardless of the battle, many proceed to sign long-term belief.

Bitcoin buyers are optimistic

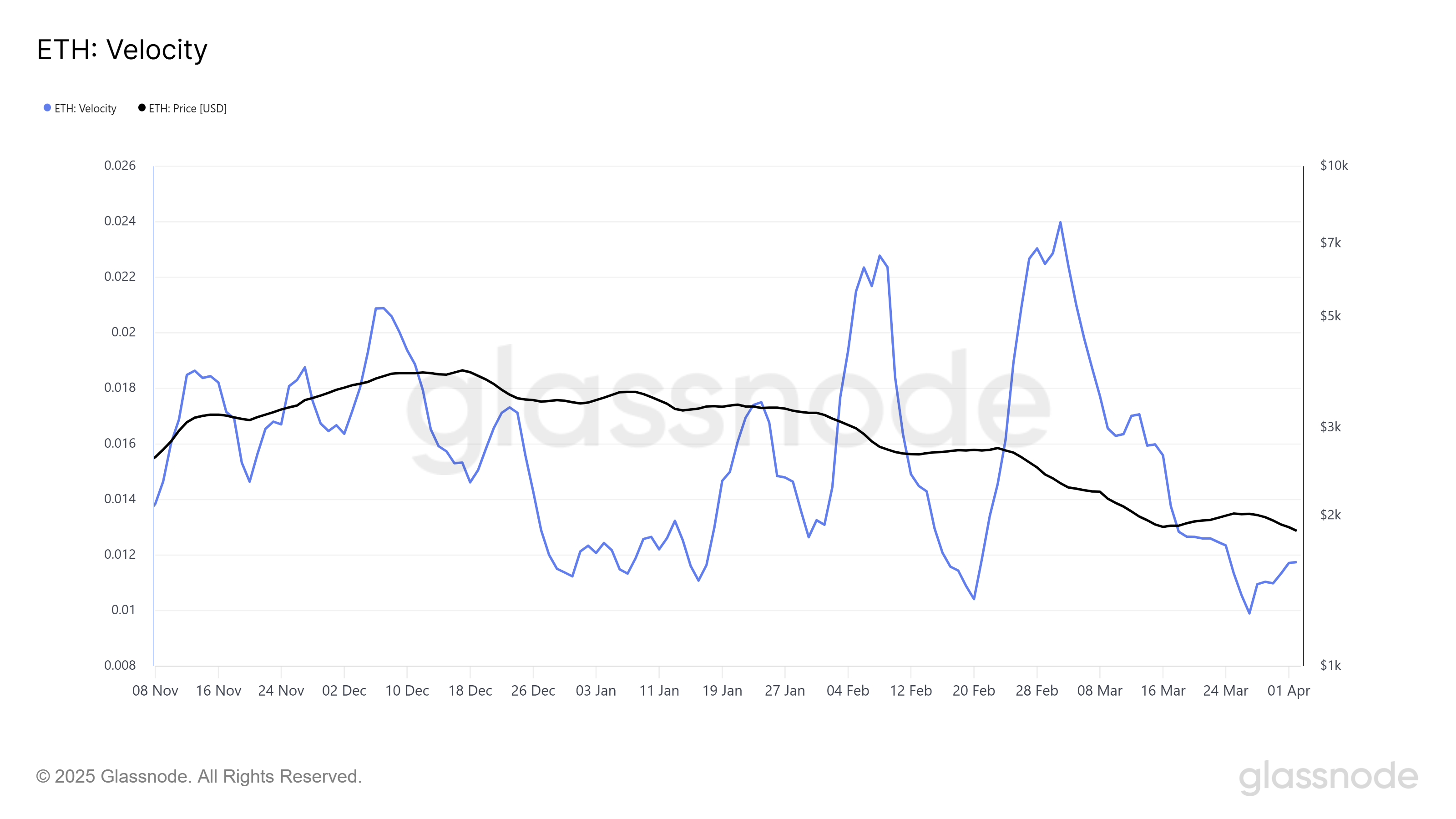

Bitcoin’s pace, which measures the circulation of cryptocurrency, has soaked low for 5 months final week. This slowdown signifies that Bitcoin holders have gotten extra cautious and fewer cash. As circulation decreases, it usually results in a modest value progress, and BTC has not too long ago skilled this development.

The slower pace displays a shift in investor feelings and has a common sense of hesitation amongst market members. In consequence, Bitcoin’s value restoration has slowed, and this cautious method is mirrored in present market conduct.

