The cryptocurrency market has remained pretty steady regardless of the worldwide macroeconomic headwinds which have shook the standard market over the previous week. Ethereum costs didn’t take pleasure in the identical reduction as different giant property. This started in April, which just about ended within the first quarter of 2025.

The second-largest cryptocurrency is on the verge of dropping the $1,800 degree, falling nearly 5% over the previous week. Nonetheless, the newest on-chain knowledge means that Ethereum costs could also be nearing the underside and could also be prepared for rebound within the coming weeks.

Metric rise says Ethereum costs could also be prepared for a comeback

In a current put up on the X platform, on-chain analyst Maartunn shared new insights into Ethereum buyers’ actions relating to centralized alternate. In response to Crypto Pundit, this newest on-chain shift means that new bottoms could possibly be brewed at Ethereum costs.

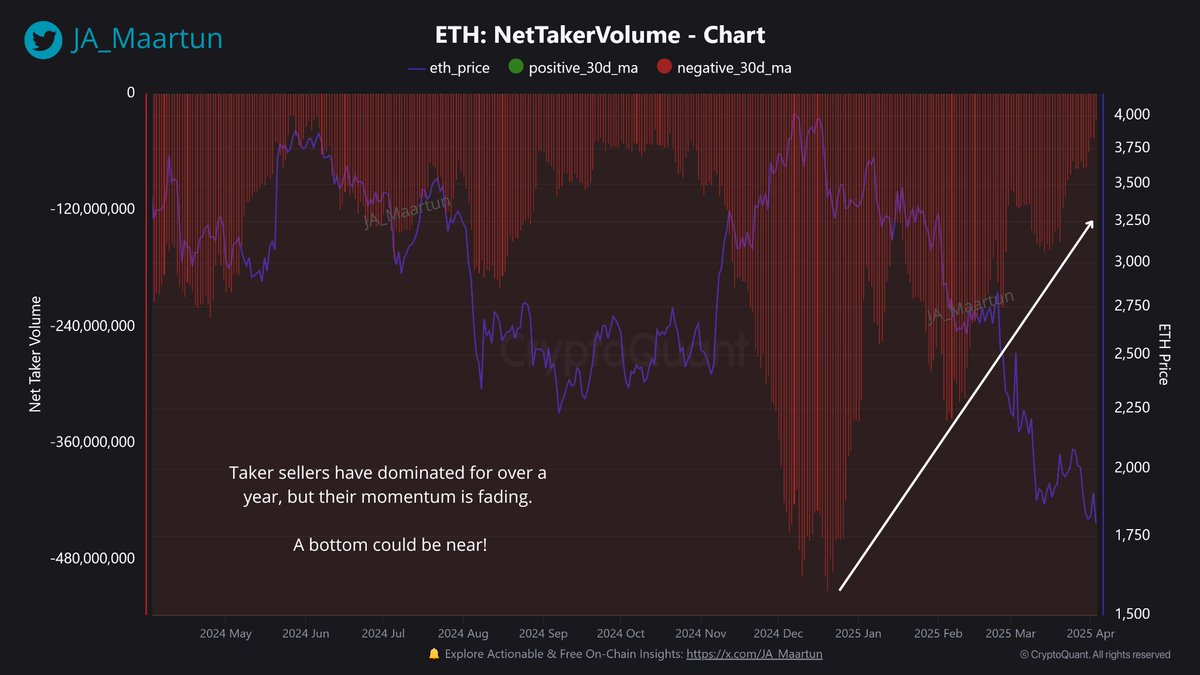

The related metric right here is the Nettaker Quantity metric, which tracks taker purchase quantity and taker gross sales quantity in a given asset market (on this case Ethereum). This on-chain indicator can be utilized to evaluate the power of your gross sales or buy strain available in the market.

When nettaker quantity is optimistic, it exhibits that offensive shopping for actions (Taker Buys) are overwhelming gross sales actions (Taker Sells), suggesting enhanced bullish sentiment. Damaging metrics imply that Taker sells increased than Taker purchase quantity. That is often a bear sign.

In his put up, Maartunn identified that aggressive gross sales actions have outperformed buying actions within the Ethereum marketplace for greater than a yr. Nonetheless, on-chain analysts emphasised that Taker’s gross sales quantity has declined over the previous few weeks and seems to have misplaced steam.

Supply: @JA_Maartun on X

As proven within the chart above, regardless of the value of Ethereum creating new lows, nettaker volumes are forming increased lows. This traditional bullish emancipation Altcoin means that it might be reducing the underside and getting ready to expertise a bullish reversal.

On the time of writing, the ETH token is valued at round $1,806, reflecting a worth improve of round 1% over the previous 24 hours.

ETH Whales are trimming their holdings

Curiously, competing on-chain knowledge has additionally emerged, indicating {that a} key class of buyers generally known as whales are offloading their property. This cohort of buyers influences market dynamics because of their important holdings and is often monitored by different buyers.

Supply: @ali_charts on X

In a put up on April 4th on X, Crypto analyst Ali Martinez revealed that whales (holding 10,000-100,000 cash) have bought over 500,000 ETH tokens within the final 48 hours. Given the scale of this sale and the affect of buyers, this exercise could possibly be a bearish impediment to the opportunity of Ethereum worth restoration.

The value of ETH on the every day timeframe | Supply: ETHUSDT chart on TradingView

ISTOCK featured pictures, TradingView chart

Modifying course of Bitconists concentrate on delivering thorough analysis, correct and unbiased content material. We help strict sourcing requirements, and every web page receives a hard-working evaluation by a group of prime know-how consultants and veteran editors. This course of ensures the integrity, relevance and worth of your readers’ content material.