Ethereum breaks essential ranges however struggles at $1,800. Can progress in community exercise and elevated lengthy positions result in a transfer to $2,000?

When the crypto market restoration pauses, Bitcoin will fall beneath $93,000, whereas Ethereum continues to fall beneath $1,800. Presently, Ethereum is buying and selling at $1,769, exhibiting an intraday pullback of almost 1.5%.

Ethereum continues to face resistance, however optimistic merchants count on a bounce after a retest. Can this restoration push costs past $2,000? Let’s look into it.

Ethereum value evaluation

On the four-hour value chart, Ethereum’s tendencies present bullish breakouts from the availability zone over time, surpassing the Fibonacci degree of 38.20%, near $1,675.

After this breakout, Ethereum handed the 50% Fibonacci degree and the 200 EMA line, near $1,755. Nonetheless, the uptrend was unable to keep up momentum above $1,834, leading to short-term consolidation and minor pullbacks.

This present pullback might be a possible retest of the 200 EMA line and 50% Fibonacci degree. Specifically, this restoration has a constructive affect on the 50 and 100 EMA strains, implying a potential bullish crossover.

Moreover, bullish restoration expands the uptrends in MACD and sign strains, exhibiting sturdy bullish momentum. Consequently, technical indicators help the potential for a reversal after a reversal of Ethereum costs.

Based mostly on Fibonacci ranges, a reversal after a hit of over 61.80% Fibonacci retracement ($1,834) might probably open the door for Ethereum to achieve $2,000. Such upward momentum will increase the possibilities of a golden crossover between 50-200 EMA strains. It is a sturdy bullish sign.

Conversely, if Ethereum can’t maintain above the 50% Fibonacci degree, the worth will likely be additional boosted and examined the resistance zone that has been turned to $1,675 help.

Analysts present that main ecosystems in Ethereum are on the rise

In Ethereum’s current bullish restoration, a brand new evaluation by Cryptoquant analyst Carmelo Alemán highlights a serious increase to community exercise. He factors out that energetic Ethereum addresses are rising sharply from 306,211 to 336,336 in simply 48 hours.

This represents a surge of almost 10% between April twentieth and April twenty second. Analysts additionally level to the general progress of Ethereum Energetic Addresses together with a broader market restoration.

Carmelo initiatives potential growth into the broader Ethereum ecosystem. This might function a launchpad for a number of initiatives constructed on Ethereum. As ecosystems improve, demand for ETH is predicted to rise, and costs might rise.

Ethereum: Energetic handle

Bullish merchants make large bets on the Ethereum Breakout Rally

As value motion evaluation suggests potential rebounds, bullish sentiment within the Ethereum derivatives market continues to develop. Based on Coinglass information, the lengthy place within the derivatives market is approaching 55%.

Based mostly on Coinglass’ long-term ratio chart, the lengthy place accounts for 54.98%, driving the ratio to 1.02. This means a marked improve over the previous three hours from 46.3%.

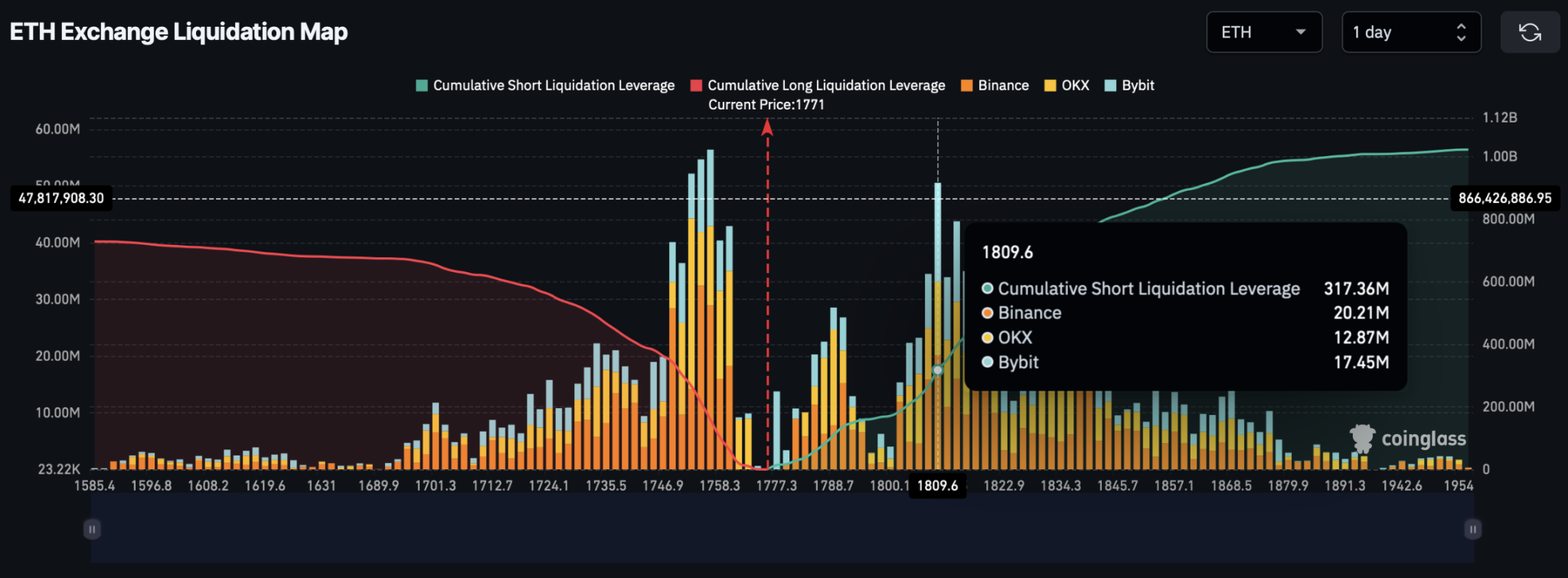

With new optimism for breakout rallies, by-product merchants are placing an enormous guess on Ethereum. Based on the Ethereum Alternate liquidation map, breakouts over $1,800 can result in vital brief liquidation.

This information exhibits the potential for a cumulative brief fluid of $317.36 million, near the $1,809.60 degree.