Ethereum’s (ETH) benefit has steadily declined over the previous two years. This means that investor capital not prioritizes ETH. As an alternative, the fund could also be shifting in the direction of different altcoins corresponding to Bitcoin and Solana and XRP.

Nonetheless, analysts see a serious alternative on this scenario. Many consider there’s an uncommon alternative to build up ETH.

Will Ethereum’s five-year domination be a chance?

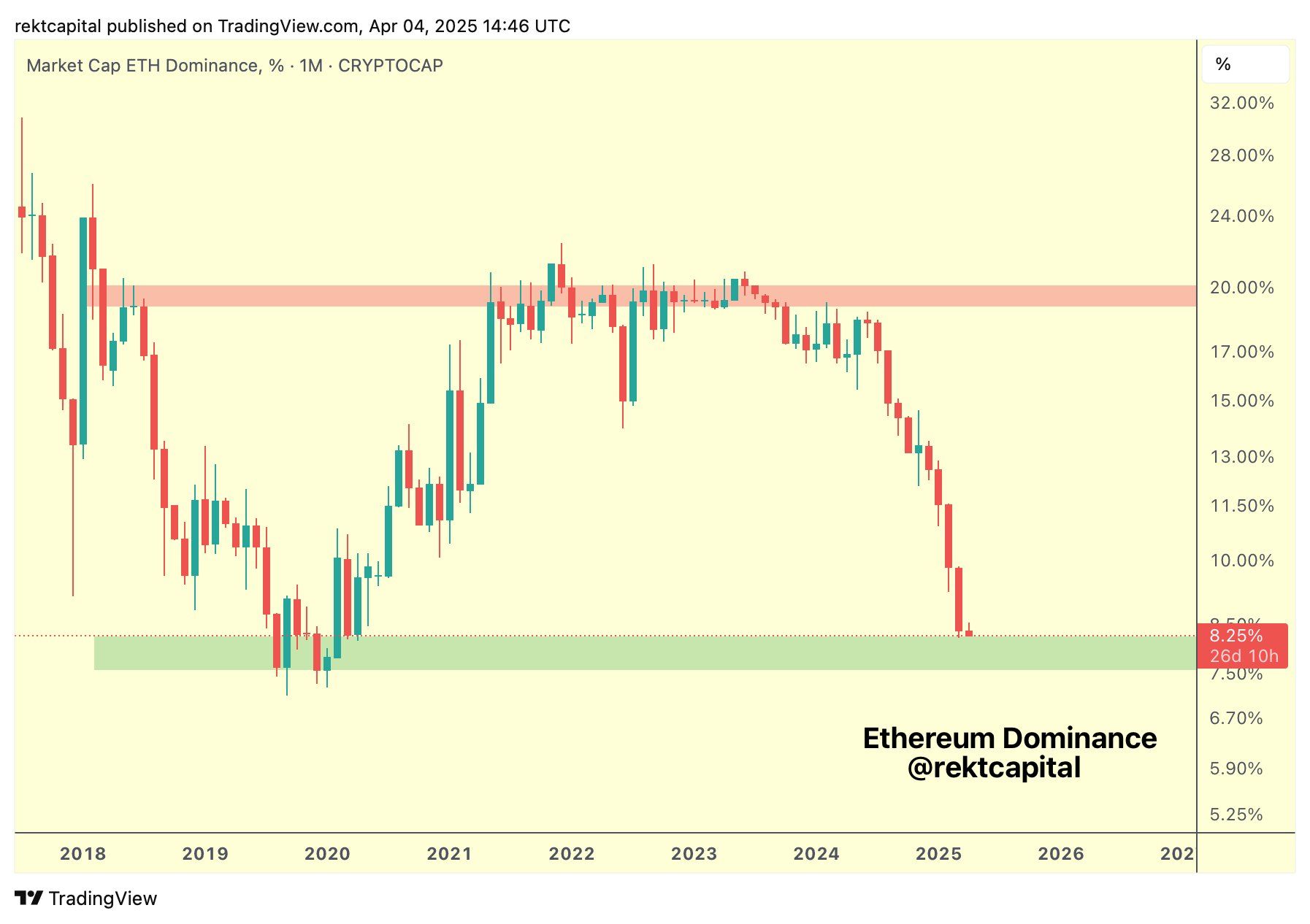

Based on analyst Rekt Capital, Ethereum Dominance (ETH.D) fell from 20% in June 2023 to eight% in 2025. On the time of writing, it was even decrease at round 7.3%.

Eth.D is expressed because the market capitalization as the share of the mayor of Ethereum’s market capitalization. The decline in ETH.D exhibits that traders’ curiosity in ETH has not solely decreased in comparison with the previous, but additionally in comparison with different property available in the market.

Rekt Capital shared a chart exhibiting touching the inexperienced assist zone. Traditionally, Ethereum has tended to show again from the area and acquire market power.

Ethereum dominant efficiency. Supply: Rekt Capital

Rekt Capital questioned whether or not Ethereum may repeat this historic sample, calling it a strong buy sign.

