Causes to belief

Strict modifying coverage specializing in accuracy, relevance and equity

Created by trade specialists and meticulously reviewed

The very best customary for reporting and publishing

Strict modifying coverage specializing in accuracy, relevance and equity

The soccer value for the Lion and Participant is smooth. I hate every of my arcu lorem, ultricy children, or ullamcorper soccer.

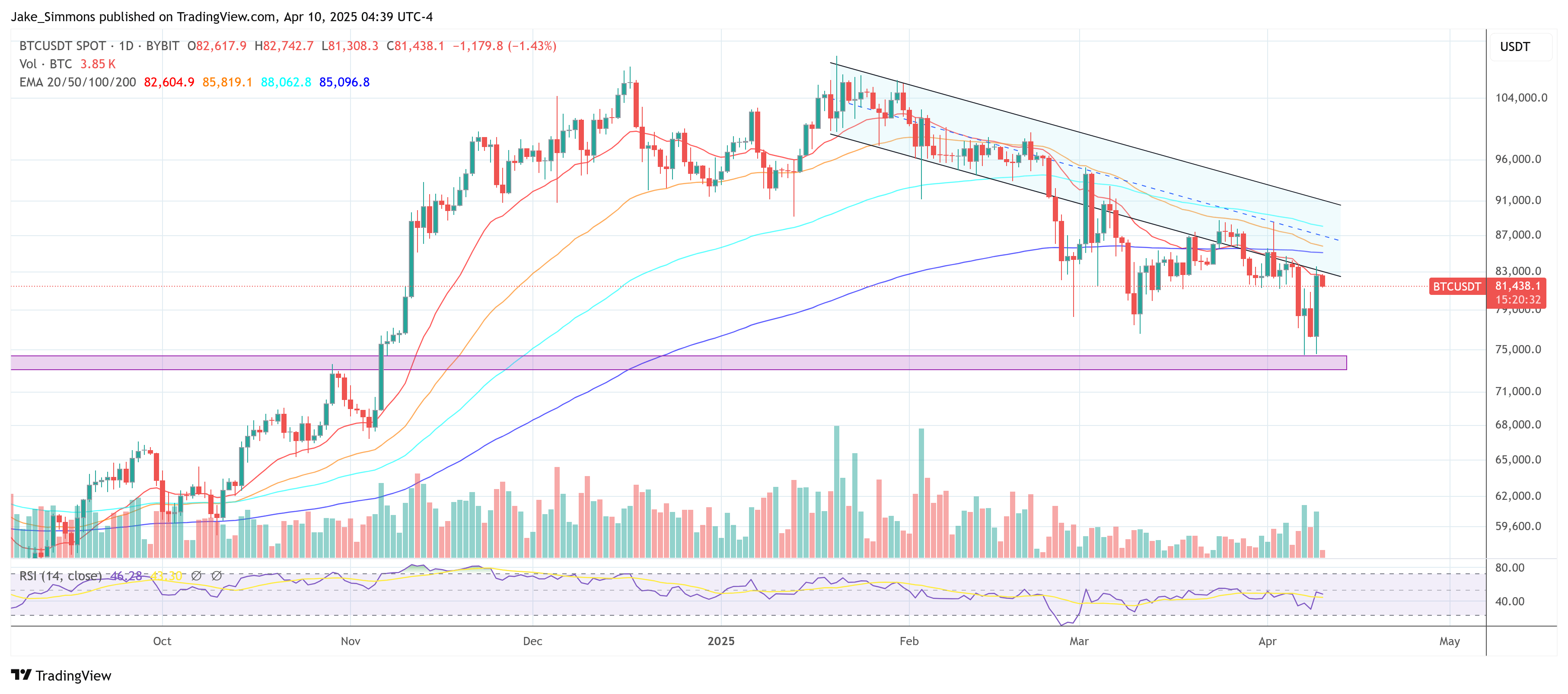

Bitcoin surged by greater than 8% on Wednesday, reaching a excessive of $83,588 after President Donald Trump introduced a 90-day suspension on new mutual tariffs in additional than 75 nations besides China. Buyers and market analysts view the transfer as a aid sign, reflecting the hope that not less than quickly, the fast escalation of tariffs will waned. However President Trump concurrently hiked China’s tariff charge to 125%, indicating that the commerce battle between the 2 greatest economies on the planet is way from an answer.

