Cryptocurrency costs have steadily appreciated all through the Easter weekend, surpassing $88,000 on Monday, bringing the greenback to its lowest stage in three years.

BTC is rising sharply whereas the greenback continues to free fall

His risk to fireside President Donald Trump’s aggressive tariffs and Federal Reserve Chairman Jerome Powell have shouted conventional markets and overseas buyers weakened the dollar, however Bitcoin (BTC) and bodily gold seem to have emerged as secure shelters.

Market Metric Overview

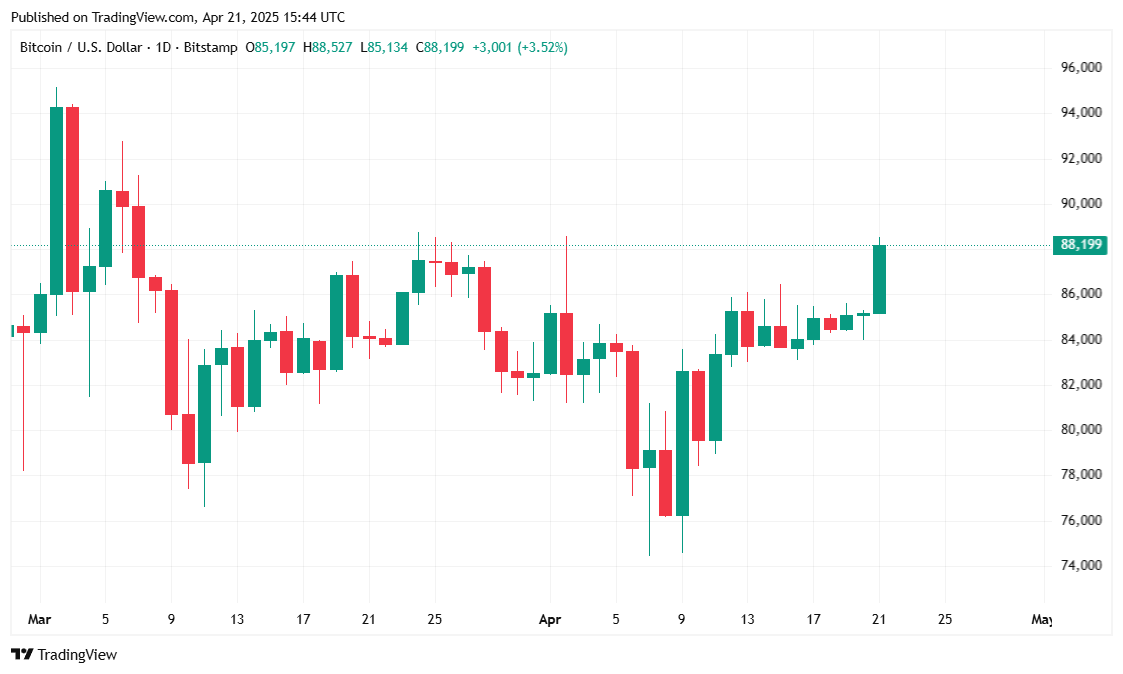

Bitcoin began the week at a robust tempo, rising 4.48% during the last 24 hours to $88,260.09 when reported. Digital property traded between $84,281.02 to $88,460.10 as buyers sentiment continued to enhance. Over the previous seven days, BTC has received 5.08%, supported by steady purchases and broader market optimism.

(BTC Worth/Commerce View)

