In 2021, the Inconceivable Token (NFT) sector skilled explosive development. However that meteor rise adopted by a recession, prompting questions on sector sustainability.

Alexander Salnikov, co-founder of Rarible, believes the market is going through a shift, not a collapse. In an unique interview with Beincrypto, Salnikov provided his perspective on the state of the NFTS and its position in 2025.

Is NFT nonetheless related in 2025 or is it operating the course?

The rise of NFTs, fueled by pleasure and hypothesis, was inevitable for a market experiencing such speedy innovation. However, as with many rising applied sciences, this early surge adopted by revisions. The hype has given strategy to the truth of market maturity and sustainability.

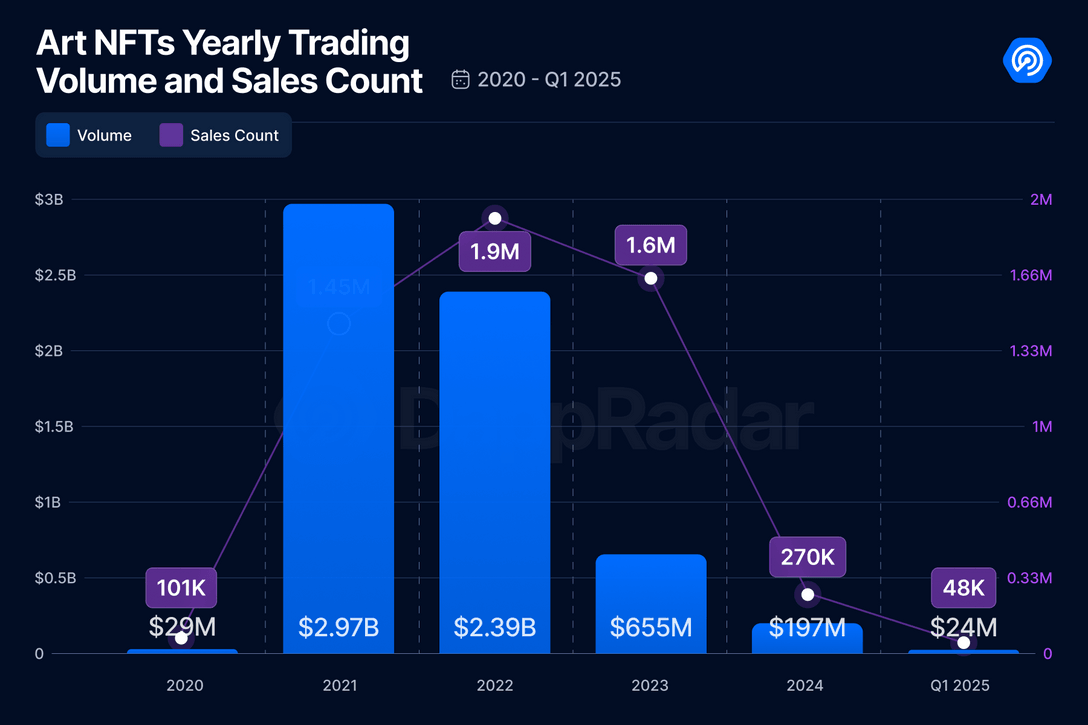

In accordance with the newest report from Dappradar, the ART NFT market noticed a powerful surge in 2021, with buying and selling volumes reaching $2.9 billion. Nonetheless, by the primary quarter of 2025, buying and selling quantity had recorded simply $23.8 million, a 93% decline.

NFTS buying and selling quantity over time. Supply: Dappradar

Equally, the variety of lively merchants peaked in 2022 at a report excessive of 529,101. Nonetheless, this determine fell 96%, with 19,575 lively merchants remaining by the primary quarter of 2025.

Earlier trade reviews from Dappradar revealed that overwhelming efficiency is not only a pattern in the direction of 2025 developments. In actual fact, 2024 was one of many worst years for the NFT market since 2020. Moreover, Beincrypto reported on a examine that exposed that 98% of the NFT initiatives launched in 2024 have been basically “useless.”

Regardless of the decline, Rarible’s Salnikov maintains a constructive outlook for the sector. He emphasised the significance of a transparent objective on the subject of NFTS.

“As soon as upon a time, after .com burst, the headline rang out saying that the web is only a pattern. However as extra corporations built-in know-how into on a regular basis use instances, it turned ingrained as part of their lives,” he informed Beincrypto.

