After years of high-risk investments, buyers are actually shifting some cash in direction of protected investments.

They’ve poured money on the quickest tempo in gold, ultra-short Treasury ETFs and low-volatile shares since March 2023. They act amid concern that the world commerce struggle represents an enduring menace to financial and income progress.

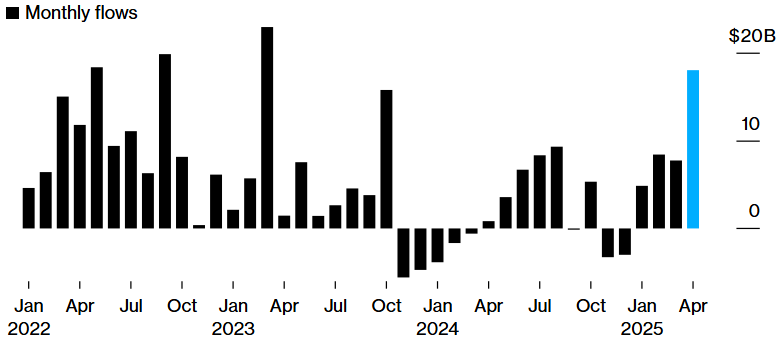

Information edited by Bloomberg Intelligence These three teams have seen a complete influx of about $18 billion thus far in April, with about two-thirds of them flowing into cash-like funds.

SPDR Bloomberg 1-3 Month T‑ Invoice ETF (BIL) raised $8 billion this month, adopted by the iShares Brief Treasury Bond ETF (SHV) for $3 billion, and iShares 1-3 Yr Treasury Debt (Shy) gained $1 billion.

Gold-related funds have earned the third consecutive month of revenue, however after almost two years of outflow, low-power fairness ETFs have rebounded.

Buyers poured $18 billion into protected funds in April. Supply: Bloomberg

Danger-off sentiment escalated Monday when issues over the Federal Reserve’s independence sparked the sale of US shares, {dollars} and long-term Treasury debt. The S&P 500 index fell 3% that day.

Trump’s warning to the Fed has pressured buyers to enter protected funds

Along with his temper, President Donald Trump warned that if the Fed would not minimize rates of interest instantly, the US financial system may decelerate. In consequence, there was a surge in protected havens just like the Swiss franc and the Japanese yen.

“The market is on the lookout for coverage readability from Washington, which stays elusive,” stated Ryan Grabinski, senior funding strategist at Strategas Securities. “Customers, companies and even the Fed are hesitant to make huge choices as a result of there’s a lot to be unknown.”

Regardless of the risk-off slope, broad index funds proceed to draw above-average inflows. Main the group is the ISHARES Core S&P 500 ETF (IVV), which has drawn $35 billion over the previous month.

“We proceed to see indicators of warning, nevertheless it’s not panic,” stated Cayla Seder, macro multi-asset strategist at State Avenue World Markets. “At a excessive stage, this seems to have much less stream to shares for each shares and money, and there seems to be extra demand. All the things means extra room to search for shelters in case your arduous knowledge begins to weaken.”

Elsewhere, buyers nonetheless chase excessive danger, with shares excellent among the many prime 50 ETFs leveraged by property since Trump’s so-called “liberation date” on April 2nd.

“The concept of buyers procuring stays,” says Mark Hackett, chief market strategist nationwide. “Regardless of file ranges of pessimism, retail buyers proceed to purchase.”