Ethereum is making an attempt to recuperate after bounces again from the $1,800 zone, however costs stay beneath essential resistance, and the broader pattern continues to be bearish. The short-term momentum has improved barely, however the upward continuation stays unsure.

Technical Evaluation

By Edris Dalakshi

Day by day Charts

Day by day charts present that ETH is secure across the $1,900 space after a pointy rejection from the $2,200 zone in late March. Property are nicely beneath the 200-day shifting common, persevering with to slop across the $2,800 area, confirming the bear market construction at a macro degree.

The most recent bounce has put the worth again into the $1,900 resistance zone, however consumers have but to point out sturdy follow-throughs. Moreover, RSI is rebounding from the bought degree, suggesting short-term aid, however there isn’t any bullish divergence or momentum breakout to help a reversal of sustainable developments. The decisive each day closure, from $1,950 to $2,000, is the primary sign that consumers are regaining management.

4-hour chart

Within the four-hour timeframe, ETH is traded inside a horizontal integration sample, with the low boundary at $1,800 and the upper boundary at $2,200. After the current sale, costs have rebounded into the $1,900 provide zone, however confronted quick resistance and are actually being pulled again barely.

Moreover, the RSI approaches the circumstances which have passed by throughout bounce and is at present cooled, indicating a possible consolidation or one other retest of the $1,800 space. If ETH doesn’t happen past the upper boundary of the sample, one other leg is lowered to clear up liquidity between $1,780 and $1,750. Nevertheless, confirmed breakouts over $2,200 negate the sample and recommend a short-term bullish reversal.

Emotional evaluation

By Edris Dalakshi

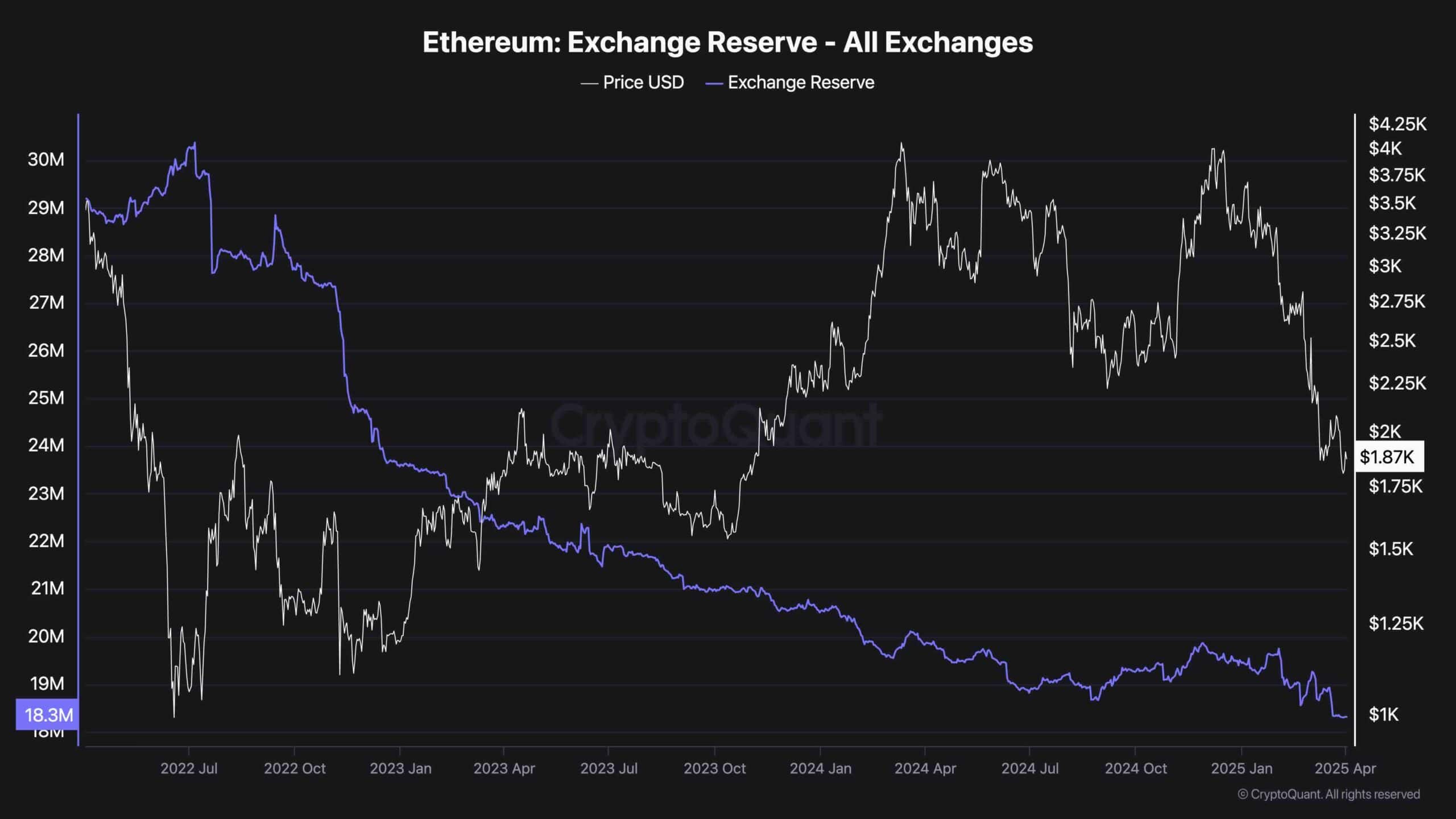

Substitute Reserve

Ethereum’s Trade Reserve has been on a downward pattern for a number of months, reaching its new low of round 18.3m ETH, at present held on the buying and selling platform. This sustained decline means that long-term holders and businesses are shifting belongings to refrigerate or pile, decreasing quick promoting stress.

Regardless of bearish worth habits, the provision of exchanges has not elevated. This has traditionally served as a bullish divergence when accompanied by inverted buildings. Low reserves might act as a provide constraint when demand reappears, however for now the dearth of bullish momentum signifies that this on-chain pattern is extra supportive than decisive.