Ethereum confronted a noticeable improve in buying stress, resulting in bullish rebounds with key help of $1.5,000. The worth is dealing with a vital vary of resistance at $1.8k, and is anticipated to enter short-term integration earlier than it breaks.

Technical Evaluation

By Shayan

Every day Charts

After a interval of calm worth motion and market inactivity across the decisive $1.5k long-term help space, Ethereum in the end surged into stress purchases, inflicting bullish rebounds. This wave of demand has led costs to a key resistance zone of $1.8,000. This space coincides with the vital ordering blocks that Sensible Cash often locations orders and strengthens its significance.

Value motion at this degree is vital. A profitable breakout of over $1.8k will affirm a bullish inversion situation and open the trail to the two.1K goal. Nevertheless, short-term integration of this resistance is feasible earlier than a vital transfer unfolds.

4-hour chart

Within the decrease timeframe, the combination of the earlier tight vary of ETH was damaged by a distinguished purchaser influx, leading to impulsive breakouts on high of the descending channel. This breakout was accompanied by robust bullish momentum, pushing costs in direction of the 1.8k key $1.8K resistance zone.

The realm is aligned with Ethereum’s earlier swinglow, making it a sturdy provide space. Consequently, short-term consolidation is anticipated at this degree till provide or demand stress determines the following transfer. A bullish breakout of over $1.8k units the $2.1,000 vary as a possible goal for consumers:

Emotional evaluation

By Shayan

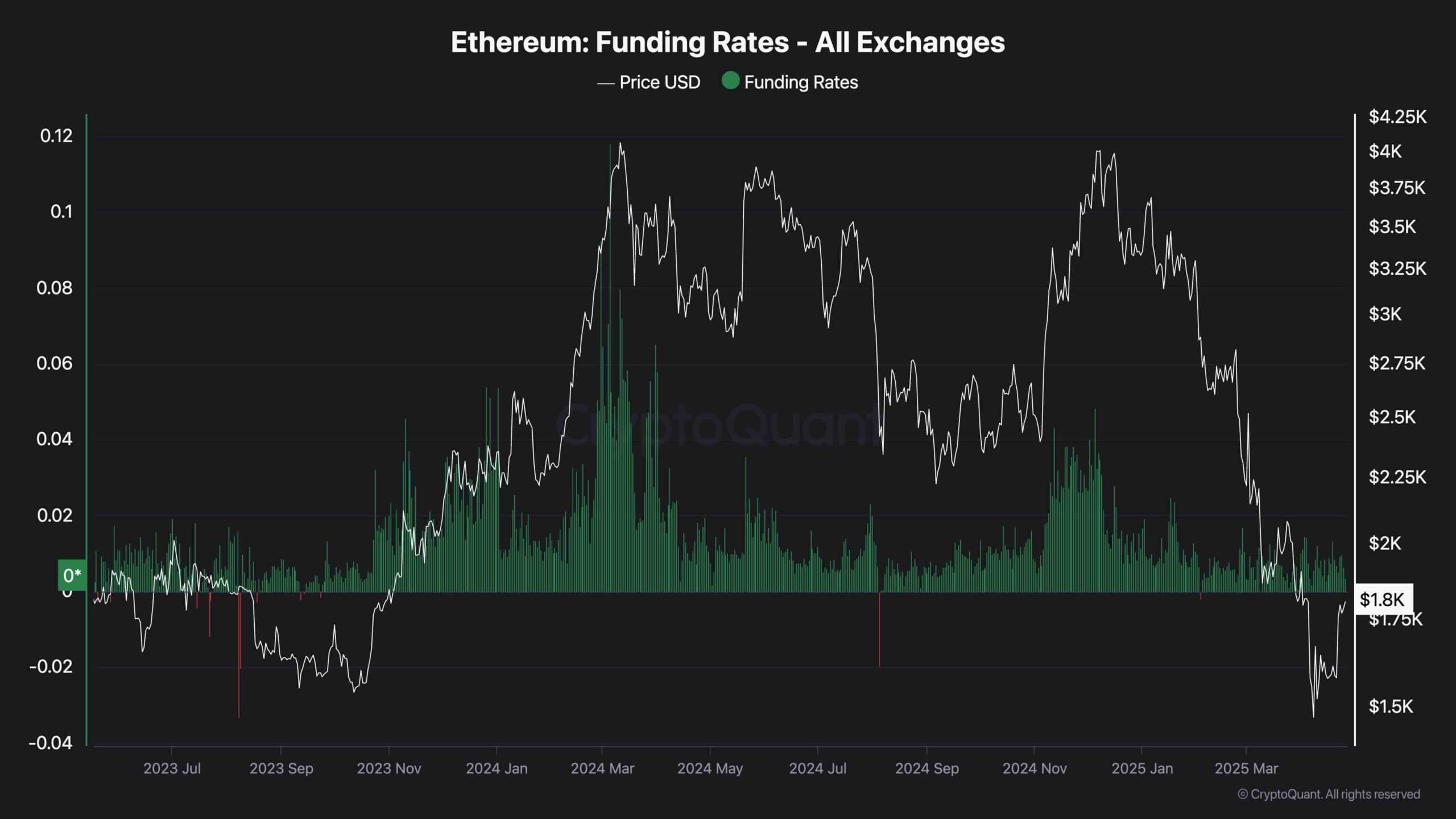

Funding price indicators are key indicators of sentiment within the futures market. Analyzing latest behaviors provides you vital perception into the most recent surge in Ethereum. Usually, wholesome, sustainable bullish tendencies are accompanied by elevated funding charges, indicating an inflow of consumers in each the lasting future and the spot market.

Nevertheless, the funding price is at the moment consolidated and there’s no important improve. This means that Ethereum’s latest worth surge is pushed primarily by buying spot markets fairly than hypothesis within the futures market. This bullish pattern is examined and sustainable, financing price indicators should start to rise, reflecting elevated confidence within the futures market and aggressive buying.