Monetary markets sparked cautious optimism as U.S. shares closed aggressively on Friday, with NASDAQ Composite rising 2.06% and the digital belongings sector rising 3.72% to a valuation of $2.63 trillion. Equally, publicly listed Bitcoin miners loved rebounds as 9 of the 9 of the highest 12 firms by market capitalization rose to a excessive diploma.

Bitcoin Minor Pop launched on Friday – However YTD’s losses are nonetheless deeply decreased

The revealed Bitcoin Miner closed the week on an upward trajectory. The dominant share of those firms introduced constructive returns following unstable stretches. After Trump’s tariffs helped drive consecutive declines, the Nasdaq added 2.06%, the NYSE added 1.84%, the S&P 500 added 1.81%, and the Dow Jones Industrial Common added 1.56% in comparison with the US greenback.

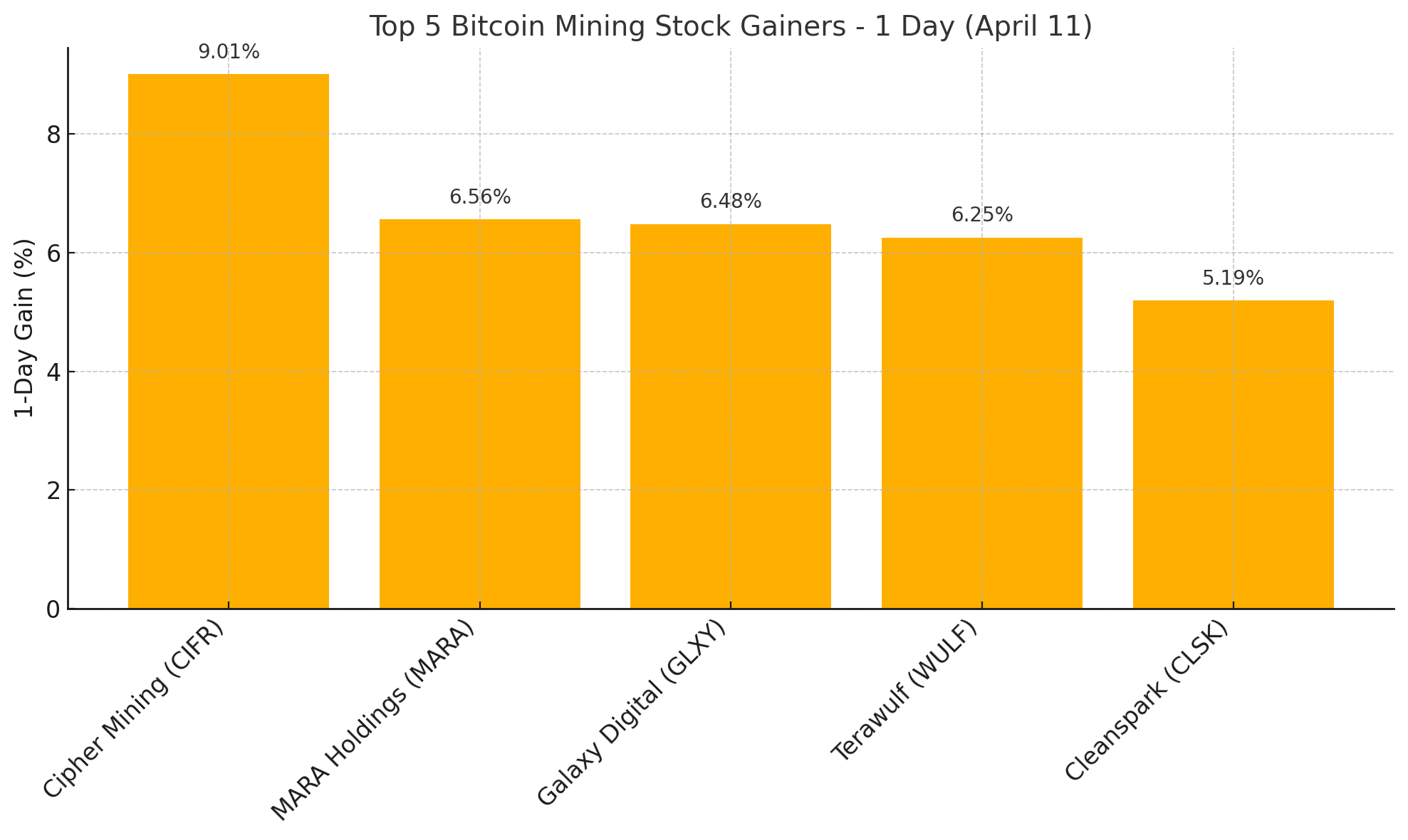

The inventory revival pushed 9 of the 12 Bitcoin mining entities into aggressive territory, with inventory costs rising decisively. BitcoinminingStock.io Metrics Present Cipher Mining (CIFR) overtook Mara Holdings (Mara), who gained the highlight on Friday with a 9.01% leap and secured a 6.56% enhance. Galaxy Digital (GLXY) acquired a score of 6.48%. This rose 6.25% in parallel with Terawulf (WULF).

To shut out the market victory Higher Echelon on April 11, CleanSpark (CLSK) achieved an altitude of 5.19%, solidifying its rank because the fifth most prolific advancer. Equally, BTDR, Riot, Corz, Hut and APLD had been registered on Friday within the vary of three.12% to 4.61%. Nevertheless, over the 5 days, seven of the 12 main Bitcoin miners of market capitalization recorded constructive returns.

Glxy dominated weekly efficiency with a 15.77% score, dragged carefully by the CIFR, with a rise of 15.23%. Regardless of the fleeting rally, the year-to-date indicators for Bitcoin Miners in 2025 reveal a widespread downward trajectory. CleanSpark (CLSK: -18.56%) and Mara Holdings (Mara: -25.40%) fastened the non-severe losses, whereas Riot platforms (Riot: -30.85%) and Utilized Digital (APLD: -30.75%) mirror steep refusals.

Galaxy Digital (GLXY: -36.94%), HUT 8 (HUT: -40.65%), and IREN (IREN: -42.66%) along with Northern Information (NB2: -47.34%), Cipher (CIFR: -47.84%), CORE SCIENTIFIC (CORZ: -49.67%), TERAWAW (CIFR: -47.84%), and Cipher (CIFR: -47.84%). -57.95%) and Bitdeer (BTDR: -63.31%) characterize the hardest contraction of the sector this 12 months.