Bitcoin pace. Supply: GlassNode

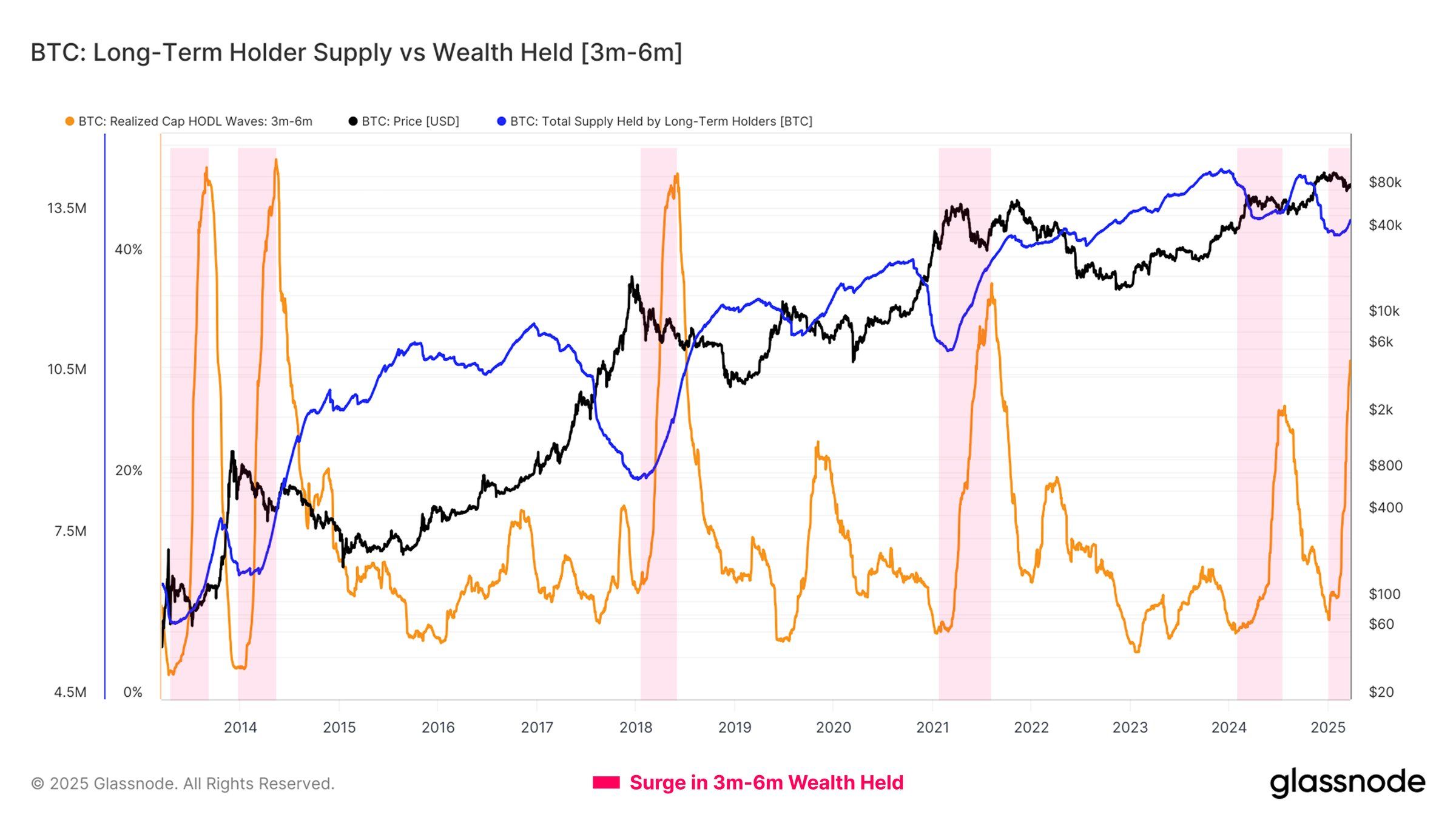

In distinction to cautious short-term sentiment, medium-term holders (holders for 3-6 months) have elevated their wealth throughout this era. These holders have moved to long-term holders (LTHS), indicating a change in investor belief. Many of those cash are acquired close to Bitcoin’s all-time highs, and their continued growing older suggests robust perception amongst these buyers.

Expenditures from this cohort have reached lowest ranges since mid-2021, indicating that long-term holders are unlikely to promote, even during times of market uncertainty. This drop in gross sales strain is a optimistic signal because it means that key buyers are working to carry their place and will not be in a market hunch.

Bitcoin wealth is retained. Supply: GlassNode

Can BTC costs recuperate current losses?

On the time of writing, Bitcoin priced at $83,403 and sits slightly below the necessary $85,000 resistance. Earlier this week, Bitcoin surged to $88,500, however skilled a decline after the announcement of tariffs on Trump’s launch date. This has quickly immersed market sentiment, however costs have remained steady above $80,000.

Trying forward, if help from long-term holders continues, Bitcoin might recuperate. Nevertheless, for this to occur, you’ll need to first accumulate $85,000 in help. The confirmed restoration is marked by pushing Bitcoin over $89,800, indicating a possible path to a better stage.

Bitcoin value evaluation. Supply: TradingView

If a $85,000 violation fails and the circulation is low, Bitcoin’s value might return to the subsequent key help stage at $80,301. Such a decline might negate bullish outlook and result in additional consolidation or bearish value motion within the brief time period.