“Since June 2023, Ethereum’s benefit has dropped from 20% to eight%. Traditionally, Ethereum’s dominance has reversed from this inexperienced territory and places extra precedence in the marketplace. Can Ethereum repeat historical past?”

One other analyst, Cryptoanup, additionally thought that the drop was not a chance for errors. He identified that when Eth.D hits file low information, it typically marks a very good time to build up ETH earlier than a brand new development cycle begins.

“ETH’s management appears to have discovered the ground. Quickly once more!” predicted Cryptoanup.

Nonetheless, a current evaluation from Beincrypto reveals that ETH whale addresses are nonetheless actively promoting. This week, addresses with 100,000-1 million ETHs offered 1.19 million ETHs price greater than $1.8 billion. These gross sales exacerbate the decline in ETH costs and management.

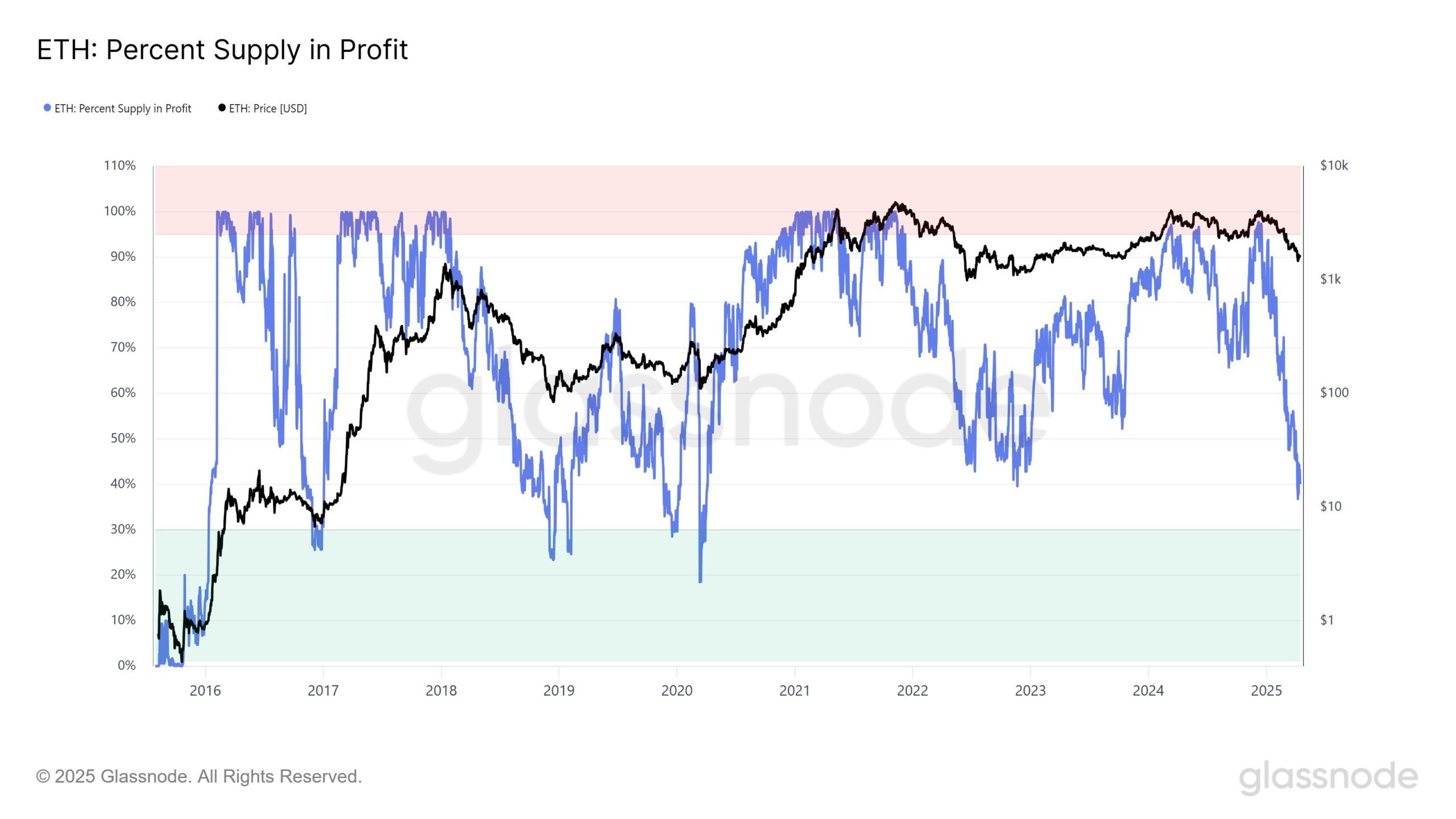

Revenue provide drops to the bottom degree over 4 years

Past the decline in benefit, GlassNode information exhibits that the proportion of ETH provide in earnings has additionally fallen to its lowest degree in 4 years.

Provide of ETH % in revenue. Supply: GlassNode

At present, solely 40% of ETH provide is worthwhile, down considerably from 97.5% in early December 2024. The analyst enterprise founder says that if the metric falls under 30%, it signifies a uncommon buy alternative that has solely been proven a number of occasions previously decade.