Trump’s choice to droop most of his newly introduced tariffs was linked to considerations Disruptive adjustments within the bond market. Yen Treasury bond yields, which surged to seven-week highs, remained up after a tariff suspension was introduced. Regardless of the non permanent aid of many nations, speedy tariff hikes in China spotlight an ongoing stalemate and suggests sustained uncertainty within the world market. Some analysts see Speedy progress in threat propertyas pushed partly by adjustments in expectations concerning future negotiations, together with Bitcoin.

Potential China is just not the worth of Bitcoin

Inside this background, Joe McCann, Founder, CEO, CIO, Solo Managing GP Sesimmetric of Crypto Fund; voice His perspective on X observes that whereas the market was initially pricing for customs duties in China, the EU and worldwide, it’s now just for Chinese language pricing.

Associated readings

He confirmed that the market will explode larger if a breakthrough emerges because the take care of Beijing stays priceless.” “The market was priced in order that China, the EU and everybody else had tariffs. At the moment, the market is priced solely in China. The market is just not priced for Chinese language trades,” McCann stated.

He additionally famous that “explosions on the lengthy edge are explosions of the danger parity pod,” referring to the fast market motion in long run bonds. McCann sees the present setting as harking back to the market backside in the course of the group, with funds starting to cowl positions and quick time period durations. He highlights the likelihood that if the yuan is strengthened towards the greenback, it may imply that China is able to negotiate, implying that equity and crypto markets could possibly be too low in commerce.

“As we speak, solely lengthy funds are grossed once more, shorts are coated. Trump is keen to sign China’s greatest ache and negotiate. The market can solely have a better value. If Yuan gathers towards tonight’s greenback, it is seemingly an indication that China needs to barter.

“I have not left the forest but.”

Jeff Park, head of Bitwise Alpha Technique; caveat The setting stays weak, weakening the unique dynamics at X, noting that 10-year yields above 4% and ongoing credit score considerations at spreads above 400 foundation factors will persist as potential headwinds. In keeping with him, “(This could be) an unpopular opinion (…) we’re nonetheless out of the woods (…) the online final result continues to be adverse for dangerous property, particularly if the Federal Reserve doesn’t reduce rates of interest as beforehand anticipated.”

Associated readings

He cited this lack of monetary help as an element that amplifies volatility. “I am really extra involved about how little liquidity out there is to expertise this on line casino swing, if any,” he writes through X.

X consumer Adam Yoder agrees, “The bonds are nonetheless up at present and cash has risen.” “That is really a scary transfer,” Park advised, expressing confusion over what the White Home hopes to attain with a partial pause that leaves China alone to take the brunt of the brunt.

In the meantime, with a fast turnaround from earlier calls, Goldman Sachs I retreated After a 90-day suspension was confirmed, the just lately introduced baseline for the recession has been confirmed. The revised outlook issued by Jan Hatzius argues that whereas gross duties (each current 10% and the anticipated sector-specific 25%) are nonetheless in place, the market is sparing speedy world escalation.

Goldman returns to earlier non-biased baseline forecasts for 0.5% This fall/This fall GDP progress in 2025, 45% possibilities of a recession, and three consecutive 25 basepoint “insurance coverage.” Federal Reserve Reductionsn June, July, September. “We proceed to sit up for further sector-specific tariffs,” based on the assertion, and an total charge was anticipated to method the 15% level enhance that Goldman had initially anticipated.

I am taking a look at at present’s CPI launch

Particularly, at present, the US Client Value Index (CPI) knowledge for March 2025 is scheduled to be launched by the US Bureau of Labor Statistics (BLS) at 8:30 ET.

The February 2025 CPI confirmed a rise within the earlier 12 months (Yoy) year-on-year (unseasonally adjusted) year-on-year, with a 0.2% enhance within the month (mothers) over the course of the 12 months. Core CPI, excluding meals and vitality, elevated by 3.1% year-on-year. This exhibits slight cooling from the three.0% year-over-year heading charge in January, suggesting a gradual developmental development.

Expectations for CPI in March would probably fall to round 2.5%, with some analysts suggesting that if developments in housing prices, lease and vitality costs proceed to ease, they may fall beneath 2.6%. Core CPI is predicted to hover round and round 3.0% to three.1%, reflecting sustained stress from service and shelter prices.

On the time of urgent, BTC traded for $81,438.

Featured photographs created with dall.e, charts on tradingview.com