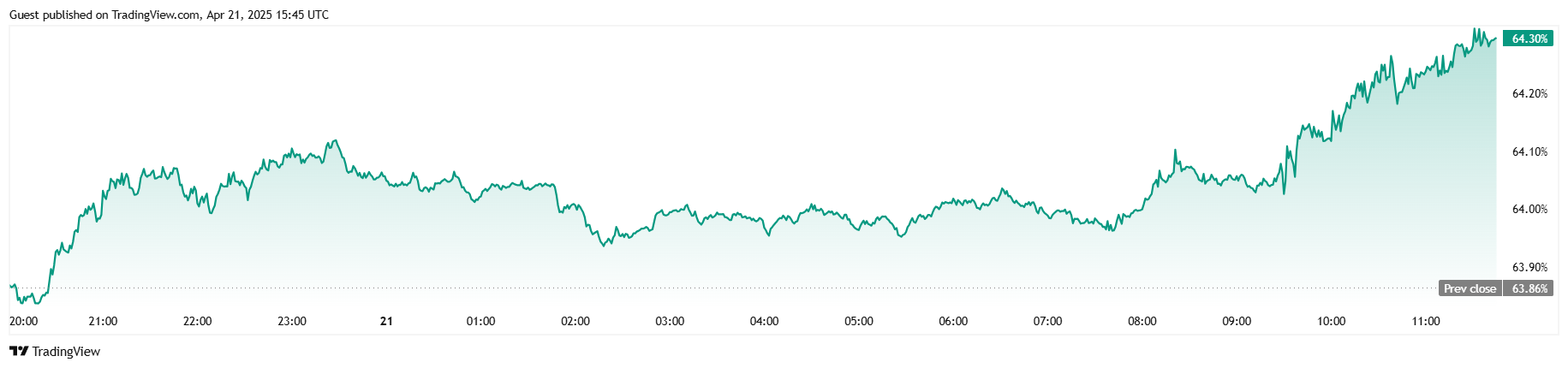

Buying and selling quantity surged to $344.1 billion, a rise of 133.17% in comparison with the day past. It is a bounce as a result of a typical post-week surge. Bitcoin’s market capitalization additionally rose 4.15% to $1.74 trillion. In the meantime, BTC’s dominance rose to 64.30%, incomes 0.67%, strengthening Bitcoin’s management position within the crypto market.

(BTC dominance/commerce view)

Coinglass information reveals a major enhance in open curiosity in Bitcoin futures. Regardless of the surge, the general liquidation remained minimal at $460,490, with $276,400 from the shorts and $184,090 from the longs. The comparatively low liquidation quantity emphasizes the orderly nature of the market at the same time as costs and buying and selling actions rise.

Trump’s powerful discuss tank greenback

Trump touted decrease than anticipated inflation numbers launched by the Bureau of Labor Statistics on April 10, calling Powell “the principle loser” on Monday, and didn’t reduce rates of interest to assist sluggish the US financial system.

“There might be little inflation, however so long as you are too late, you are a loser, a serious loser, and you are going to have a slower financial system,” Trump posted to The Fact Society. “Europe has already “down” seven occasions. Powell was all the time “late,” the president added.

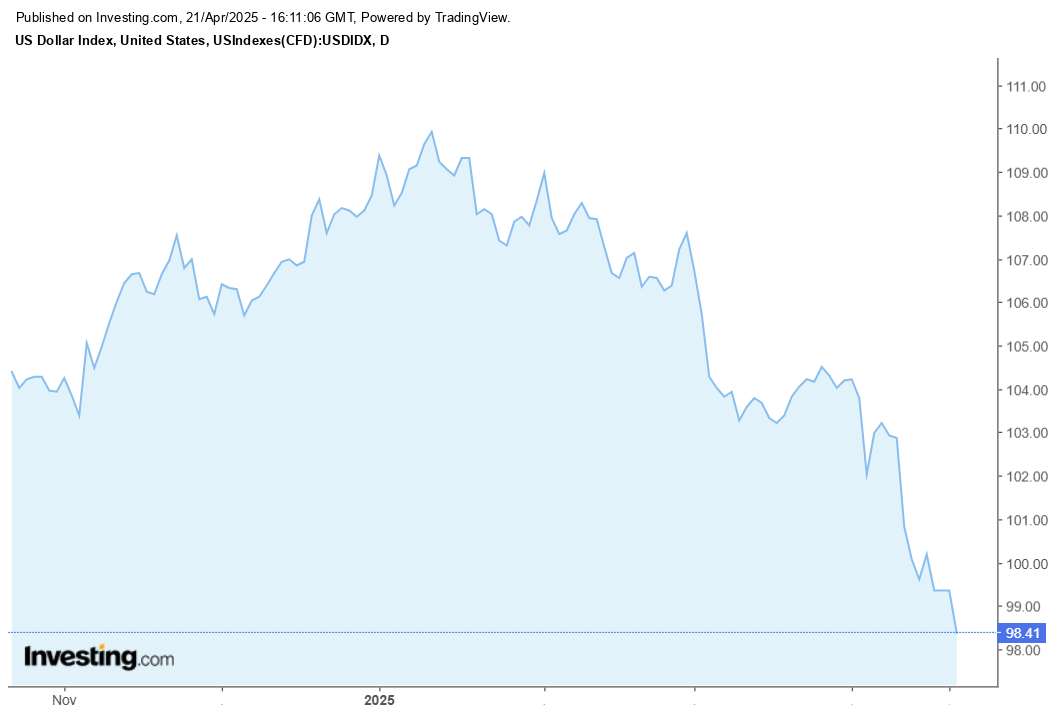

Final week, Trump threatened to fireside Powell, specializing in the problem of FRED independence. The president’s harsh commerce coverage and his shot at Powell led to the escape of overseas buyers, sending the US Greenback Index (DXY) to 3 years’ low, gold, all-time excessive, and Bitcoin to $88,000.

(The US greenback index, which tracks the greenback’s power in opposition to a basket of overseas forex, fell to its lowest in three years on Monday / Investing.com)

If the development continues, dollar dangers freely giving international management to cryptocurrencies, particularly designed as an antidote to reckless Fiat insurance policies.