A latest publish by Crypto analyst Axel Adler Jr. makes use of the Pareto precept to make clear the well being of the present marketplace for Bitcoin. His evaluation exhibits that 80% of the cash within the community are nonetheless worthwhile and 20% are shedding. The large drawback is that Bitcoin is overheating? Need to know extra? Please learn it!

Understanding Pareto’s rules within the crypto market

The Pareto precept, generally often called the 80/20 rule, means that about 80% of the influence comes from 20% of the trigger.

Briefly, the precept explains the unequal relationship between enter and output.

Celebrated Crypto analyst Axel Adler argues that Pareto’s rules might be utilized to the Crypto market, significantly the Bitcoin market, as an efficient approach to analyze market well being.

As Balanced Bitcoin: What It Means

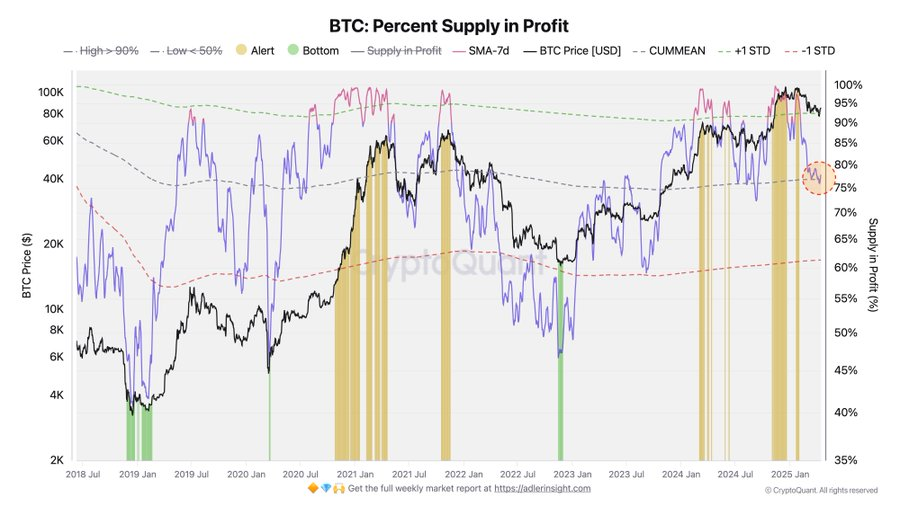

The BTC share provide on the revenue chart exhibits that greater than 80% of Bitcoin holders are at present making earnings, whereas greater than 20% are shedding BTC.

Analysts level out that the market has overheated when 95-98% of the cash have made earnings prior to now.

He claims that the variety of worthwhile cash now reaches a extra balanced common degree.

April was a unstable month for the BTC because of the world financial turmoil brought on by US President Donald Trump’s aggressive tariff coverage. Earlier this month, the BTC priced at $82,541.66. On the second day of the month, the market touched on a peak of $88,502.71 monthly, however by the top of the day the market had slipped to $82,541.66. Between April 5 and eight, the market witnessed a decline of 8.93%.

The Bitcoin market has skyrocketed over 9.56% since April ninth, however BTC’s present costs are only one.43% above the opening worth this month.