“The ETH proportion provide for ETH (40%) is decrease than the final naked market cycle backside (42%) when ETH was buying and selling at $800. Wanting on the on-chain, this can be a sign that’s already rolling out,” VentureFounder mentioned.

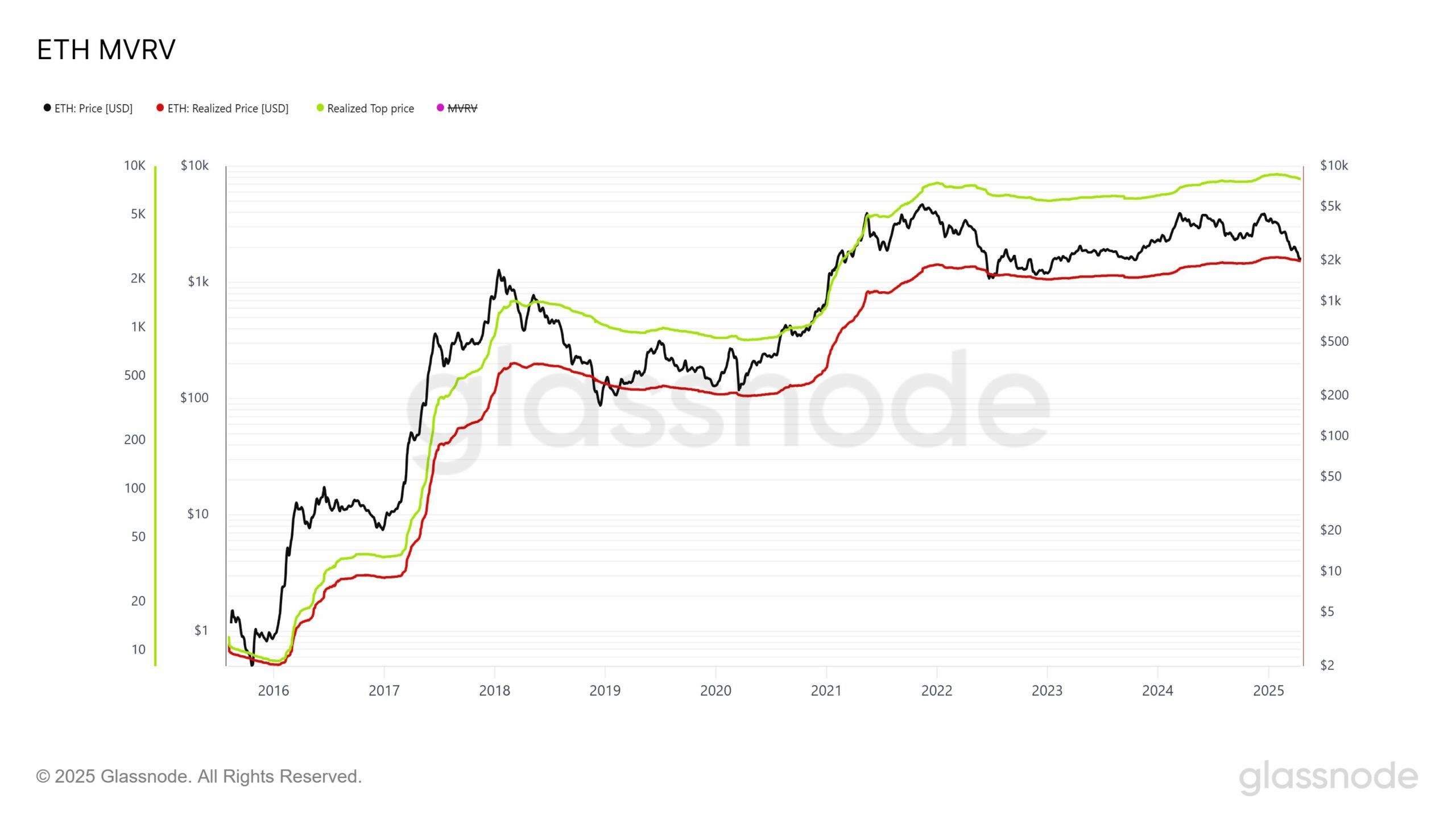

VentureFounder highlighted one other necessary metric. Ethereum’s present market worth has declined to match its on-chain realised worth. The realized worth displays the typical worth that every one ETK tokens moved final. When market costs drop to this degree, they typically present uncommon buy home windows. Traditionally, such moments are likely to precede a robust worth rise.

Ethereum MVRV. Supply: GlassNode

“Have a look at this long-term chart for ETH. Do you need to purchase Ethereum or promote Ethereum? Be trustworthy,” commented the enterprise founder.

Regardless of ETH falling 60% from its late 2024 excessive, a current report from Beincrypto confirms that Ethereum stays the highest DAPP platform. DAPP charge income exceeded $1 billion within the first quarter of 2025.

Moreover, future upgrades for Pektra and Fusaka will likely be launched on Mainnet in Could 2025 and later in 2025, respectively. These upgrades can significantly enhance community efficiency and enhance investor sentiment.