The surge in gold on April twenty first is over $3,390 as extra traders flock to protected property amidst financial uncertainty. Gold boosts might doubtlessly present an identical sample in crypto, particularly Bitcoin.

In response to newest Buying and selling Economics knowledge, Gold reached an all-time excessive amongst international financial volatility. On April twenty first, gold rose 2%, properly above the $3,390 threshold, reaching round $3,395 at 7:30 UTC. Analysts predict that the rise in efficiency might be on account of rising international commerce tensions and the weaker US greenback.

Only a week in the past, President Donald Trump ordered an investigation into potential tariffs on new tariffs on vital US mineral imports. This represents a big escalation of commerce disputes between the USA and different nations, notably China. Moreover, traders are starting to lose religion in conventional Fiat forex because the US greenback plunged to its lowest stage in three years.

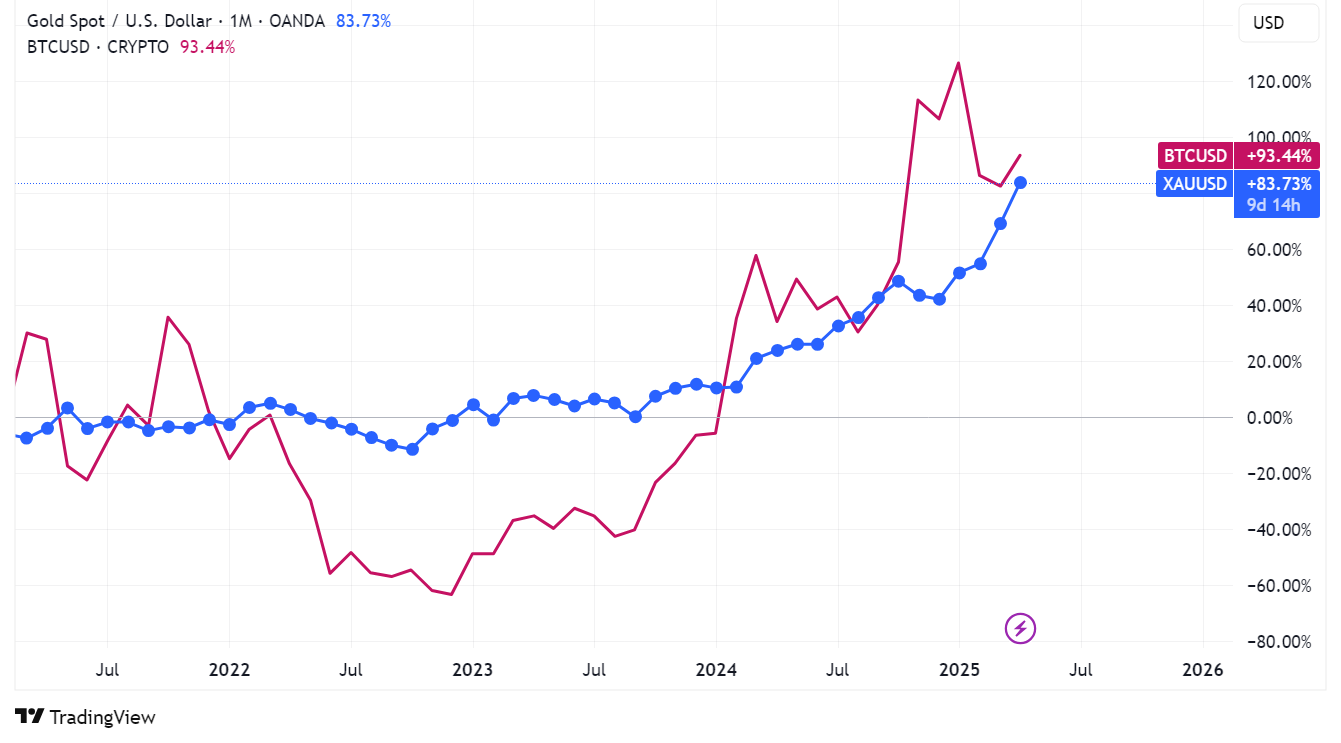

In the meantime, the rise within the Gold meteor might mark the start of a bullish rally within the crypto market. Merchants have seen that gold and Bitcoin (BTC) costs are sometimes carefully associated, bearing in mind that each are “protected haven” property.

Value chart evaluating Bitcoin and Gold actions out there, April 21, 2024 | Supply: TradingView

You would possibly prefer it too: Futures buying and selling that involves tokenized gold spots and Bitget wallets

In actual fact, on the identical day, Bitcoin reached a brand new month-to-month peak of $87,570. On the time of urgent, BTC rose greater than 3.2% within the final 24 hours of buying and selling. At present buying and selling palms for $87,538. The final time BTC hit greater than $87,400 got here again on March twenty eighth, however the recession broke out in early April.

What’s the historic relationship between cash and code?

Bitcoin is usually in comparison with “digital gold” by market merchants and traders. Federal Reserve Chair Jerome Powell stated Bitcoin is a gold competitor, on account of how each property are used as worth shops relatively than as fee choices.

Equally, Cathie Wooden, founder and CEO of ARK Funding Administration, predicted that Bitcoin’s $2 trillion market capitalization might someday surpass Gold’s $15 trillion over time. Regardless of its lengthy existence, the cash was lengthy earlier than reaching $2 trillion.

“At $2,700, Gold is a $15 trillion market in comparison with simply $2 trillion in Bitcoin. Even after breaking $100,000, Bitcoin remains to be in its early innings,” Wooden stated.

Traditionally, constructive gold market actions have typically adopted the rise in Bitcoin costs. Except for the truth that each property are thought of “protected shelters” to guard traders from the volatility of conventional Fiat forex, each have a finite provide that must be mined.

Regardless of these similarities, Bloomberg evaluation discovered that gold nonetheless has a a lot decrease volatility charge in comparison with Bitcoin. Gold’s annual volatility charge is round 10% to twenty%, whereas Bitcoin is usually over 50%. Whereas this can be true, analysts additionally notice that macro-bitcoin tendencies are inclined to comply with gold inside a number of months.

You would possibly prefer it too: Gold hits the perfect ever in bullish bitcoin for $2,700