Salnikov argued that belief would quickly lower when NFTs are thought of merely a speculative asset. In distinction, initiatives rooted in real-world neighborhood engagement or providing concrete utilities present clear worth and it’s simple to grasp.

In the meantime, slightly than viewing sector decline as a collapse, executives view it as a market readjustment, with the main focus shifting from speculative hype to a extra sustainable and precious mission.

“There was a second within the speculative section, however now we see NFTs evolve into actual infrastructure, a software that creators use to construct communities, merchandise, and new digital economies,” he mentioned.

NFT Past Hype: Unlock real-world utility

Sarnikov emphasised that the utility of NFT areas is not a distant idea. Creators use NFT, loyalty program manufacturers, and participant identification video games for membership.

He identified that NFTs are linked to items, occasions and even real-world belongings, which has led to a rising convergence between the digital and bodily worlds. Binance Analysis’s April 2025 report additional helps this pattern.

This report focuses on a number of real-world partnerships and demonstrates curiosity in NFTS. Examples embody Azuki’s bodily NFT and animated characters with Michael Lau, Sandbox’s Jurassic World Collaboration, Eggrypto’s Eparida, and Sony’s Soneium Platform will associate with Line to create Web3 Mini-Apps.

“The subsequent wave of development is not about chasing developments, however about unlocking the brand new type of possession and entry that we really feel is native to the Web era,” Sarnikov mentioned.

This attitude presents optimism, however the actuality of many corporations is kind of completely different. Because of low buying and selling volumes, main platforms comparable to BYBIT, X2Y2 and Kraken have resorted to discontinuing NFT providers.

Those that did not shut down explored options. For instance, Magic Eden expanded past NFT with the acquisition of Slingshot. However, Sarnikov dismissed this technique and commented,

“We’re not making an attempt to bolt non-NFT options simply to remain busy. We’re truly constructing NFT commerce that matches the neighborhood.”

He defined that this method makes use of a modular, customizable on-chain market. Creators can tailor to a selected viewers, comparable to sport initiatives, L3s, and legacy manufacturers.

“NFT is a function. It requires correct framing,” mentioned the co-founder of Rarible.

When fame fades away: Movie star-supported NFTs Decreased

Again, an attention-grabbing pattern within the NFT hype period was celeb involvement. Well-known figures like Justin Bieber, Madonna and Neymar jumped on the bandwagon and attracted appreciable consideration within the sector. Regardless of this, their funding methods haven’t been significantly profitable.

In January 2022, Bieber spent 500 ETH (about $1.3 million on the time) on the boring APE #3001. This NFT is from Yuga Labs’ boring APE Yacht Membership (BAYC) assortment.

Nonetheless, in accordance with the newest information, the NFT is price simply 13.51 weeks (roughly $24,174), a 98.1% drop. The singer does not promote his NFTs, however he is been receiving little consideration lately, with no promotional efforts or noticeable debate.

Thus, celebrities can flip their consideration to NFTs, which underscores the necessity for substances past the title itself. As Sarnikov identified, celeb involvement within the sector is fleeting.

In accordance with him, celebrities’ names alone can not substitute real artistic instructions or robust communities.

“Movie star drops come and go, and that is the tradition behind them that decides whether or not or not they stick,” he mentioned.

He claimed that celebrities who deal with NFTs as mere merchandise would block the viewers. However, if the NFT drop is intentional and also you actually faucet on one thing significant like music, trend, fandom, it finds its lasting worth.

“We’re extra desirous about working with creators who’re constructing over the long run than merely chasing headlines,” Sarnikov revealed to Beincrypto.

The manager additionally outlined the necessity for a extra accessible and user-friendly method to attracting customers. He detailed that onboarding customers should not really feel “like a tech demo.” Salnikov identified Rarible for example.

In accordance with him, Rarible focuses on making certain that every market constructed on the platform is the product individuals actually need to use. This contains options comparable to Fiat Onramps, low-cost mint, a clear person interface, and most significantly, content material that resonates with the person.

“We do not promote NFTs, we’re selling the expertise that occurred to be on-chain,” concluded Sarnikov.

The NFT market faces ongoing challenges, however it’s nonetheless unclear whether or not the trade is getting into a brand new section of development or whether or not there can be additional obstacles to evolution forward.